FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

Swiss crowdfunding has been stable after years of decline, signs of stagnation – FinTech Schweiz Digital Finance News

Breaking Fintech News: Stay updated with the latest in the financial technology world.

Table of Contents

Free newsletter

Get the hottest fintech news in your inbox every month

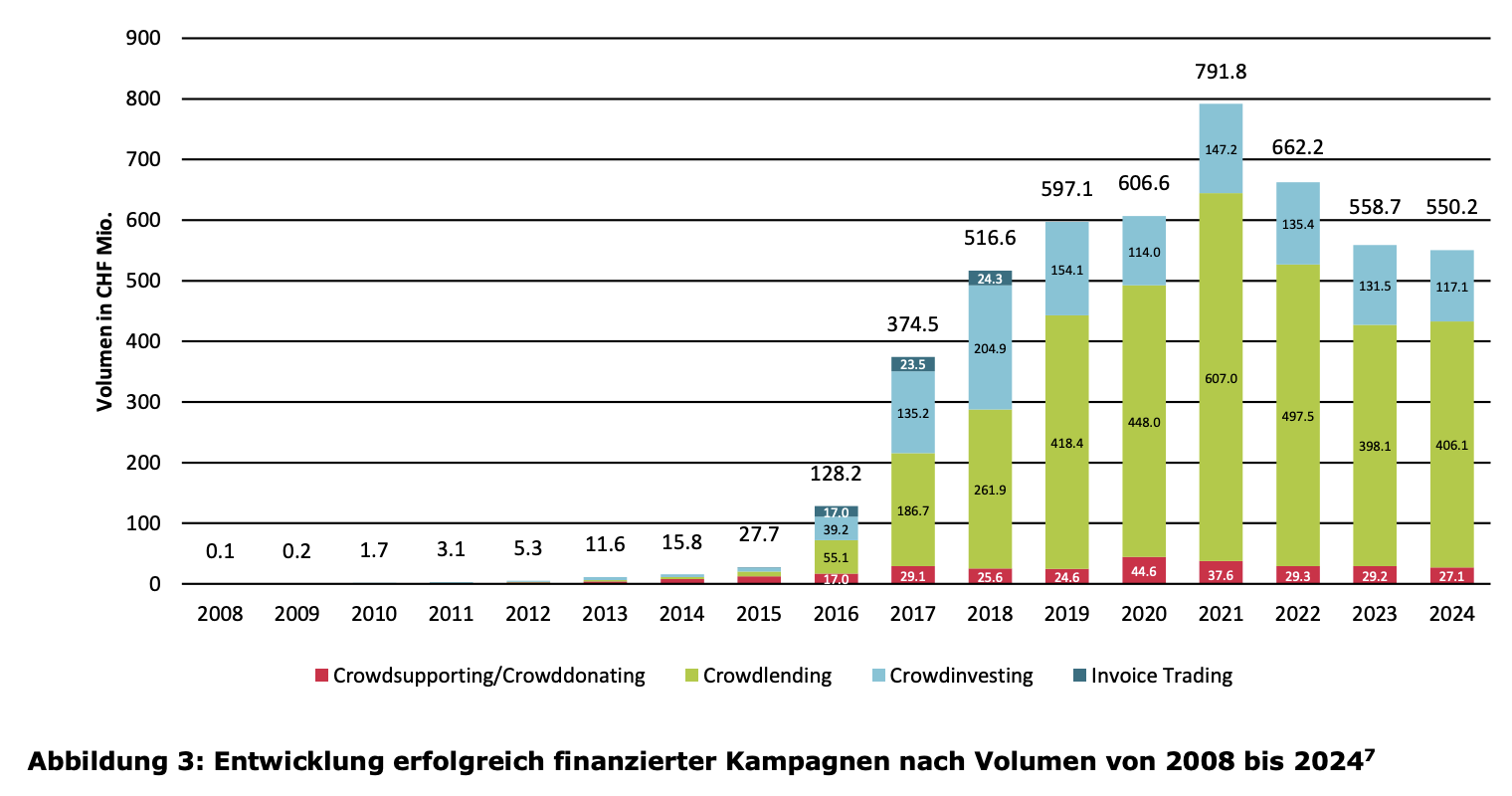

In 2024, the Swiss crowdfunding market showed signs of stability after years of decline.

according to In a new report from Lucien University of Applied Sciences and the Arts, the number of campaigns successfully funded by the Swiss crowdfunding platform reached CHF 550.2 million, down 1.5% year-on-year.

This is a noticeable improvement compared to a clearer drop 16.4% in 2022 and 15.6% in 2023. The number of successful financing activities also increased slightly by 0.5% to 4.071.

The Schweiz report, a crowdfunding monitor released in June this year, shows that Switzerland is now home to 38 crowdfunding platforms. However, there are only 23 financing activities in 2024. This is the same as the previous year, further demonstrating the stagnation of the market. Last year, three platforms left the market (Gobeyond, Neocredit and YesWefarm), while two new platforms were launched (Imvesters and Solarify).

His stagnation has occurred, and the report found that more and more Swiss consumers are participating in crowdfunding. In 2024, about 280,000 people supported at least one crowdfunding campaign, a 40% increase from 200,000 in 2023, while 180,000 in 2019 increased by 55%.

Crowd-driven market

In 2024, Crowdylending remains the backbone of the Swiss crowdfunding market, making up for most crowdfunding activities. The crowd is also the only part that records the increase in loan volume.

Many investors have loaned from individuals or institutions, earning CHF 406.1 million in 2024, a year-on-year increase of 2%. You are loans issued through eight platforms including Swiss, cash and loans/brilliant. The acceleration of the crowd is more than three-quarters of the crowdfunding.

In CrowdyLending, the business unit totaled CHF 133.6 million, which is only slightly 0.6% compared to 2023. You are loans mainly used for project financing, debt restructuring and short-term liquidity needs.

The growth of consumer craverderding grew more dynamically, with private lending growing by 19.1% to CHF 73.1 million. These loans are primarily used for debt consolidation, education, purchase, travel or wedding.

In contrast, real estate craver fell around the board, down 2.2% year-on-year to CHF 100 million.

Growth, Crowneys remained a niche, accounting for only a small part of the overall loan market. In 2024, Swiss consumers received 116,716 new loans, totaling approximately CHF 4.2 billion. Ofse, only 1,641 loans (or 1.4%) are in trouble.

Similarly, the Swiss mortgage market sees CHF 15-180 billion in new or updated loans each year. By comparison, this makes 100 million Swiss francs negligible through the CrowdyLending platform.

This also applies to business landings, where banks hold business loans of CHF 402.9 billion on these balance sheets, making Throch throch commercial scrambles CHF 133.6 million in 2024.

Real estate investment field

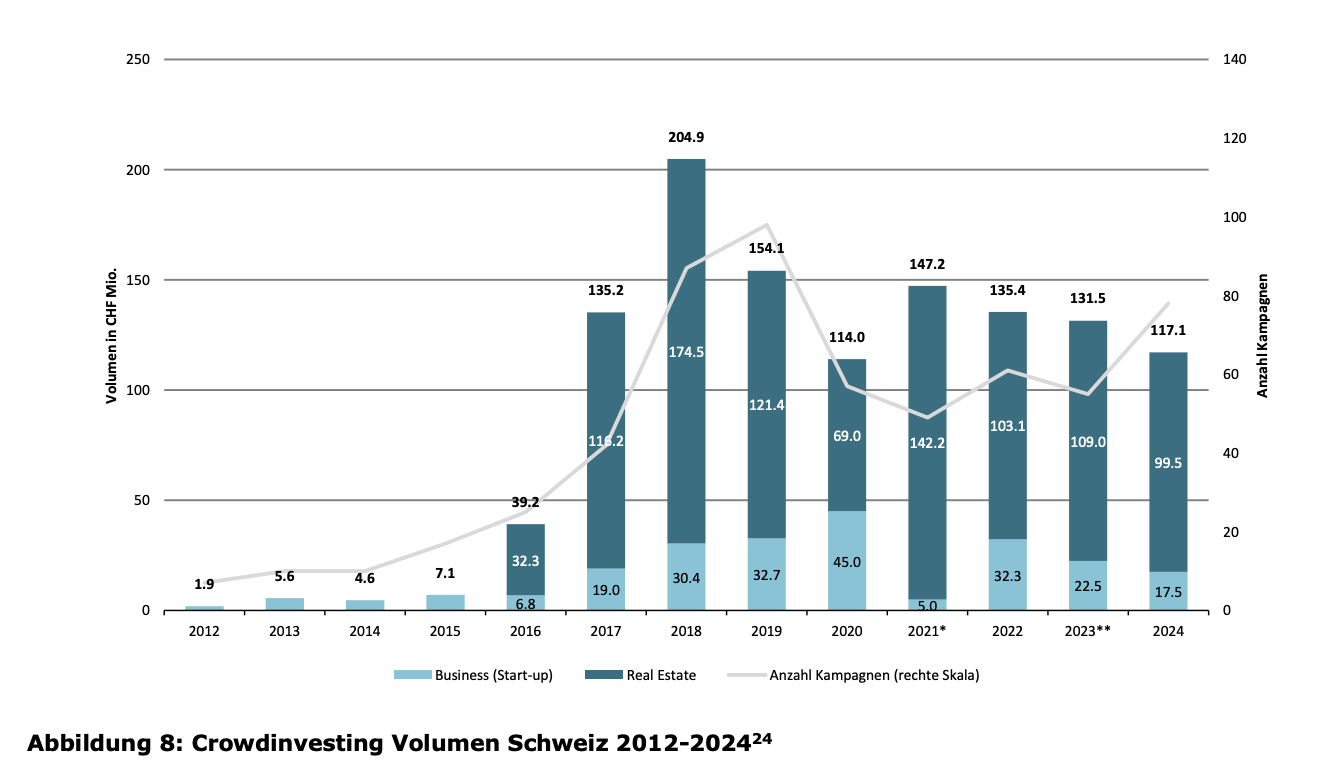

Stock-based crowdfunding or crowd investment investing in stock acquisitions remains prominent in the Swiss crowdfunding landscape. In 2024, there were 78 successful crowd investment campaigns, up from 55 in 2023. However, the total fell 10.9% to CHF 117.1 million.

In this segment, real estate continues to lead, accounting for CHF 99.5 million, or an astonishing 85% of the crowd investment market.

Most of this volume comes from the crowd, Kanda and Fox Stonethree famous group investment platforms in Switzerland. The minimum investment amount usually starts from tens of thousands of Swiss francs, with an average investment of approximately 75,000 Swiss francs per investor in 2024.

Globally, crowdfunding has become a building and reliable way for businesses and consumers to obtain funds. at present according to Statistics on the German data platform. Europe lasted nearly $10 billion, driven primarily by activities from Crafdylendent.

In Europe, the UK is the largest hub for raising digital capital, followed by Germany and Italy. The United Kingdom and Germany also lead In terms of platform density, each hosts more than 100 active crowdfunding platforms in 2023.

However, like Switzerland, many of these platforms make up only a small part of the overall loan market and have a relatively limited supporter base. Many people report less than 500 active investors in 2022.

Featured Images: Images edited by Fintech News Switzerland, based on the image’s smmedia.io By FreeEpik

No Comments