FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

The rise of private dollar stablecins in the European Parliament poses global risk to Montac’s sovereignty, financial stability – FinTech Schweiz Digital Finance News

Breaking Fintech News: Stay updated with the latest in the financial technology world.

Table of Contents

Free newsletter

Get the hottest fintech news in your inbox every month

Both the EU (EU) and the United States have taken steps to regulate digital currencies issued using distributed ledgers (DLT). However, these jurisdictions have adopted a very different approach: the United States favors private crypto innovation, while the EU prioritizes financial stability and monetary sovereignty.

according to For a new study commissioned by the European Parliament’s Committee on Economic and Monetary Affairs, the U.S. position reflects the proposed guidance and national innovations to establish the U.S. Stablcoins (Genius Act) that could further strengthen the EU economy.

By promoting Stablecoin innovation in the private sector, U.S. policy could undermine the EU’s interests in trade and multilateral relations. It may also conflict with EU end stability, consumer protection, monetary policy transmission, price stability, exchange rate flexibility and anti-currency Lainndering (AML) enforcement.

Risks related to currency denomination and cross-border issues

The report warns that pegging fixed currencies to foreign currencies, such as the US dollar, could create fragility in national monetary policies. For example, EU citizens holding a stable dollar holding a fixed dollar face exchange rate risk. If the dollar depreciates against the euro, their purchasing power will decline, which may damage EU consumption and investment.

The widespread use of stablecins by foreigners can also undermine a country’s Montage autonomy. If the dollar is fixed in a wide range of stability circuits within the economy, fluctuations in the value of the dollar relative to the local currency may undermine the efficiency of domestic monetary policy and even force the central bank to fix its currency on the dollar. This will significantly limit monetary sovereignty and effectively mimic the form of “digital dollarization”.

In addition, the increasing use of stablecoins pegged to the dollar may weaken the international role of the euro and reduce the attractiveness of the euro as a reserve asset. This further underestimates the supremacy of the US dollar for retaining currency.

Finally, if Stabloins that do not regulate the EU are free to cycle around nearby areas, they can circumvent EU rules. This increases the risk of currency l depletion and also increases the exposure of EU households and companies to increase exchange rate and financial stability risks.

Financial stability and monetary risks associated with Stabloins

The report also warns that the Stab coin presents significant financial stability and monetary risks. Bestase Digital, because currency is backed by a portfolio of assets that may be liquid or volatile, StablCoins may suffer from liquidity and mature maturity. This means that during times of financial stress, users may not exchange their stablecoins for their face value.

Stablecoin issuers also tend to chase higher yields while trying to maintain liquidity. This could lead them to respond to changing goods, thus destroying national bond markets and thus changing large amounts of funds across borders. For example, if inter-business interest rates rise, the depreciating Stablcoin issuer of the euro may transfer funds from European bonds to the U.S. Treasury bill.

Finally, Stablecoin issuer Offen retained the deposits of traditional banks. If they suddenly withdraw large sums in pursuit of higher yields elsewhere, this could hurt the bank’s liquidity and the risk of systemic crisis.

Encourage CBDC and quick payments

In response to so-called “American secret mastery”, the report recommends that the European Central Bank (ECB) closely monitor the development of the dollar’s stabilizing stabilizers in the EU and limit the Esir cycle if needed.

The report also calls on the EU to promote retail and wholesale banking digital currency (CBDC) and fast payment systems as safe and effective alternatives to stabilizers. At the same time, banks should be encouraged to provide faster, cheaper, and more user-friendly payment services, especially for businesses to reduce the attractiveness of private Stablcoins in daily transactions.

EU regulators should also promote multilateral payment systems based on cooperation and respect for state monetary autonomy. A strong payment infrastructure should foster international cooperation, including information sharing, standardized communication protocols and coordinated regulatory frameworks. It should also enable CBDCs to interoperate with each other and non-CBDC fast payment systems, and support features such as currency conversion and capital flow management.

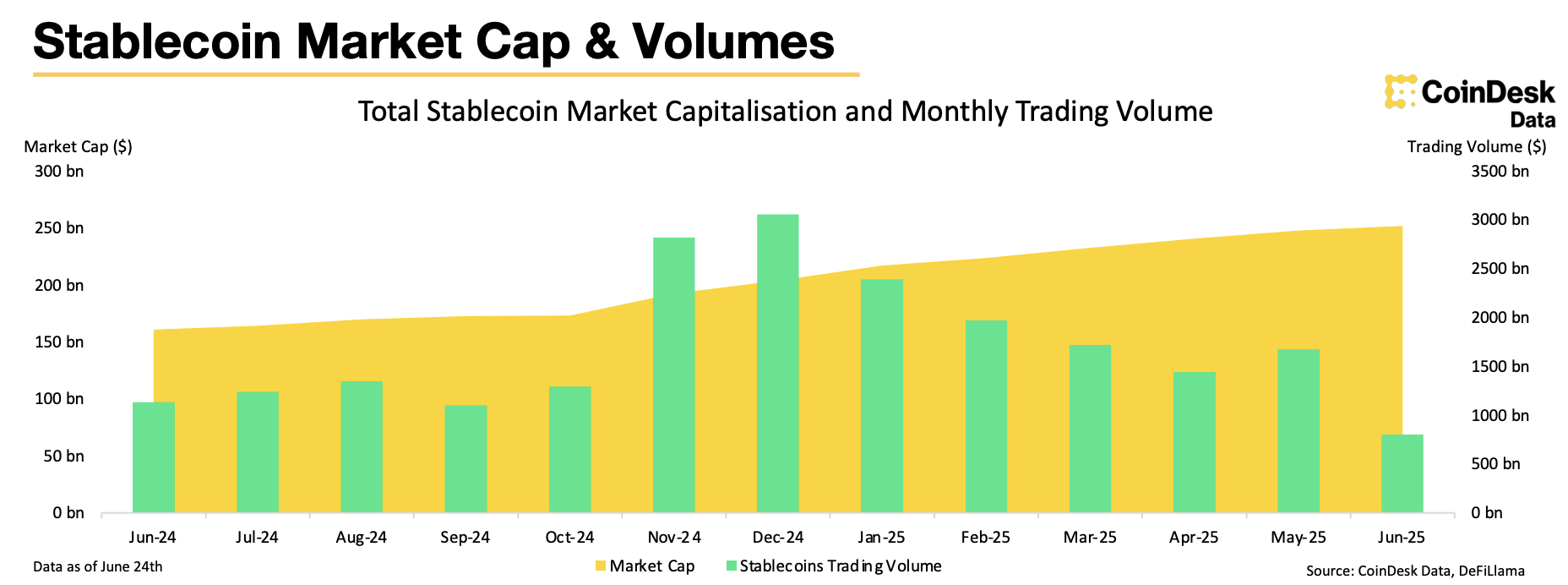

Stable and stable market

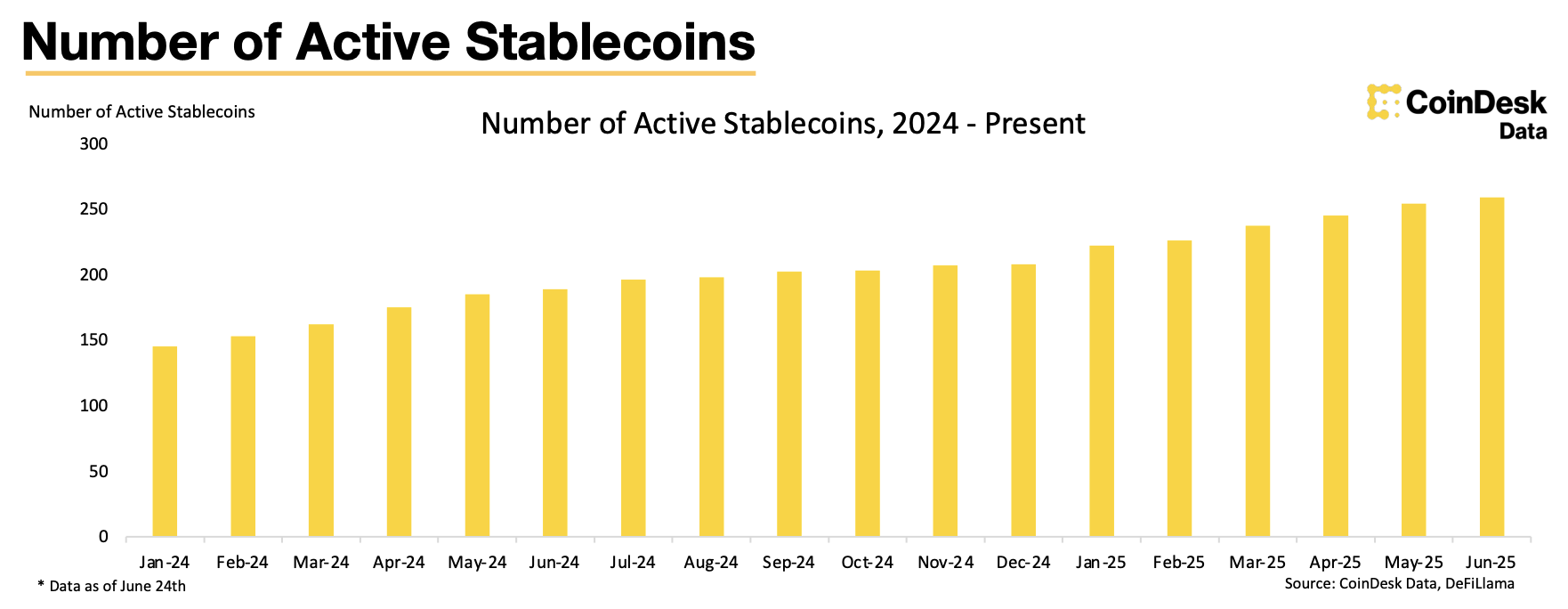

In recent years, the global Stablecoin market has expanded significantly. According to Defilama, the number of active Stablecoins has almost doubled, from 136 people in early 2024 to 259 in June 2025.

In June, the market is stabilized behind. according to To countless stablecoins and CBDCS reports.

The enthusiasm of companies has always been, with companies like Walmart and fees exploring their own stablecoins to simplify global payments, reduce processing fees, and rely on traditional financial infrastructure, The Wall Street Journal Report. Companies owned by Wall Street giants such as JP Morgan Chase, Bank of America, Citigroup and Wells Fargo It’s also consido Start to joint stability.

Favorable regulatory developments have promoted the industry. June 27, U.S. Senate pass The Genius Act received strong bipartisan support from 68 to 30 votes. The legislation aims to regulate the Stablecoin market and create a civilian framework for issuing digital currencies for banks, companies and other entities. U.S. House of Representatives expect Voting this week’s Genius Law.

Featured Images: Images edited by Fintech News Switzerland, based on the image’s Sodawhiskey and dang pham By FreeEpik

No Comments