FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

5 Proven Strategies to Maximize Valuation Discounts of S Corp Stock

Table of Contents

Introduction

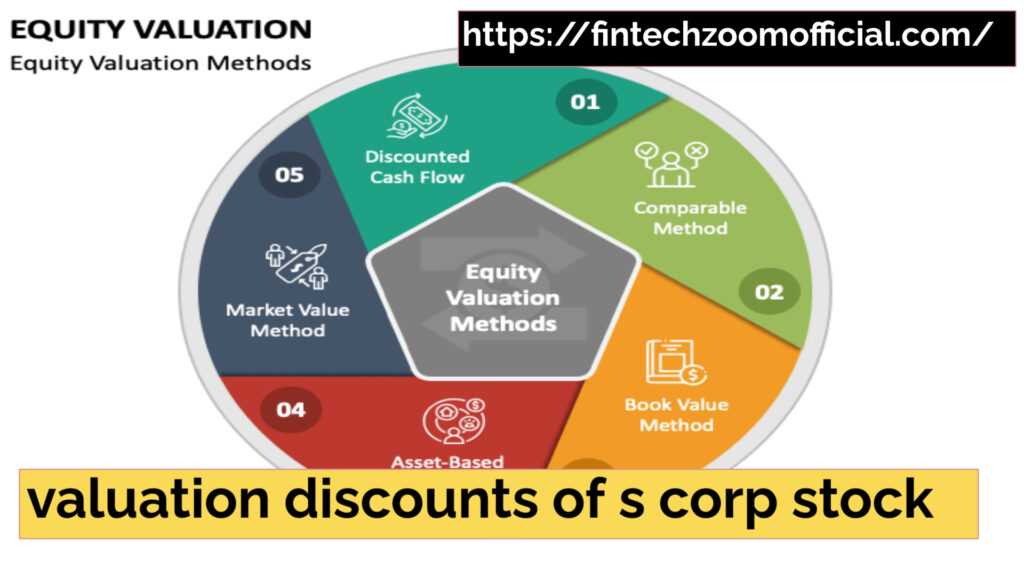

Shareholders can experience substantial financial benefits when they successfully maximize valuation discounts of S Corp stock. Understanding the nuances associated with these discounts remains vital for both business owners as well as investors searching for ways to create value. S Corps, with their special tax treatment, have a different set of pitfalls and perks compared to other corporate entities such as C Corporations (C-Corps). This blog provides a deeper dive into how valuation discounts of S Corp stock are maximized using specific strategies that emphasize tax efficiency and wealth transfer benefits.

Table of Contents

- Table of Contents

- Introduction

- Key Points

- LIVE UPDATE

- Main Content

- Understanding S Corporations

- Importance of Valuation Discounts

- Assumptions Behind Valuation Discounts

- Key Strategies to Maximize Valuation Discounts of S Corp Stock

- 1. Structural Organization of Ownership Interests

- 2.Enhancing Lack of Marketability Discounts

- 3. Utilizing Buy-Sell Agreements

- 4. Hiring Professional Appraisers

- 5-Documentation and Record-Keeping

- 6- Tax Planning Strategies

- Common Misconceptions About Valuation Discounts

- Regulatory Considerations

- Case Studies

- FAQs

- What Exactly is a Valuation Discount for S Corps?

- How Do I Value My S Corporation?

- What role do buy-sell agreements play in maximizing valuation discounts of S Corp stock?

- Conclusion

S Corporation Overview: Tax Pass-through and Shareholder Taxes

Valuation Discounts: How they reduce tax burdens and facilitate smoother transitions.

Tactics: Top tactics for cashing in on these savings.

Key Points

Taxation Differences: S Corps pass through earnings, and this is not the same with C Corporations.

Discounts — Certain valuation discounts, such as minority interest and lack of marketability, are paramount to reducing the value of stock for tax purposes.

Maximizing Techniques: Certain provisions, such as ownership structures, buy-sell agreements and tax planning can add value (in terms of reducing valuation discounts).

LIVE UPDATE

Valuation discounts of S Corp stock reduce tax liabilities during stock transfers or estate planning and are closely watched by the IRS. Staying updated ensures proper application.

Main Content

Understanding S Corporations

Rather, the tax treatment for an S Corporation is unique from a C Corporation. They benefit from pass-through taxation, which avoids having the company pay income taxes and instead passes each owner’s share of corporate taxable income to its shareholders. This structure helps S Corps sidestep double taxation (corporate and shareholder tax on the same income), which is common with C Corps, allowing them to maximize valuation discounts of S Corp stock effectively.

Tax Treatment: Income to S corp shareholders is reported on individual tax returns; no corporate-level taxes are assessed.

Control By Shareholders: It allows the shareholders to control decisions of a company, however this can lead in providing lesser valuation for shares through certain strategic points which might be discounted.

Importance of Valuation Discounts

Valuation discounts play a crucial role in the level of tax due by shareholders when stocks are transferred, businesses sold, or estates planned. These valuation discounts of S Corp stock adjust the value of stock to account for constraints on disposition that reduce, if not eliminate, conventional marketability or fair demand.

Discount of Minority Interest: Investors enjoy a small portion of wealth (shareholders) and only have little power to decide!

Discount for Lack of Marketability: Represents the challenge in selling shares that are not on a public market.

Assumptions Behind Valuation Discounts

If you have concerns about how valuation discounts are applied, it will probably help for you to be educated in a number of other factors that influence those outcomes and what aspects do not provide the differences.

Market Conditions : Economic impacts like industry and the entire economy market conditions decides one discount from another.

Company Characteristics: Industry and size is taken into account then a discount could be applied.

Holding Period — the longer the shares have been held, this can impact marketability and control premiums.

Key Strategies to Maximize Valuation Discounts of S Corp Stock

1. Structural Organization of Ownership Interests

S Corp ownership structure can significantly influence the discounts available in a valuation. Family Limited Partnerships (FLPs) and other classes of stock are frequently employed to achieve the largest discounts.

Family Limited Partnerships (FLPs) — intended to facilitate the transfer of ownership interest and preserving control within a family. However, owners can take minority interest discounts by transferring newly received nominal interests to family members.

Common: multiple classes of stock can be issued to keep control but populate ownership in a manner that will increase the discount,

2.Enhancing Lack of Marketability Discounts

The lack of marketability discount shows the challenge in selling shares, particularly in privately-held business S Corporations. Valuation discounts of S Corp stock, such as the lack of marketability discount, can be increased by restricting share sales, reflecting the illiquidity and difficulty in finding buyers for such stock.

Restrictions on Share Transferability: The restriction of when and by who the stock can be sold is going to add value discounting due to its lack of marketability.

Inadequate financial access: Limiting the availability of shareholder information can lead to more illiquid share purchases, thereby justifying a higher discount.

3. Utilizing Buy-Sell Agreements

Buy-sell agreements are essential in managing valuation and quantifying valuation discounts of S Corp stock. These agreements establish how shares of stock, particularly during a changepoint in ownership, are to be bought and sold; they also provide the value for tax purposes. Additionally, they help in determining key factors such as the lack of marketability discount and other applicable valuation discounts.

Cross-Purchase Agreements: Shareholders agree to purchase each other’s shares in the event of death or exit, helping stabilize stock value.

Entity Purchase: Corporation consolidates shares from departing shareholders, as controlling marketability and valuation (almost always) be.

4. Hiring Professional Appraisers

The discounts are difficult to calculate, and the IRS is very aggressive in its challenge of these types of valuations without professional appraisals that have been prepared at arm’s length. In addition, professional appraisals often make or break a valuation strategy, particularly when it comes to valuation discounts of S Corp stock, especially if IRS guidelines apply. Accurate and defensible appraisals are crucial in ensuring the discounts are accepted and withstand IRS scrutiny.

Value/Valuation Models: Reliance on recognized models like income and asset-based systems to determine discounts.

IRS Standards: If the rules and guidelines recommended by IRS for valuation are followed its good in case of legal actions or penalties during audits.

5-Documentation and Record-Keeping

However, if valuation discounts are being applied then maintaining careful financial records is a must. It helps you document your claim for a discount, and it makes sure that the gift is IRS compliant.

Books: Accurate, current financial statements are used to confirm the value of the business and prove discounts.

Legal Documentation — If a family member owns preferred shares directly in the business and shareholder agreements, buy-sell agreements, or restrictions on share sales are already present they must be well documented to apply discounts effectively.

6- Tax Planning Strategies

The tax impacts of valuation discounts are an essential part in estate planning and transitioning a business. Leveraging these discounts will help to minimize estate taxes and provide beneficial tax planning advantages for shareholders.

Deductions and Tax Credits — Deduction planning can enhance the financial benefits of valuation discounts.

Estate Planning: Discounted stock transferred to heirs will reduce estate tax savings

Common Misconceptions About Valuation Discounts

Many business owners assume that all valuation discounts of S Corp stock are guaranteed. However, this is not always the case. Courts, particularly the Delaware Chancery Court, have ruled against inflated discounts in several tax court cases, requiring empirical research to support claims.

Liquidity: Discounts are not solely based on the lack of liquidity; other factors, like market conditions and shareholder control, also play a role.

Control Premium: Having a small share does not always justify a large discount. Discounts must be carefully calculated based on investor-level taxes and actual marketability.

Regulatory Considerations

The guidelines for applying a valuation discount of S Corp stock and the documentation that must support those discounts are established by the IRS. These discounts are widely scrutinized in tax court cases, making it crucial to follow IRS rules closely to ensure compliance and avoid penalties.

IRS Compliance: Ensures that discounts are applied according to IRS rules, which prevents penalties from the audits.

Tax Court Cases: The Delaware Chancery Court and other tax courts have set precedents on acceptable discount levels.

Case Studies

These strategies have been used effectively by successful S Corporations to avail of valuation discounts. For example, a closely-held family business took advantage of FLPs to pass non-controlling interests in the company down to other family members at substantial discounts.

Company A: Stable valuations created predictability with ownership transitions using buy-sell agreements

So long as the appraisals are handled properly, all departments of this business have been able to take advantage of many discounts and remain in line with IRS standards

Business B: Escapes paying massive quantitys each tax year due partly because a professional appraisal ensures they receive maximal savings possible while abiding by every rule set forth.

FAQs

What Exactly is a Valuation Discount for S Corps?

Some of the most typical valuation discounts consist of the minority interest discount, for shareholders who do not have control over decisions, and the lack of marketability discount, which reflects how hard or easy it is to sell shares in a private company. These valuation discounts of S Corp stock are crucial in determining the fair market value, as they account for the limitations faced by shareholders in terms of control and liquidity in privately-held businesses.

How Do I Value My S Corporation?

Value of an S Corp is derived from a number of valuation methods, such income approach, market and asset-based approach. Appraisals are often required and in order to get accurate appraisals that fall within tax compliance you would usually need to hire an appraisal professional.

What role do buy-sell agreements play in maximizing valuation discounts of S Corp stock?

Buy-sell agreements are used to describe the conditions, under which shares can be transferred upon death or change of ownership. She explains that such agreements, by strictly limiting who can sell shares and when they may be sold, create greater valuation discounts of S Corp stock.

ALSO READ THIS BLOG : FINTECHZOOM GME STOCK: NAVIGATING OPPORTUNITIES AND CHALLENGES IN 2025

Conclusion

Applying the tax law to realize valuation discounts of S Corp stock is a complex and sophisticated process of planning, combined with understanding how these rules interface with valuation theory. Shareholders can obtain a myriad of tax savings by structuring ownership interests to fit their specific circumstances, using buy-sell agreements backed by professional appraisers and others.

With proper documentation, adhering to IRS rules, and utilizing tax planning, these discounts can be applied effectively, thereby reducing taxes owed on a dollar-for-dollar basis.

No Comments