FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

Modernization is imperative: Why financial services cannot afford legacy inertia: Author: by Sergiy Fitsak

Table of Contents

The financial services sector has reached a turning point, and it is imperative to transform traditional systems from strategic advantages to business. Institutions operating on decades-old infrastructure are facing pressures from regulatory evolution, disruptions in competition and customers’ expectations of customers that are simply not able to meet traditional architectures.

Although modernization poses inherent risks in a strictly regulated environment, the cost of doing nothing is obvious. Financial institutions that delay transformation risk regulation are non-compliant, unfavorable competition and inefficient, have increased this efficiency over time.

The integration of modernization drivers

Regulatory complexity and compliance burden

Modern financial regulations require system agility that traditional platforms cannot provide. Open banking authorization, real-time payment requirements and evolving data privacy regulations require architectures built for adaptability, not just stability. Legacy systems with hard-coded logic and manual processes are difficult to adapt to rapid regulatory changes while keeping audits ready.

The compliance burden exceeds documentation and reports. Modern regulations require granular transaction tracking, real-time risk monitoring and comprehensive audit tracking, which are features that traditional architectures usually lack without a large number of solutions.

Competitive pressures for digital challengers

Fintech startups and embedded financing providers built on cloud-based infrastructure always outperform traditional institutions in the product innovation cycle. These challengers deploy new features weekly, rather than quarterly, personalized services through advanced analytics and a seamless digital experience that traditional systems can’t match without extensive customization.

The threat range exceeds direct competition. Large tech companies entering financial services with a platform-based approach force traditional institutions to rethink their technological bases to remain relevant to an evolving ecosystem.

Evolving customer expectations

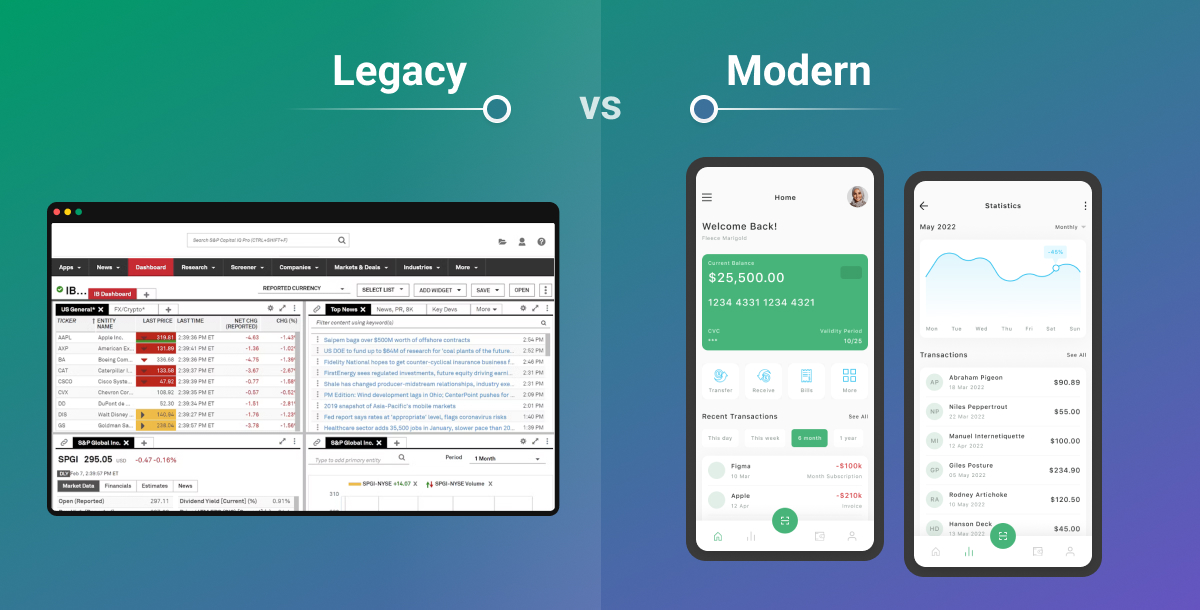

Digital-first customers expect instant account opening, real-time payment processing and personalized financial insights. Traditional systems designed for backend efficiency rather than customer experience strive to provide these capabilities without introducing significant latency or operational complexity.

As digital experiences in other fields set new standards for responsiveness and personalization, the gap between customer expectations and the capabilities of older systems continues to widen.

Strategic modernization approach to financial services

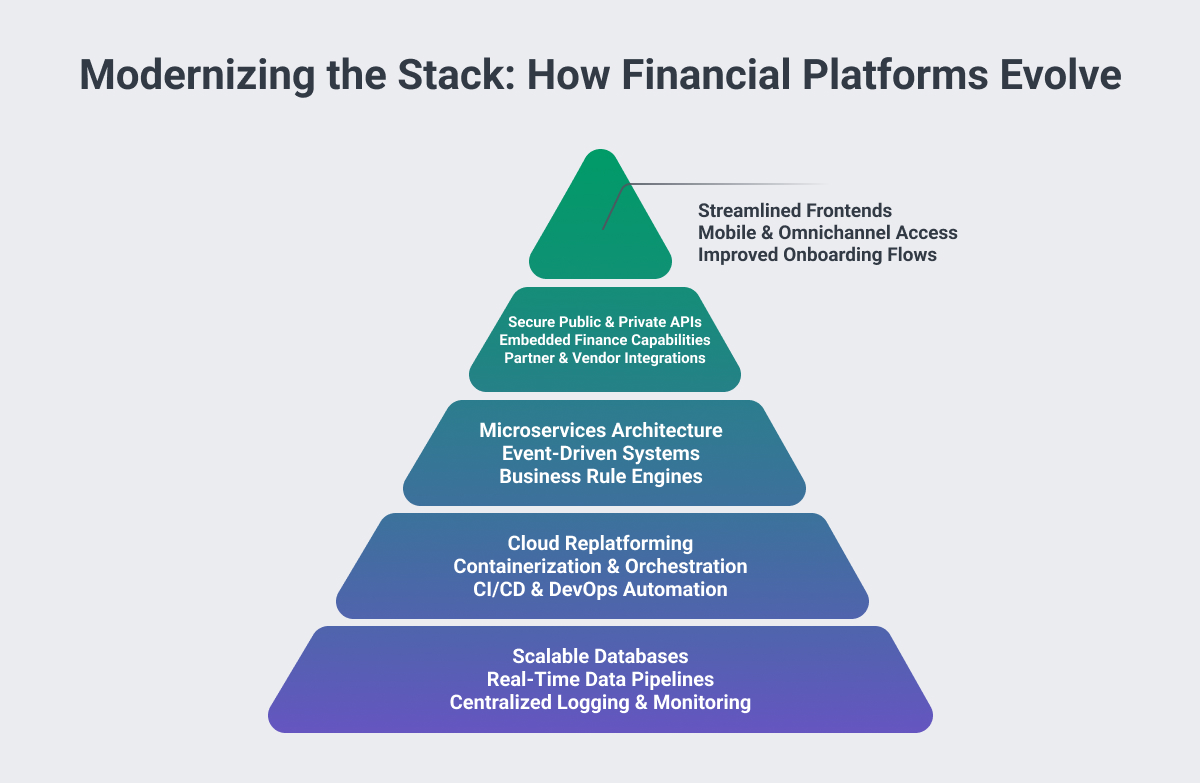

Evolution of incremental architecture

Financial institutions usually cannot afford the operational risks of wholesale system replacement. Successful modernization strategies focus on gradual transformations that preserve business continuity while improving gradual capabilities.

The core system is wrapped with API layer to represent the most common initial method. This policy enables modern application and partner integration to interface with existing systems without core logic changes. This approach provides direct value while building the foundation for a more comprehensive modernization effort.

Cloud-leading infrastructure strategy

Hybrid cloud adoption enables financial institutions to balance regulatory requirements and operational efficiency. Analytics, non-critical workloads such as customer portals and development environments migrate first, while sensitive transaction processing remains in a controlled environment until the regulatory framework continues to evolve.

Cloud-native services enable advanced features – real-time fraud detection, predictive analytics and automatic compliance monitoring – require significant investment to be done in-house traditional infrastructure development.

Modernization of data architecture

Modern financial services require real-time data processing to prevent fraud, regulatory reporting and customer personalization. Traditional ETL processes and batch-oriented data flows cannot support the analytical requirements of contemporary financial products.

Compared with traditional batch processing methods, an event-driven architecture using modern streaming platforms enables real-time transaction monitoring, instant fraud detection and immediate regulatory reporting while reducing system complexity.

Implementation precautions and risk mitigation

Regulatory compliance in a modern environment

Modernization efforts must maintain regulatory compliance throughout the transformation phase. This requires careful planning of data residence, audit records, access controls and disaster recovery capabilities. Modern architectures actually enhance compliance capabilities through improved observability, automatic monitoring and particle access control.

Documentation and change management have become critical during modernization to meet regulatory requirements for system understanding and control procedures.

Operational risk management

Financial institutions need comprehensive testing strategies that not only validate functionality but also perform under stressful conditions. Modern infrastructure can enable more complex testing methods, including chaotic engineering and automatic load testing, to improve system resilience.

Rollback features and feature markings ensure that modernization efforts can be quickly reversed if problems arise, reducing the operational risks of transformation plans.

Skill development and team consistency

Successful modernization requires labor development and technological transformation. Teams accustomed to traditional systems need to be trained in cloud-native development, API design, and modern DevOps practices.

During the transition period, organizations often complement internal teams with expertise to accelerate knowledge transfer and reduce implementation risks.

Measurable business impact

Improve operational efficiency

Modern financial institutions often reduce costs significantly by automating processes, reducing manual interventions, and improving system reliability. Cloud-only infrastructure provides a variable cost structure that combines technology spending with business growth rather than fixed capability plans.

Enhanced customer experience

Modern architecture enables real-time personalization, instant transaction processing, and a seamless omnichannel experience to drive customer satisfaction and retention. The ability to launch new products quickly enables organizations to respond quickly to market opportunities.

Regulatory response capability

Modern systems adapt more efficiently to regulatory changes through configuration rather than code changes. Automated compliance monitoring and reporting reduces manual efforts while improving accuracy and auditability.

The way forward

The modernization of financial services represents a strategic imperative that cannot be postponed indefinitely. In an increasingly digital financial ecosystem, institutions that systematically transform are (balanced innovation with risk management – for sustainable competitive advantage.

The problem facing financial leaders is not to modernize, but how to execute a growth-enhancing transformation while maintaining institutional stability and regulatory compliance.

(tagstotranslate) FineXtra(T) NewsT Online T Bank T Bank T Technology T Technology T Finance T Finance T Financial T Financial T FinT Tech T Tech T Tech T Tech T Tech T IT TI T IT Break T Latest T Latest T Retail T Retail T T Deprive T Trade Execution T Headline News Blockchain T t Digital t Investment T t Mobile t Business Challenger T Pay t Pay t Regtech T Regtech T Insurtech T Insurtech T Service

Source link

Comments are off for this post.