FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

Incidents are primarily theft, crypto adoption and wealth hit new highs – Fintech Schweiz Digital Finance News

Breaking Fintech News: Stay updated with the latest in the financial technology world.

Free newsletter

Table of Contents

Get the hottest fintech news in your inbox every month

The subvolatility of the global cryptocurrency market in the first half of 2025 marks the major hack, but the increase in Bitcoin millionaires and the wider adoption of Bitcoin ATMs, according to New report to Endbold, a financial and crypto news and data platform.

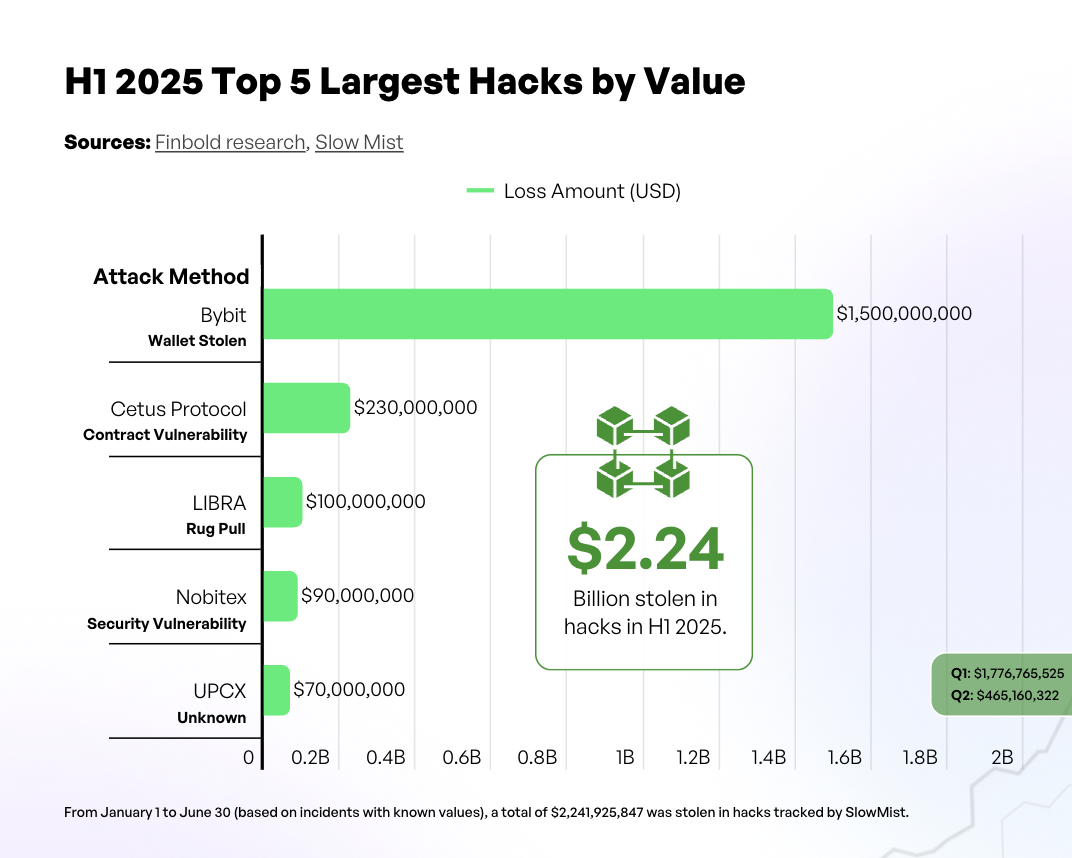

H1, driven by BYBIT, CETUS protocol and major events in Libra, has been stolen in total $2.24 billion in crypto hacks in H1 2025:

- Encryption exchange bybit Lost North Korean hackers $1.5 billion. funds Taken away From a “cold wallet” for offline storage of Ether tokens. FBI Link This time, the attack on North Korea’s “trader” network operations.

- Dental Exchange (DEX) CETUS Protocol Lost Due to contract vulnerability, it is about $230 million. The CETUS protocol running on the SUI and APTOS blockchain provides a $5 million bounty to anyone, providing relay information that leads to attacker identity and arrest.

- Libra is a meme coin, becoming one of the largest rugs in crypto history. In February, Argentina President Javier Milei promoted a little-known token on X, claiming that it would boost Argentina’s economy by funding small businesses. Within a few minutes, Libra is from essentially $0 to $5, arrive The market value is US$4.5 billion. Three hours later, insiders withdrew about $100 million, exhausting liquidity and triggering more than 90% of cryptocurrency.

Bitcoin millionaire hits new

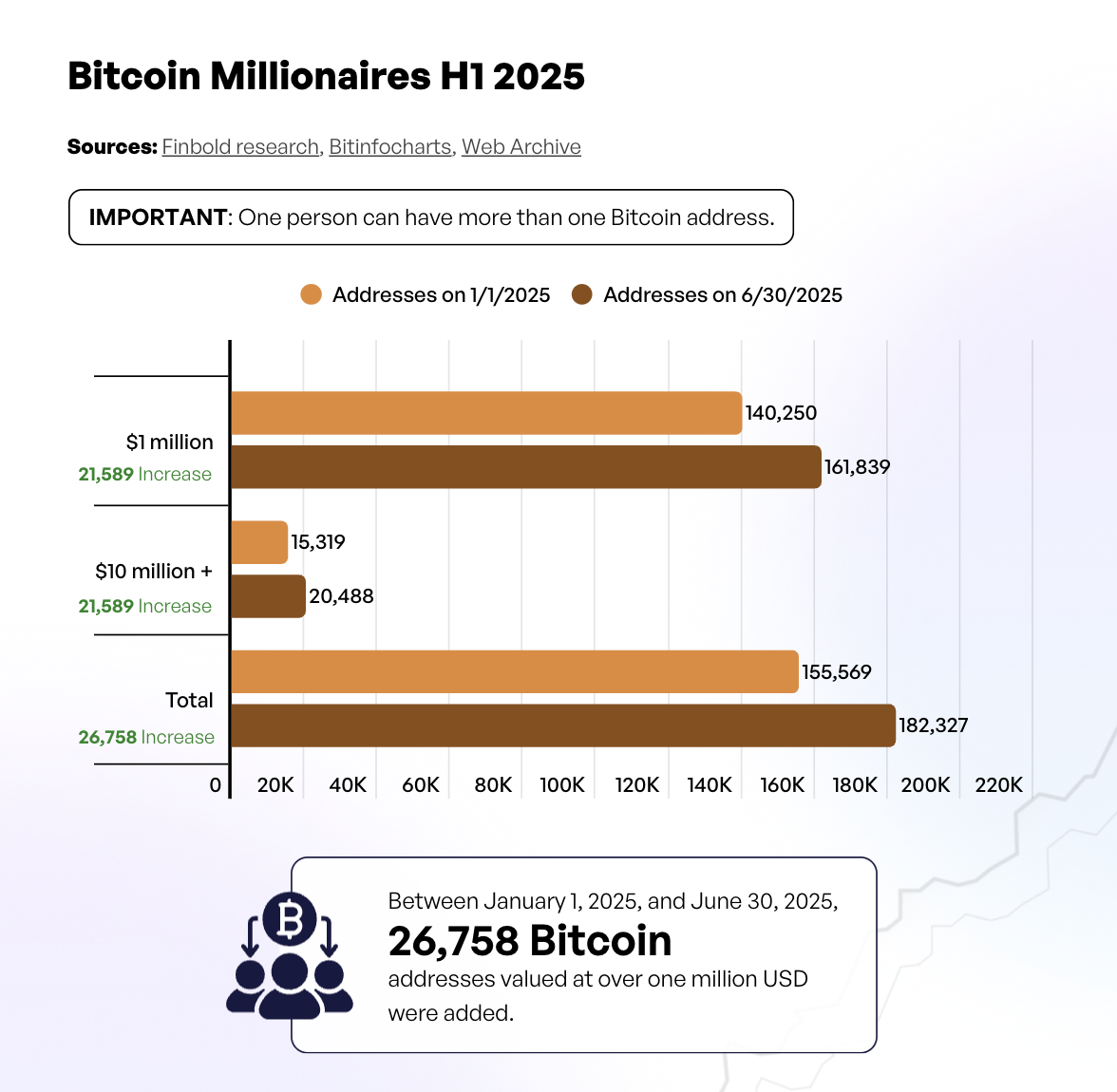

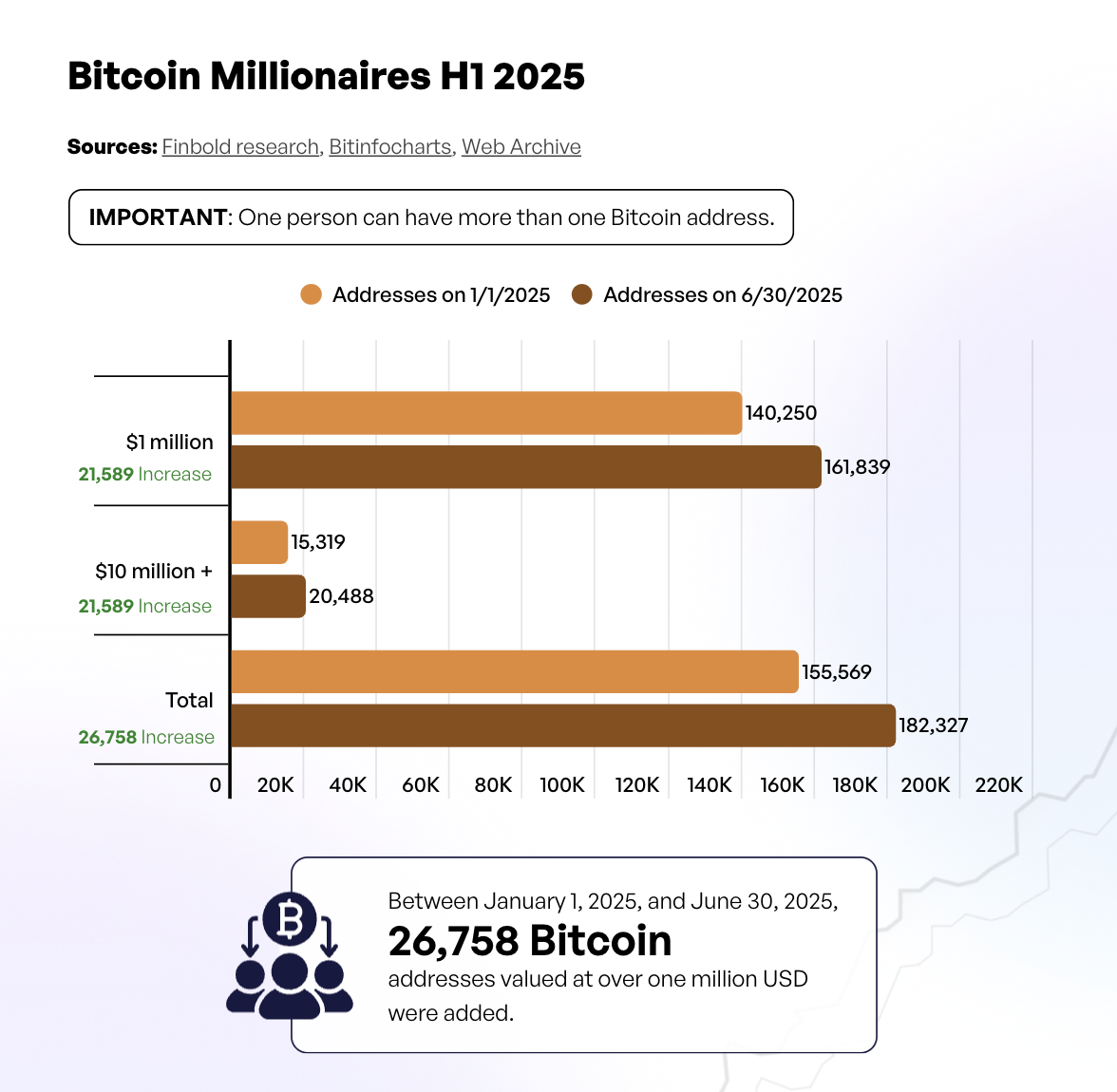

Hearing setbacks, he also saw positive trends in the sector. Bitcoin’s price rose 14% from $93,693 at the beginning of the year to over $107,000 for more than $107,000. Chain wealth concentration will also increase, with the millionaire Bitcoin increasing by 26,758 to 182,327, accounting for 17.2% growth.

Bitcoin ATM Network Extension

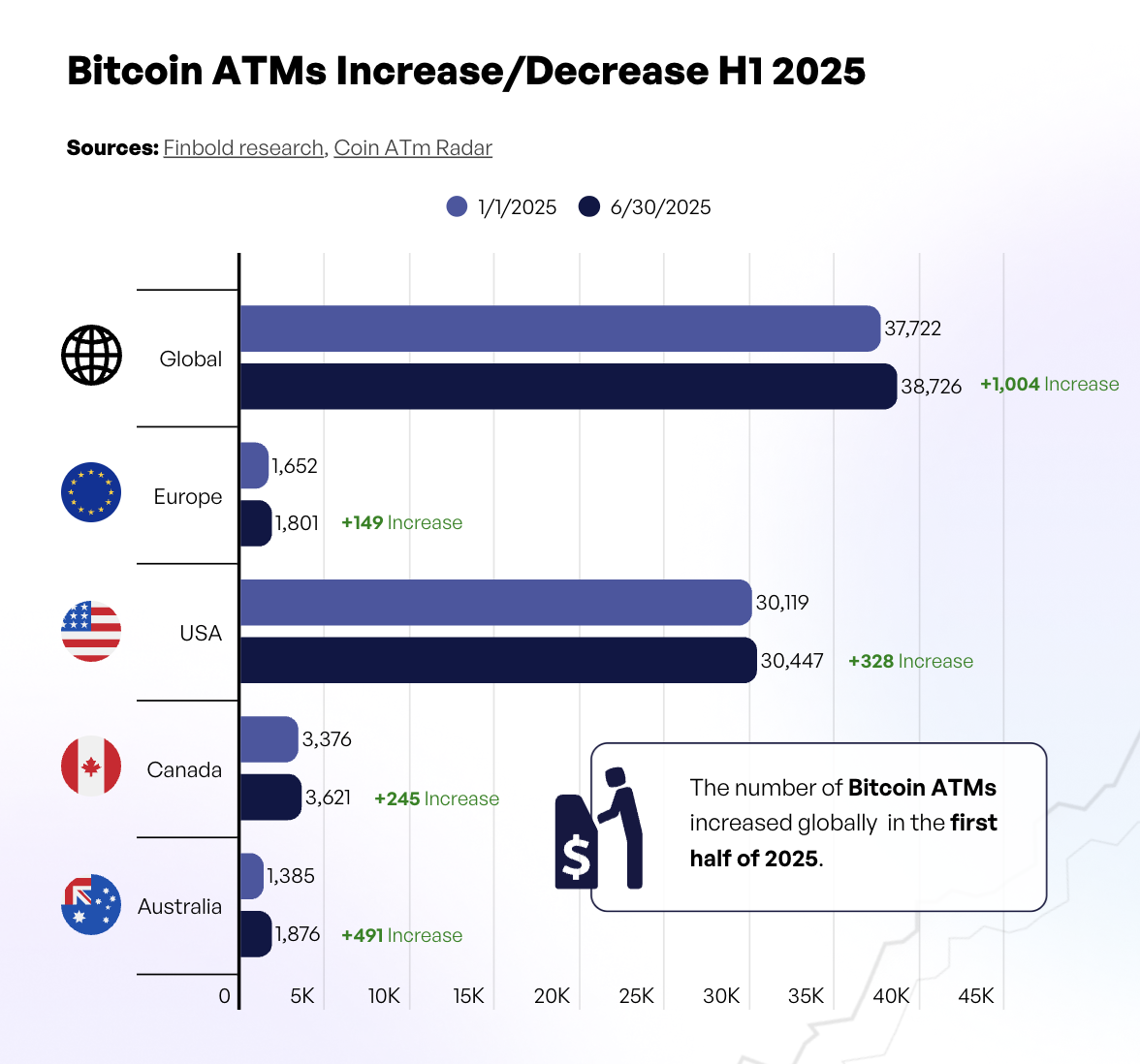

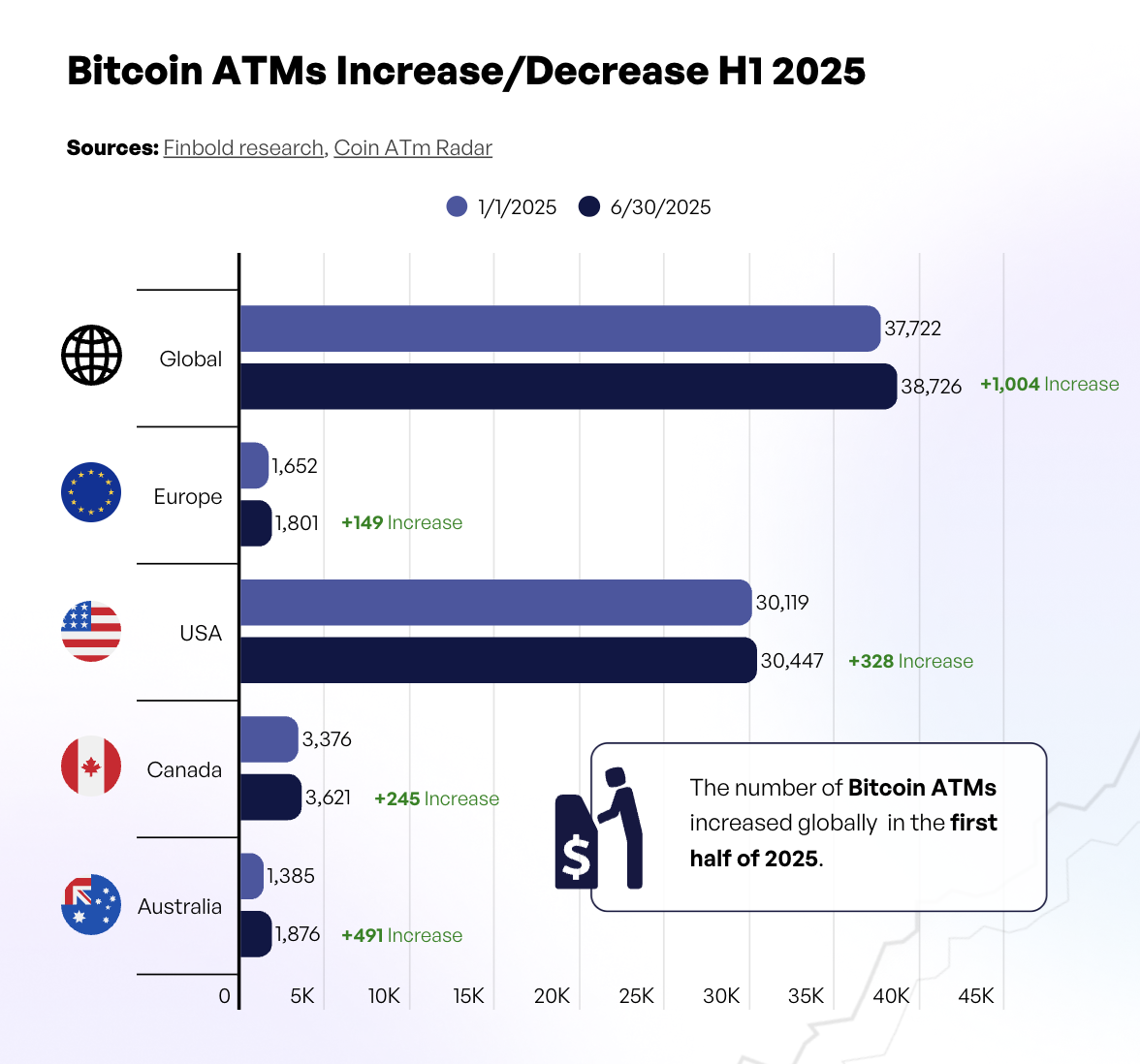

Another positive development in H1 2025 is the growing number of Bitcoin ATMs, from 37,722 at the beginning of the year to 37,722 to 38,726 at the end of the period. The U.S. refuted the world’s leaders in the number of Bitcoin ATMs deployed with 30,447 devices, followed by Canada’s 3.621 and Australia’s 1.876. Europe trailed 1,801 ATMs in H1 2025.

The rise of defi

In H1 2025, dentin finance (DEFI) continues to gain ground. according to In an analysis conducted by Swiss bank Amina Bank, the Defi industry has been running strongly over the past three months, with AAVE’s AAVE token recording an impressive 74%, while Uniswap’s Uni climbed 38%. The total market capitalization of the leading Defi token has expanded to $11.41 billion, increasing to 25.4% in just 90 days.

This caused you to hold back, your regulatory clarity began to take shape in the United States and renewed investor Confidenze. June 2025 honeycomb Amid the possible regulatory exemption for the Defi project, cautious optimism has sparked.

Meme Driver Encryption

Memecoins is another emerging trend in the cryptocurrency space. These cryptocurrencies based on internet memes and viral culture are helping to adopt cryptocurrencies more widely by attracting new investors into the market.

according to For the H1 2025 survey commissioned by Gemini, many people’s first experience with cryptocurrencies was through members such as Dogecoin, Shiba Inu or Pepe. After buying the meme, these investors often expand on poison cryptocurrencies (such as Bitcoin or Ether).

For example, in the United States, about 31% of people who own Memecoins and mainstream cryptocurrencies say they bought Memecoins first. There are similar patterns in Australia (28%), the United Kingdom (28%), Singapore (23%), Italy (22%) and France (19%).

Europe drives growth in crypto ownership

The Gemini report also found that Europe’s leading crypto ownership is in H1 2025. In the UK, cryptocurrency ownership rose 6 points year-on-year to 25% in 2025. France still remembers that it grew older at the age of 3 and climbed to 21%.

There are smaller growth in Singapore and the United States, with Ajasses being 2 and 1 points respectively.

Traditional finance and cryptocurrencies

Another major trend this year is the increasing overlap between cryptocurrencies and traditional finance. June 5, Circle, Stablecoin issuer, First appearance On the New York Stock Exchange (NYSE). The company raised nearly $1.1 billion at $31 per share, with shares soaring 168% on the first day. There are obvious signs that institutions need to contract, encrypt local infrastructure.

Just a few days ago, June 2, online brokerage platform Robinhood Complete ETIS acquired Bitstamp, received $200 million in acquisition, received more than 50 regulatory licenses, and positioned itself to serve retail and institutional crypto clients.

Ultimately, on June 11, US payment service provider Fringe deepened its cryptocurrency Get Private, Web3 wallet infrastructure provider. The move is designed to enhance Stripe’s ability to provide seamless blockchain integration in mainstream applications.

Featured Images: Images edited by Fintech News Switzerland, based on the image’s Thanyakij-12 By FreeEpik

No Comments