FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

WEF and Cambridge Fintech Report: The Future of Global Fintech – Fintech Schweiz Digital Finance News

Breaking Fintech News: Stay updated with the latest in the financial technology world.

Free newsletter

Get the hottest fintech news in your inbox every month

According to a new report from the World Economic Forum (WEF) and the Cambridge Alternative Financial Centre, the global fintech industry is entering a stage of sustainable growth, with customer acquisitions slowing, but revenue and profit growth remains strong.

The second edition of the future of the Global Fintech Report, relay In June 2025, an updated view of the industry was provided through new data on market performance, regulatory perceptions and technological innovation. The findings are based on a global survey of 240 selected fintech companies in six retail verticals and six regions for drivers in the fourth quarter.

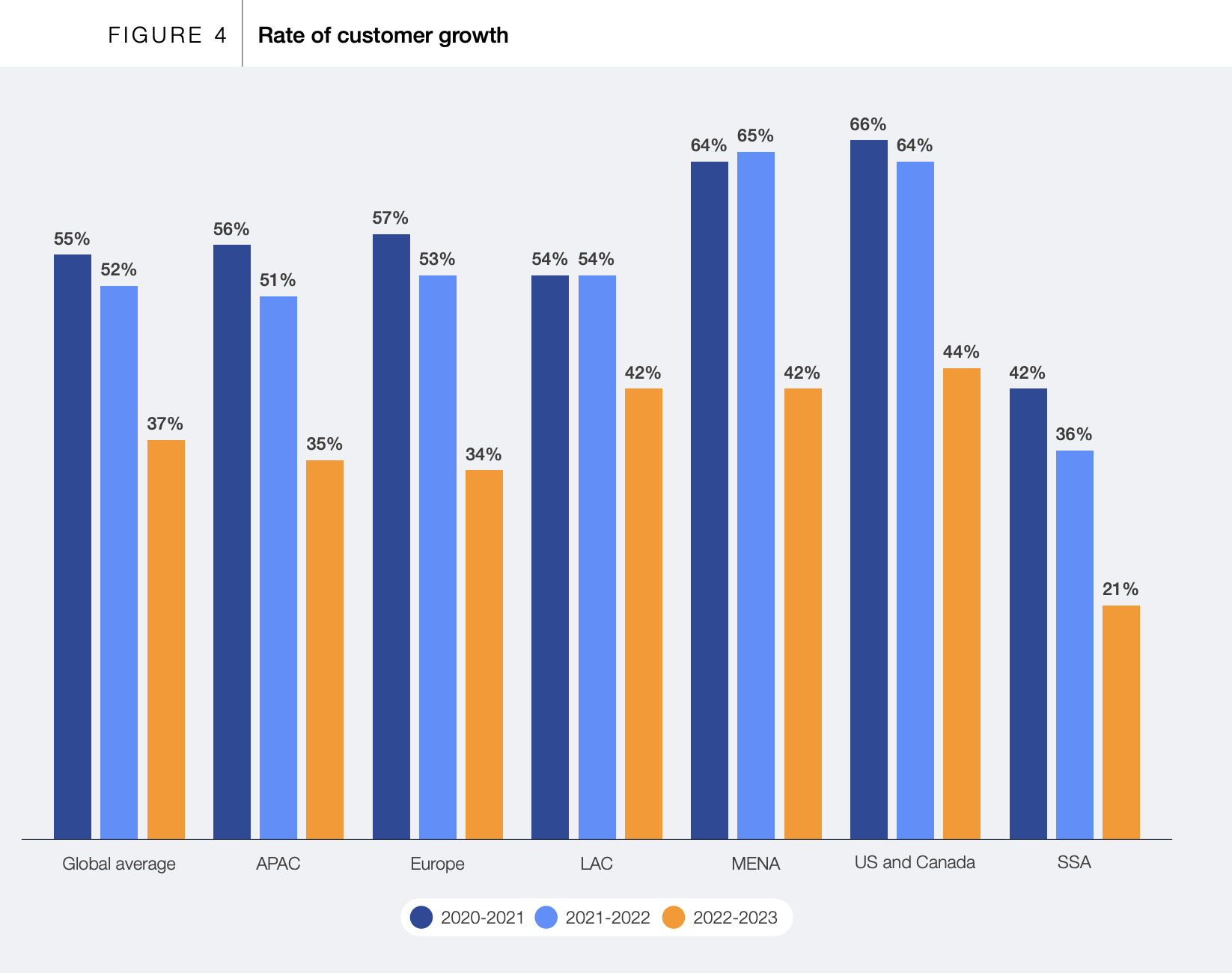

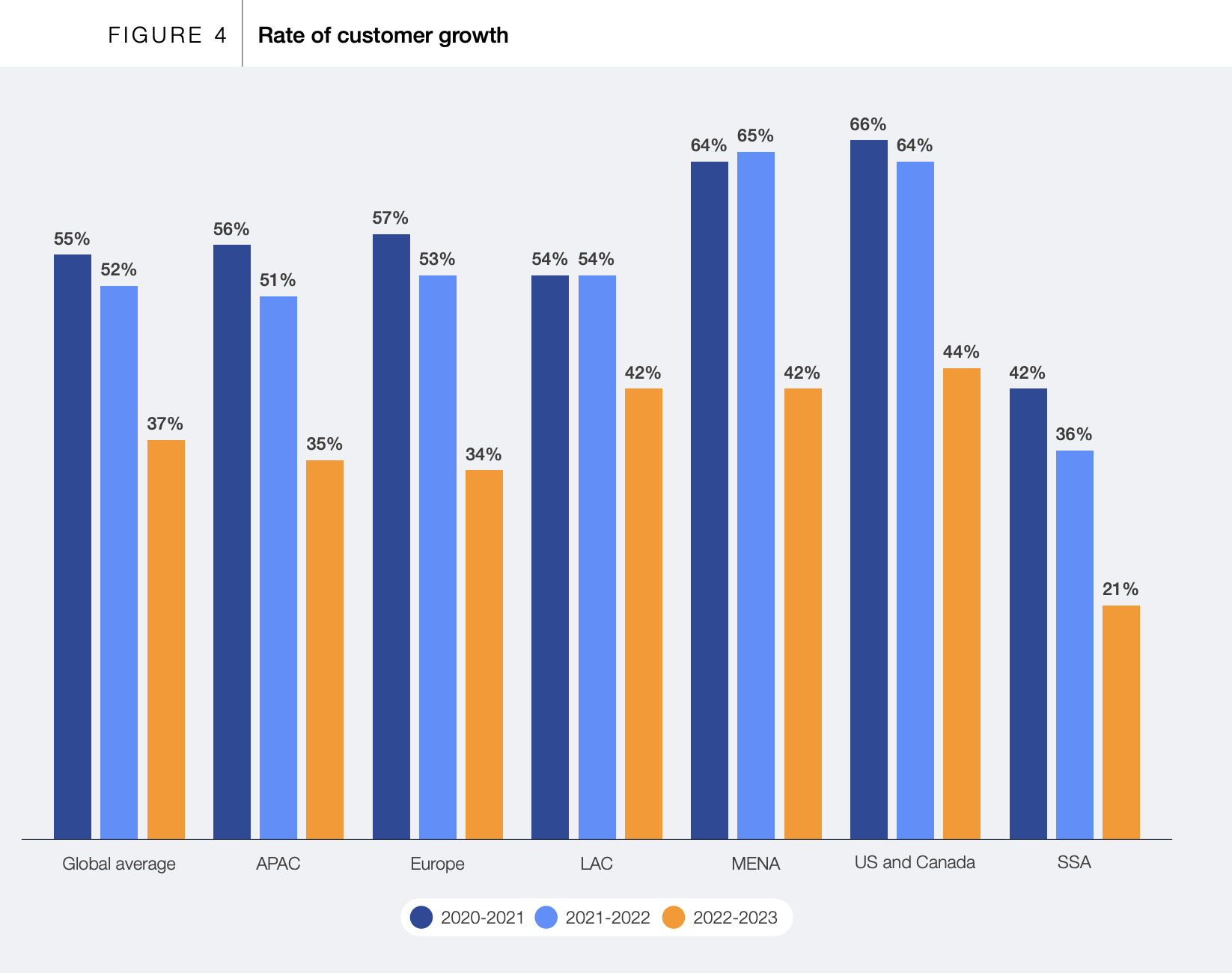

The report shows that from 2022-2023, customer growth slowed to an average of 37%, compared with 52% in 2021-2022 and 55% in 2020-2021. In December, vertical and regional composition highlighted the normalization of the post-199 pandemic after rapid adoption of digital financial products. This also reflects an increasing number of people focusing on deepening value propositions and strengthening customer relationships rather than relying solely on user acquisition.

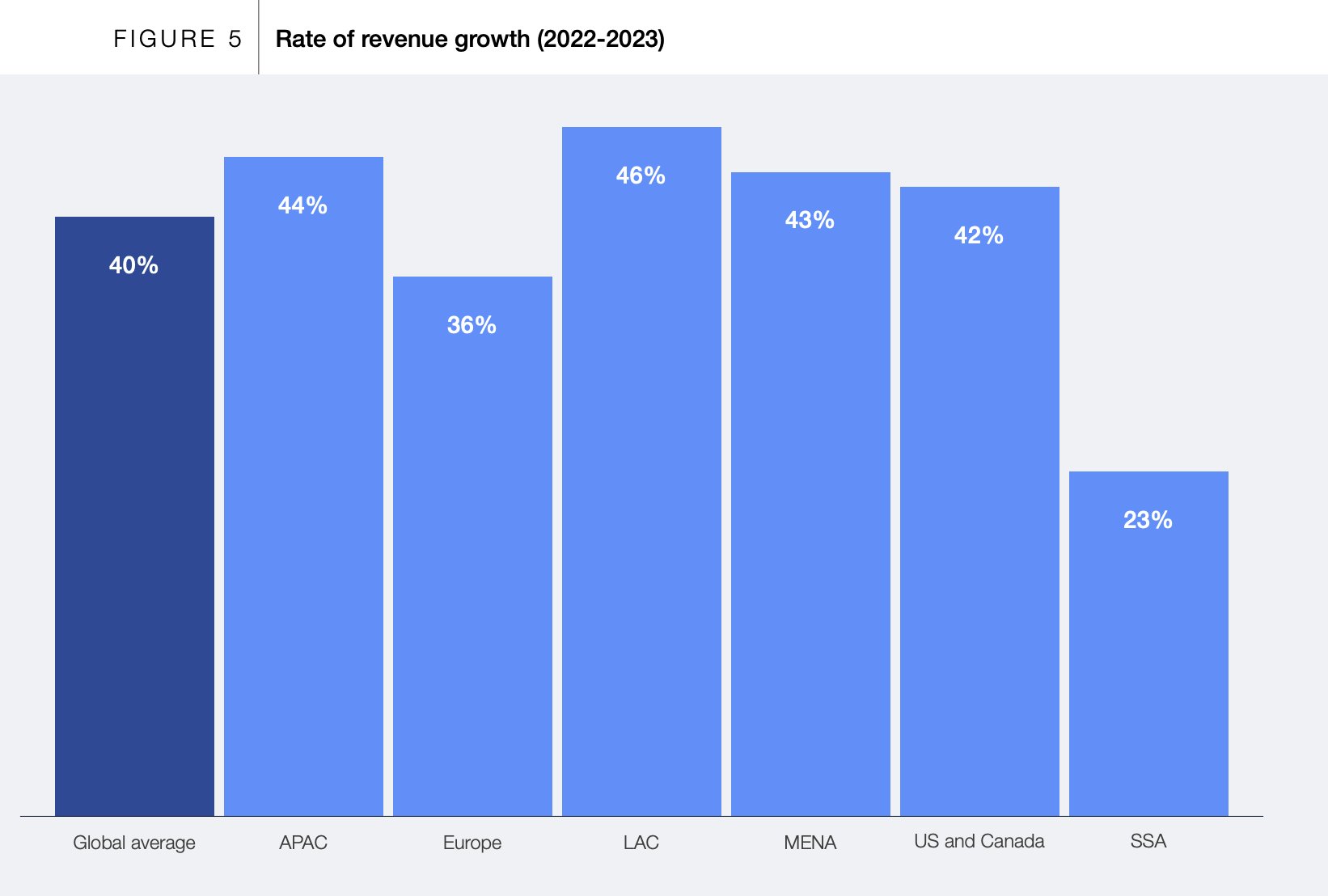

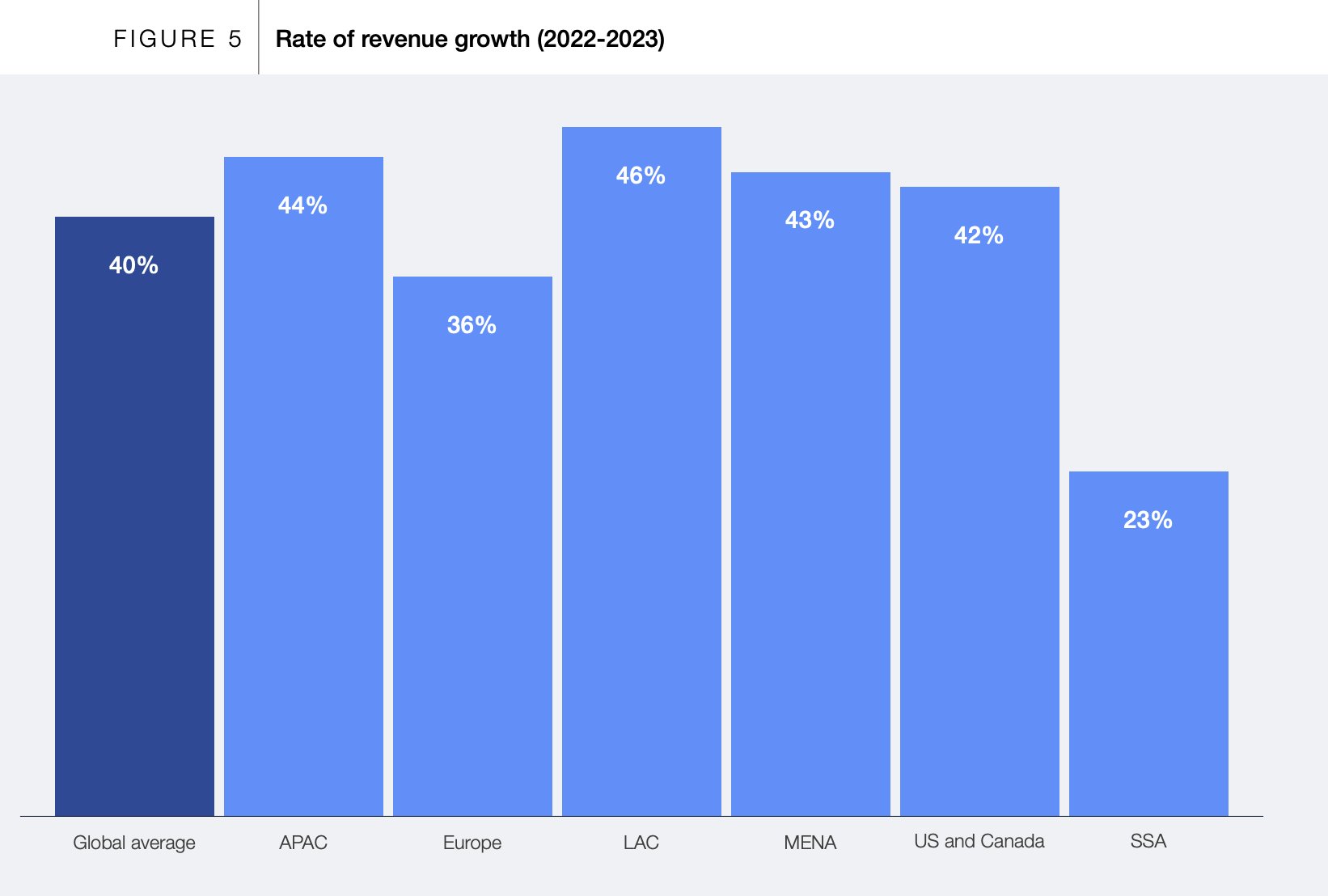

Encouragingly, the study found that revenue growth remains strong. In 2023, the average revenue growth rate is 40%, which is a strong implication for digital financial services.

In particular, fintech companies in emerging markets and developing economies (EMDEs) outperformed companies in developed economies (AESs) respectively, with average revenue growth rates of 42% and 39% respectively. Latin America and the Caribbean (LAC) have a 46% increase in revenues with revenge, followed by Asia Pacific (APAC) (44%), Middle East and North Africa (MENA) (43%).

In the entire vertical industry, revenue growth is exaggerated in all industries except digital capital raising and insurance company companies. Digital banking and savings rates increased by 67%, while insurance companies and digital foster companies grew at 31% and 18%, respectively.

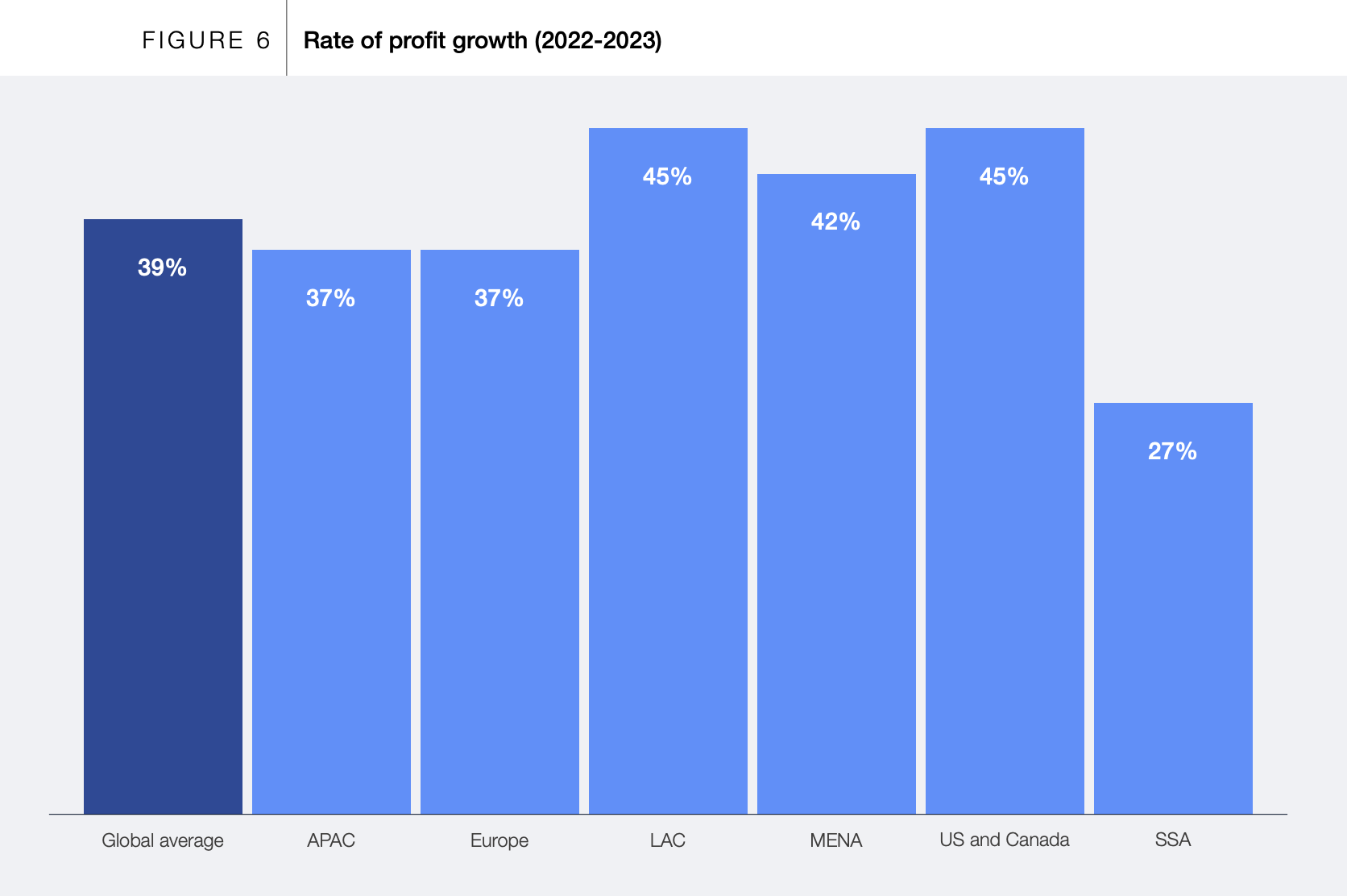

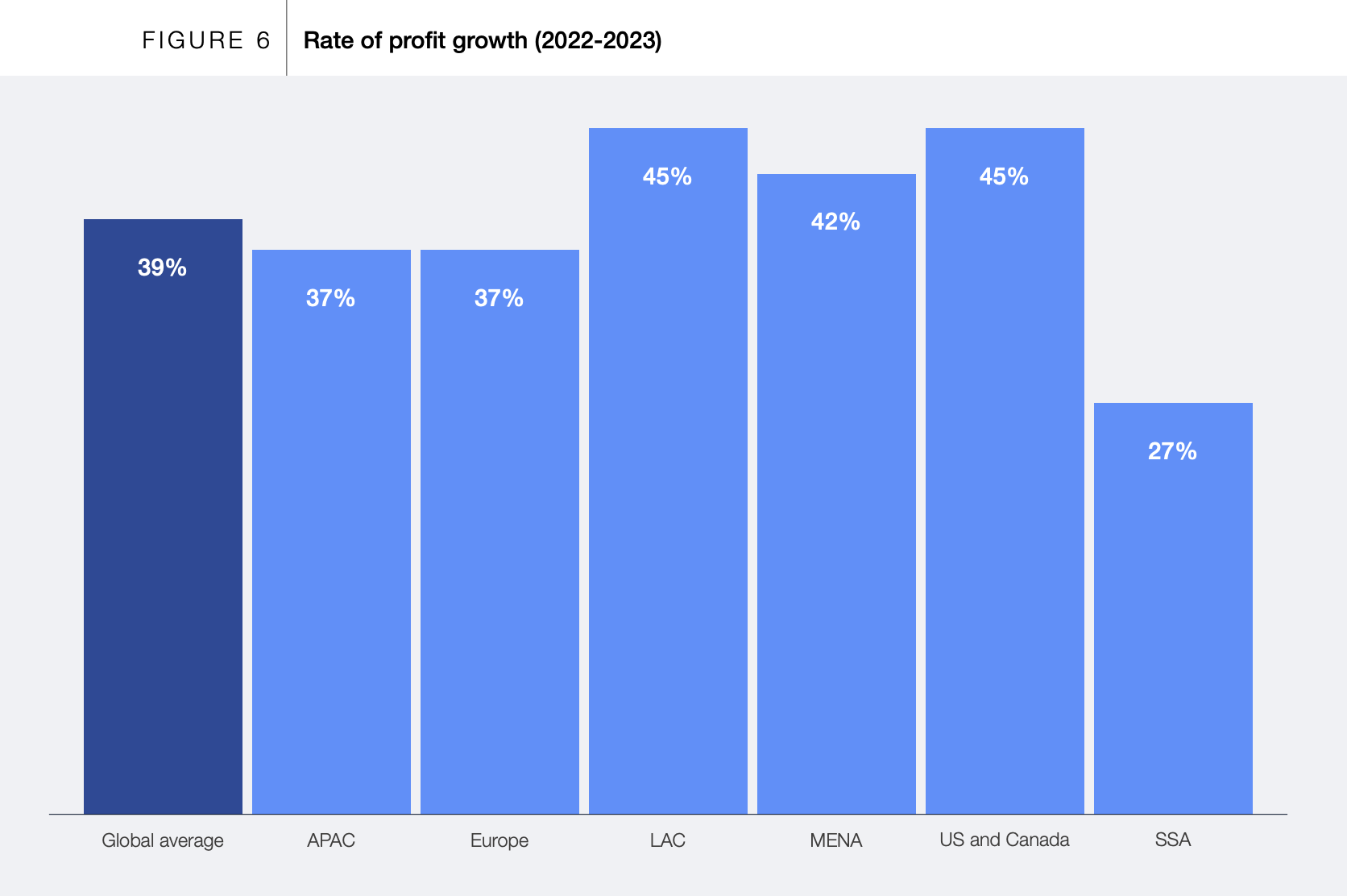

The global fintech industry also demonstrated strong profit growth in 2023, with an average profit growing by 39%, emphasizing effective operations and adaptability.

Like revenue growth, all fintech verticals have reported higher than average profit growth, except for digital capital raising fintech companies. Digital banking and savings also result in profit growth of 59%, driven by amazing customer adoption of digital financial services. Insurtech subsequently saw a profit growth of 42%, reflecting the growing and troubled innovative insurance solutions.

Financial inclusion and partnerships remain vital

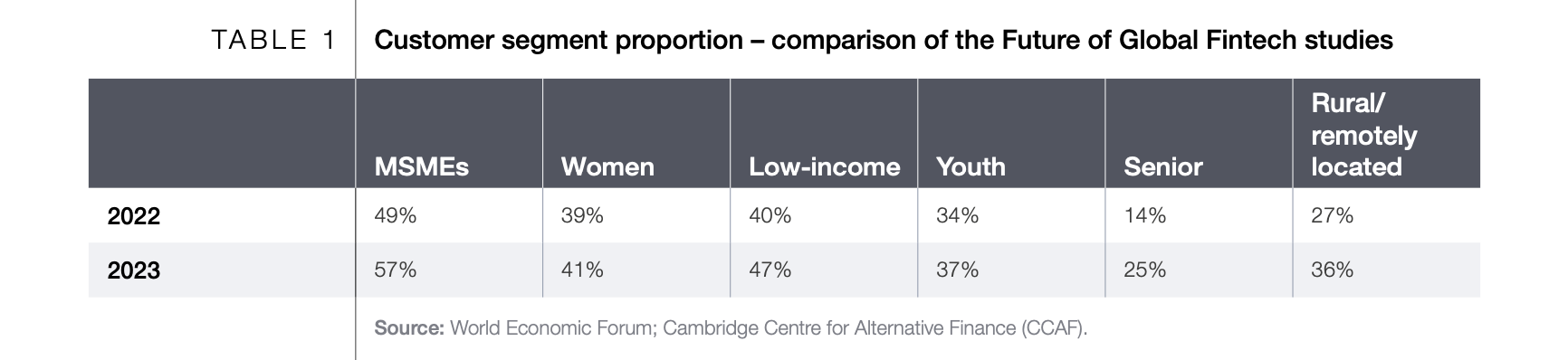

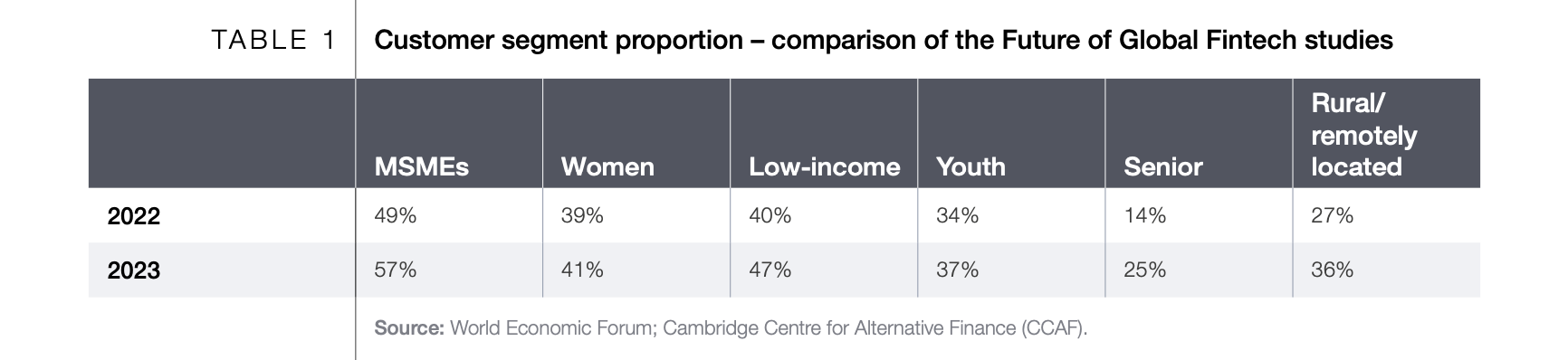

In 2023, financial inclusion remains at the heart of the fintech value proposition, and underserved segments continue to account for the majority of the customer base. MSME was 57% of fintech customers, an increase of 8 points (YOY); low-income people were 47%, up 7 points; women were 41%, up 2 points.

These segments also promote a larger share of fintech companies. Low-income customers’ income rose 17 percentage points to 43% in 2023, while older people’s contribution increased by 8 points to 28%.

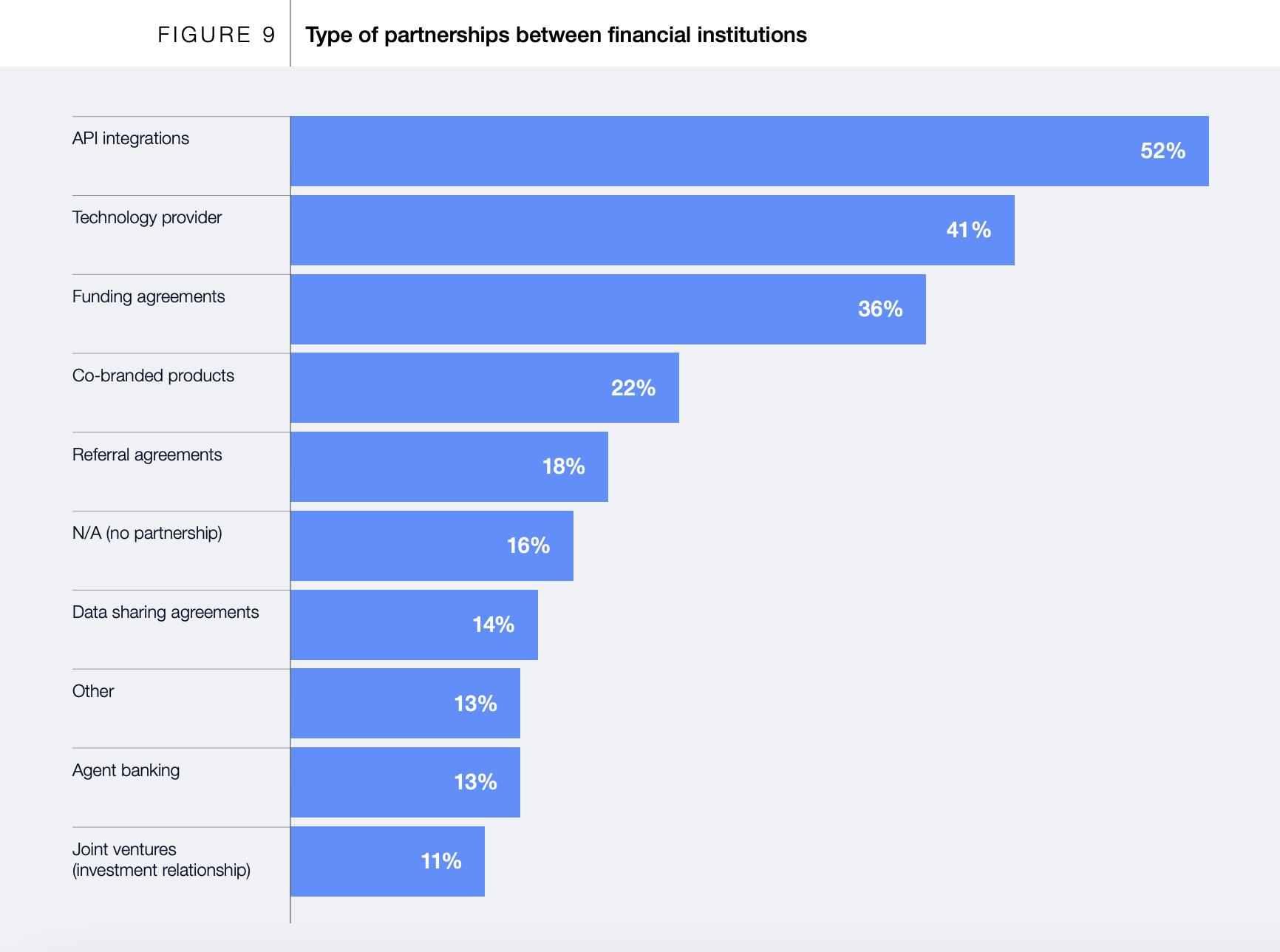

Partnerships are also still key to fintech growth, with 84% of fintech companies working with Inmbent financial institutions on their reports.

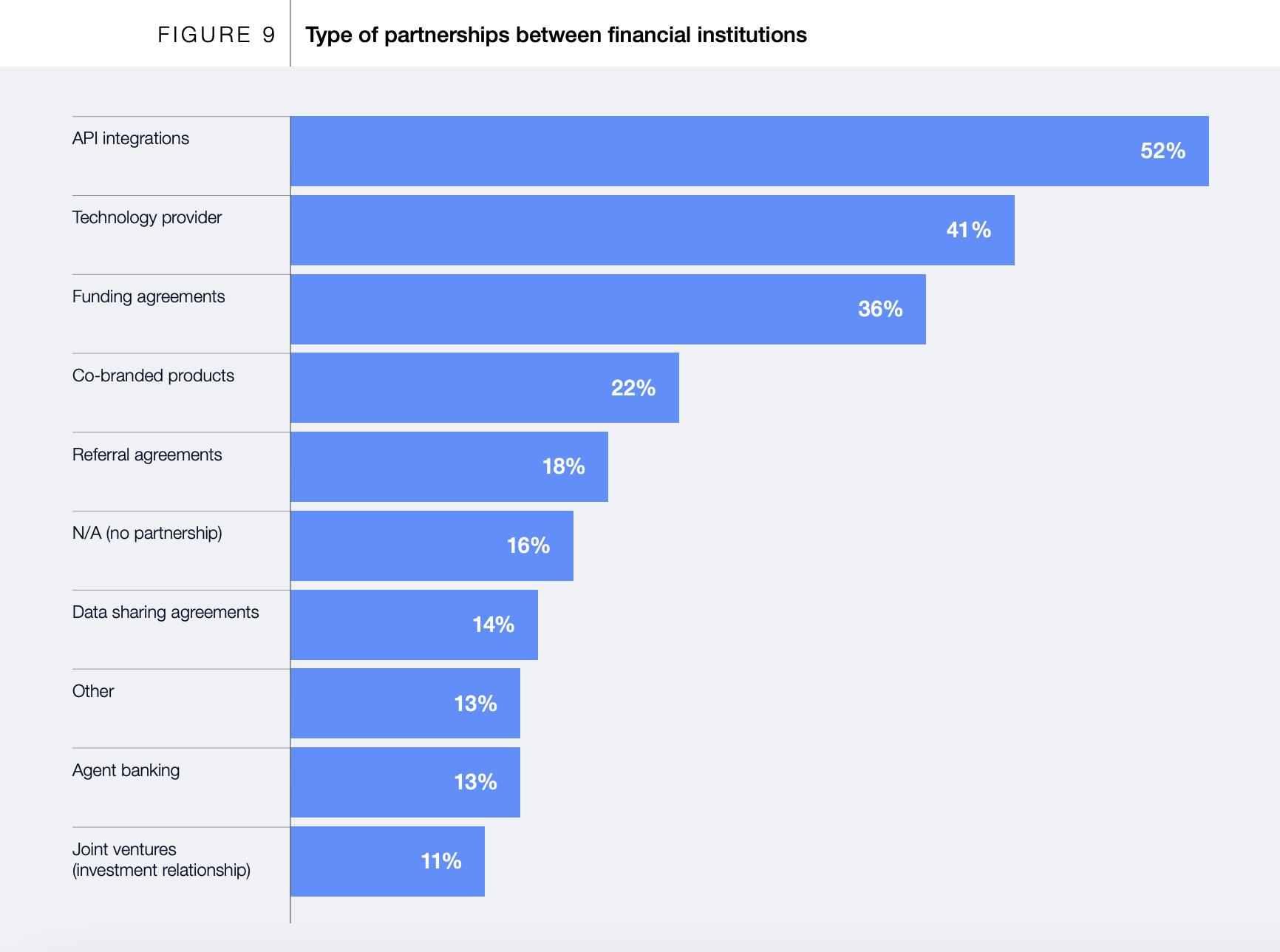

Application Programming Interface (API) integration is the most common partner program, which mainly supports payment processing, purchase transactions, and cross-border remittances. The technology provider has a 41% follower, highlighting the role of the Third Park technology solution in driving fintech operations. The funding agreement ranked third at 36%, indicating the importance of financial cooperation in sustaining growth and innovation.

Technology adoption accelerates

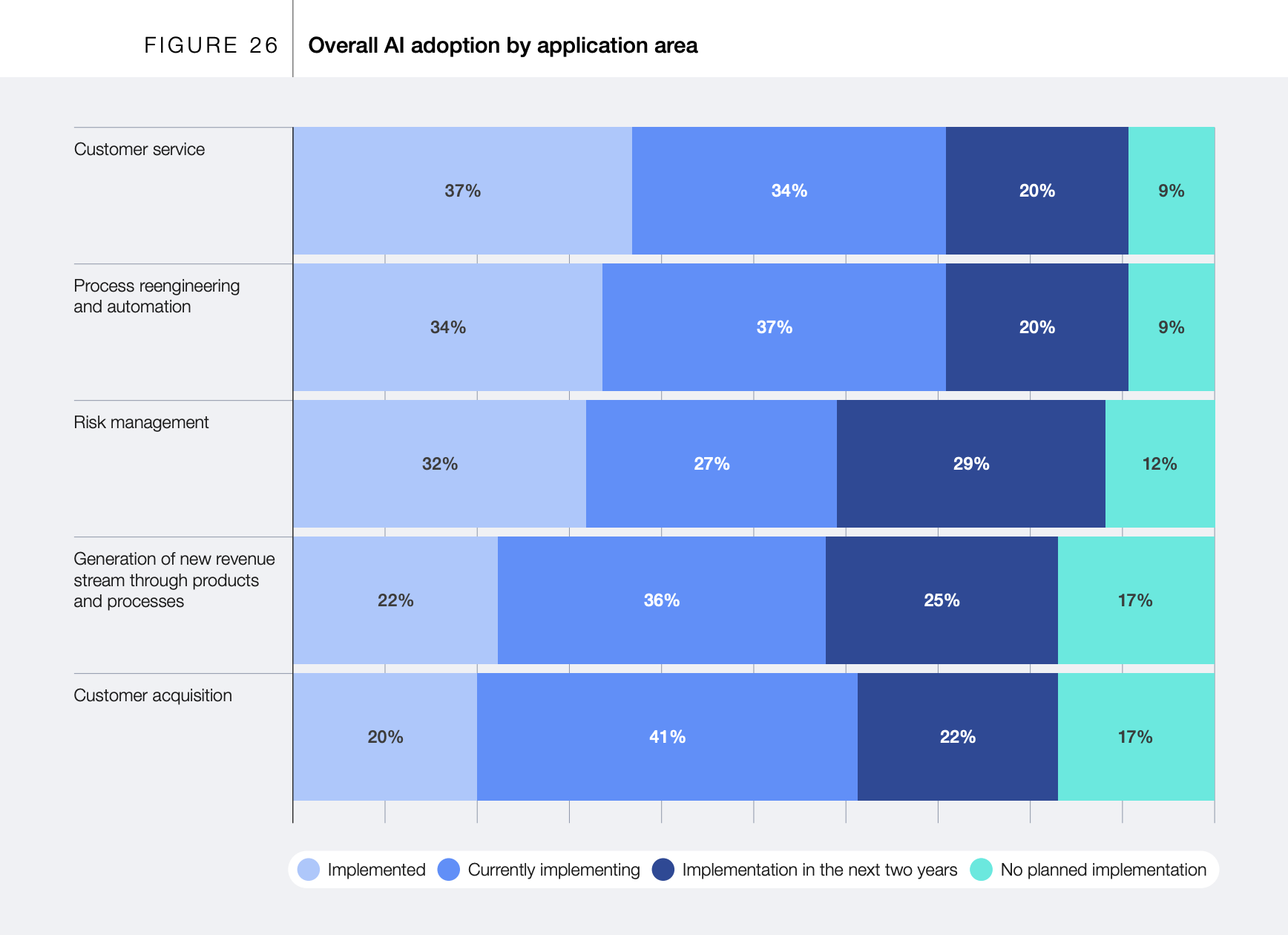

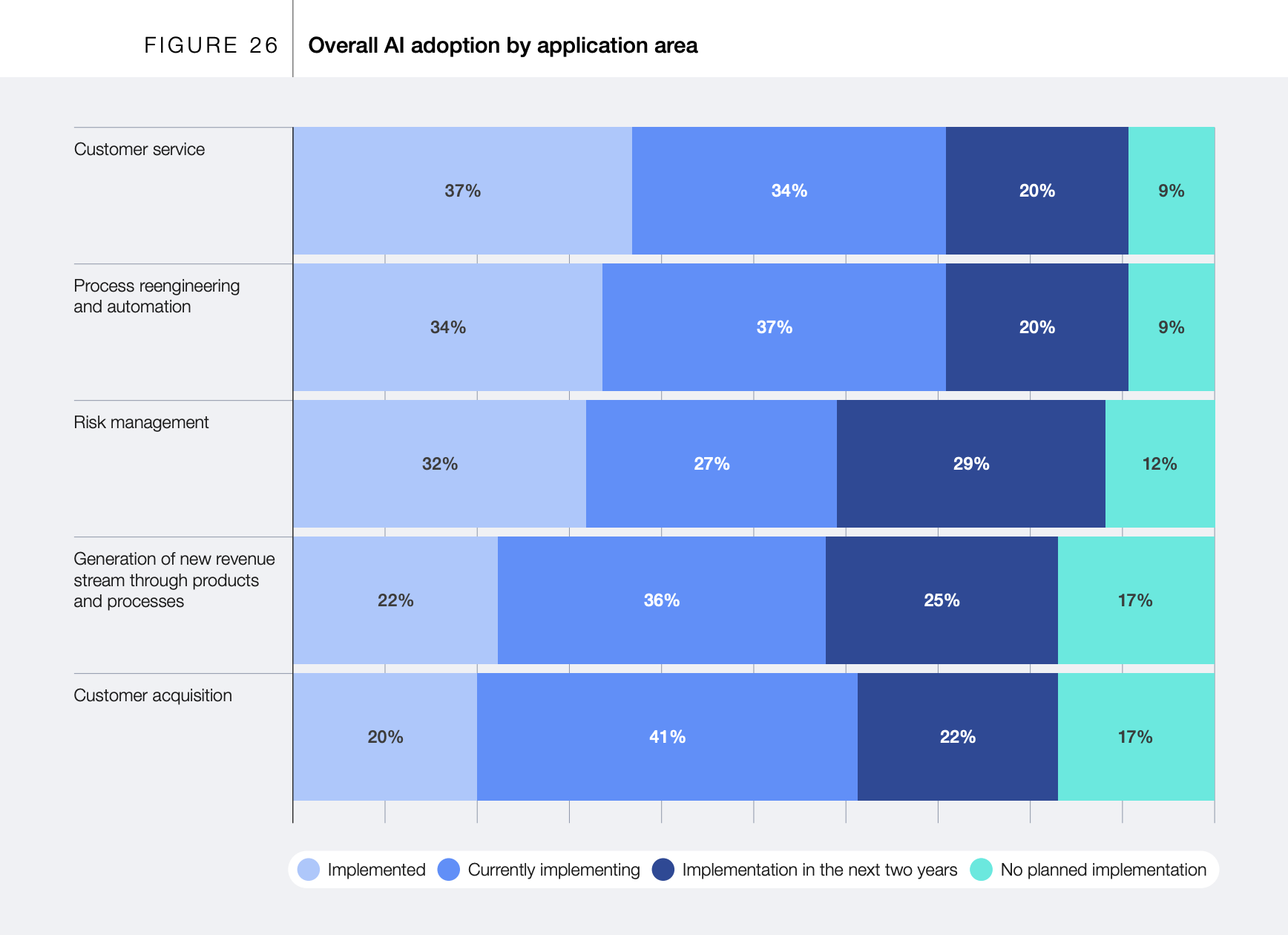

In 2024, technology remains the core driving force for fintech performance. In total, 80% of the surveyed fintech companies implement artificial intelligence (AI) in multiple business areas. Customer service and process automation lead AI applications, with 91% of companies in Eithher implementing AI or planning to implement it in these areas in the near future.

The number of risk management is 88%. New revenue streams are made through products and processes, while customers get 83%.

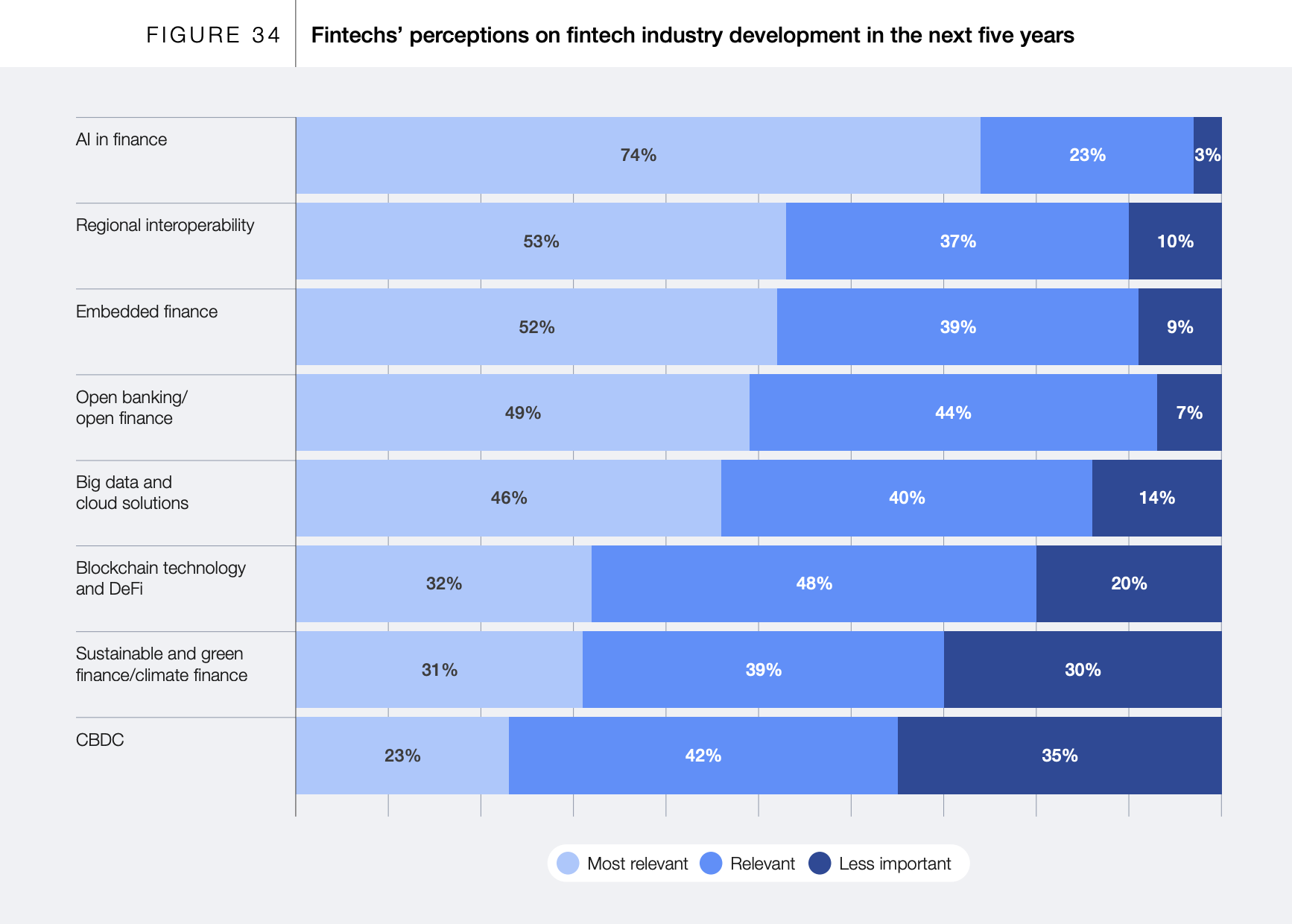

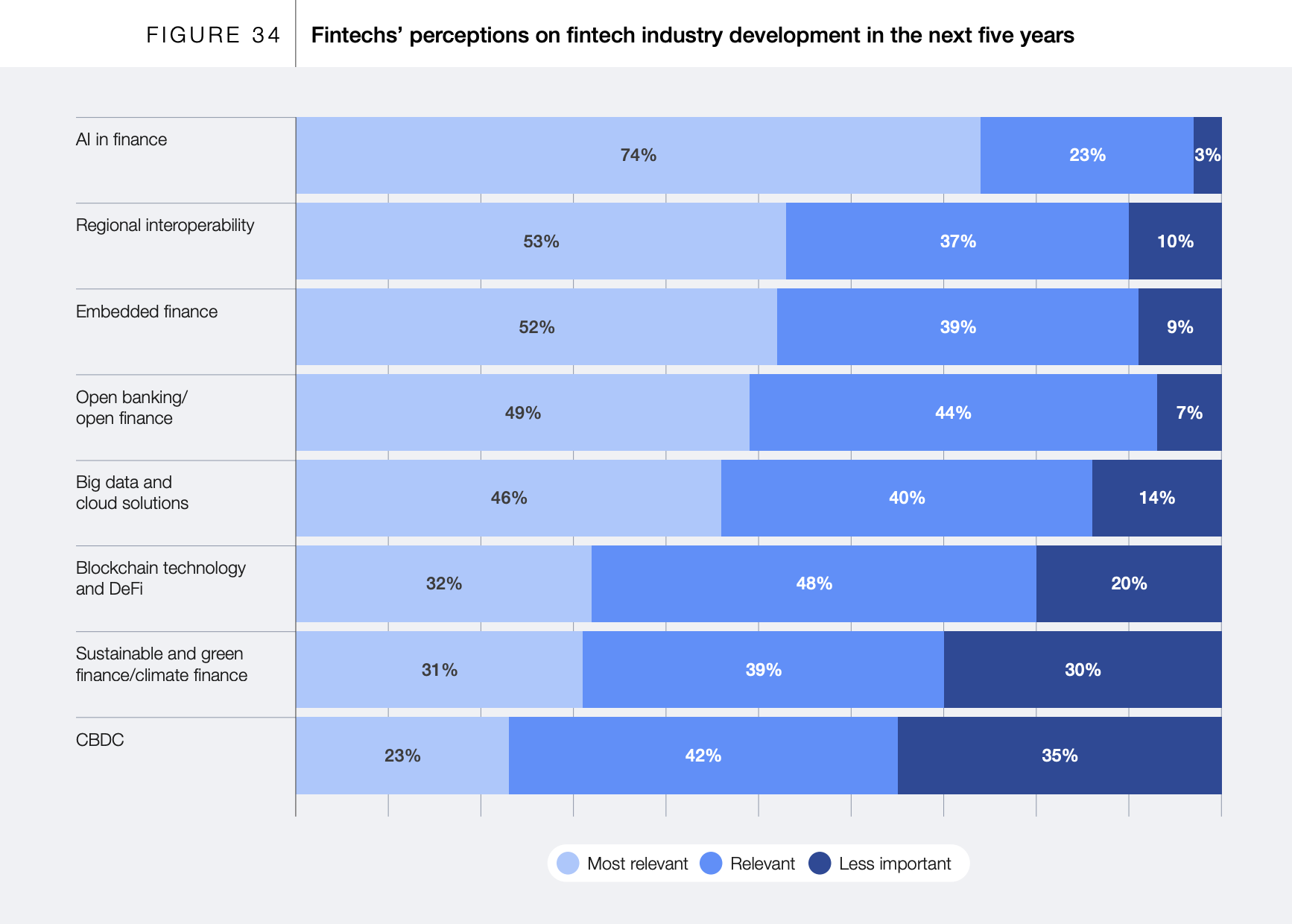

Looking ahead, fintech leaders identify AI as the most critical area in the next five years, with 74% of respondents ranking AI’s “most relay race”. Regional interoperability is 53%, with 52% of financing embedded and 49% of open banking/open banking.

Coupled with the broader discovery, ahead of the trend, further pointing to the collaborative transformation from pure disruption to digital financial services, and a deeper integration with traditional financial infrastructure.

Embedded Financing in 2021 rear According to McKinsey’s estimates, U.S. revenue is $20 billion. The market is expected to double in the next three to five years. In the European Economic Area and the UK, income from embedded financing will rise to €100 billion by 2030.

McKinsey expect In the banking industry, production AI increases productivity by 3% to 5%, with delivery value equaling an increase of $200 billion to $340 billion in annual revenue.

Featured Images: Images edited by Fintech News Switzerland, based on the image’s Farknot By FreeEpik

No Comments