FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

FintechZoom Lucid Stock Review: How Will It Transform the Market in 2025?

Table of Contents

Introduction

For investors, determining the latest trends in FintechZoom Lucid stock is essential. In the course of this article, an attempt is made to provide some information about how Lucid Motors’ stock performed, what the market conditions were, and what it means for prospective investors.

Table of Contents

- Table of Contents

- Introduction

- LCID Live Stock Chart

- Technical Analysis (LCID)

- Stock/ETF Screener

- LCID Mini Chart

- Several Key Facts

- Main Content

- Overview of FintechZoom Lucid stock

- Understanding Lucid Motors

- Table

- Current Stock Performance

- Live Updates on Lucid Stock Performance

- Market Trends Impacting EV Stocks

- Financial Health of Lucid Motors

- Competitive Landscape

- Technological Innovations

- Investor Sentiment and Market Predictions

- Risks Associated with Investing in Lucid Stock

- Future Outlook for Lucid Motors

- Using FintechZoom When Making an Investment Decision

- Live Update: Market Sentiment and Performance Metrics

- LCID Live Stock Chart

- Technical Analysis (LCID)

- Stock/ETF Screener

- LCID Mini Chart

- FAQs

- What is Lucid Motors’ current stock status?

- In what ways does FintechZoom Lucid stock aid investors?

- What are some of the biggest challenges faced by Lucid Motors?

- Conclusion

A fresh perspective is being brought into the electric vehicles segment that is bound to revolutionize the three-step component model through which, right now, most of the consumers view the electric vehicle. Such a rise has been backed up by changes in the technology and socio-economic dynamics.

LCID Live Stock Chart

Technical Analysis (LCID)

Stock/ETF Screener

LCID Mini Chart

As well as a favorable environment, in other words, a regulatory push towards greener source of energy and its use in mobility. With the help of platforms such as FintechZoom, investors can gather crucial and comprehensive information and make decisions since the market constantly and rapidly changes.

Analysing some metrics about Lucid, its stock performance or changes in time.

Several Key Facts

Demand Niche: Lucid Motors is primarily focusing on luxury electric cars, which puts them into direct competition with big shots like Tesla

Price Movements: Volatility in the stock price and recorded revenue shows potential of making returns but investors should be on the lookout.

Risk Management: However, every thought of such an investment comes with it risks and opportunities that are related to investing in Lucid stock.

Main Content

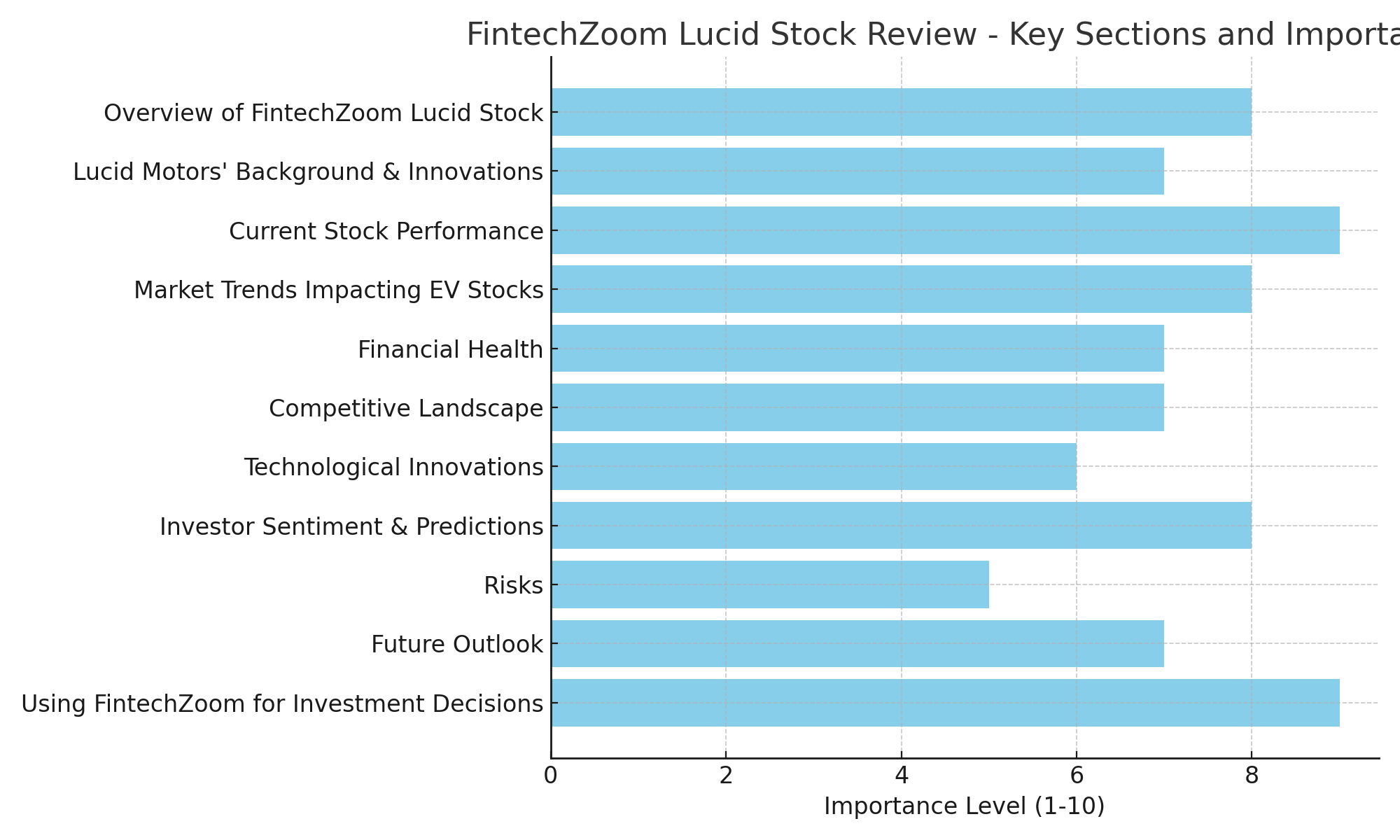

Overview of FintechZoom Lucid stock

FintechZoom Lucid stock is believed to be a crucial platform and financial analysis service for investors allowing the tracking and analysis of stock performance.

Features: Investing in FintechZoom is the favourable option for its real-time updates, covering financial news and analytical tools. Investors will receive comprehensive stock assessments, an overview of the markets as well as projections that will takedown suitable investments.

Benefits for Investors: FintechZoom expands the view of its users onto the markets to make better investments. It is seen that the investor interface is less complex and can be used by all classes of investors, including the beginners.

Understanding Lucid Motors

Lucid Motors is an American automobile manufacturer specializing in electric vehicles, focusing on high-end luxury vehicles.

Company Background: Founded in 2007, Lucid Motors has set out to revolutionize the premium electric vehicle sector. Lucid Air, their best-selling vehicle, has been well received for its sophisticated design, strong performance, and intelligent technology.

Key Innovations: Lucid Motors is mostly centered on sustainability, as well as developed technology including quick charging and powerful battery life. The company’s sustainable energy policies are in line with worldwide intentions to curb climate change.

Table

| Model | Starting Price | Key Features | Competitors | Competitor Pricing |

| Lucid Air Pure | $77,400 | – 480 hp – 406 miles range – Luxury interior | Tesla Model S | Starting at $94,990 |

| Lucid Air Touring | $91,000 | – 620 hp – 500 miles range – Advanced tech features | Rivian R1T | Starting at $73,000 |

| Lucid Air Grand Touring | $140,000 | – 1,050 hp – 503 miles range – Top-tier amenities | BMW iX xDrive50 | Starting at $84,100 |

| Lucid Air Dream Edition | $169,000 | – 1,111 hp – 503 miles range – Exclusive features | Porsche Taycan 4S | Starting at $103,800 |

Current Stock Performance

FintechZoom Lucid stock has been oscillating sharply, but these price movements have used the general sentiments of the market and some market related issues with the company.

Recent Movements: With respect to production information and state of the market, the share price was quite volatile. For example, the share price may rise after positive news of the timelines of delivery or associations.

Factors Contributing to Volatility: The mood of the investors can take wild sops due to unfulfilled promise of timelines, advancement of technology or the health of the economy. Further, external factors come into play such as bottlenecks in the supply chain and the growing competition in the EV industry.

Live Updates on Lucid Stock Performance

It is important for the investors to keep track of the news which has a bearing on the price of Lucid stock.

Real-Time Data: FintechZoom Lucid stock and other platforms are providing their clients instant news concerning shifts in stock price, changes in trading volumes, or even market sentiments. Following these numbers and putting them in the right context may enable investors to spot opportunities and act appropriately.

Recent News: Reports like quarterly earnings results or announcements of strategic alliances have been known to affect stock prices and investors are thus, advised to keep track on news. Such events will determine and shape the market forces in the future and the impact will be huge.

Market Trends Impacting EV Stocks

There is a great influence of trends from outside to the course of the investment in the electric vehicle market because of the demand it has developed.

Consumer Preferences: People are realizing the threat posed by climate change and as such global warming and are using electric cars in order to alleviate this problem. This trend is further boosted by subsidies in the use of EV vehicles by the government.

Regulatory Changes: Countries all over the world have made it a point to reduce emissions due to the use of traditional cars which have led them towards EVs. This change in legislation encourages Lucid Motors and as such, expands the market opportunities for them.

Financial Health of Lucid Motors

Evaluating Lucid Motors’ financial health reveals both growth opportunities and challenges.

Revenue Growth: Recent quarterly earnings reports indicate fluctuating revenues. For example, a surge in deliveries can significantly boost revenue, while production delays may hinder growth.

Profitability Challenges: Despite high revenue potential, Lucid Motors faces challenges in achieving consistent profitability. High production costs, primarily driven by battery technology and materials like lithium and cobalt, impact margins.

Competitive Landscape

Lucid Motors operates in a competitive EV market, facing challenges from established brands like Tesla and emerging players like Rivian.

Market Positioning: Lucid Motors differentiates itself through its focus on luxury electric vehicles, emphasizing performance, design, and advanced technology. This positions it uniquely against competitors that may prioritize different market segments.

Competitive Analysis: Tesla remains the dominant player in the EV market, but Lucid’s innovative features and luxury positioning attract a specific customer base. Understanding the strengths and weaknesses of competitors is crucial for investors.

Technological Innovations

Advancements in battery technology and autonomous driving are pivotal for FintechZoom Lucid stock .

Battery technology: Increases in battery performance translate directly to increases in the performance of the vehicle and the attractiveness of it from consumers. Lucid Motors has heavily invested in research and development of battery systems with greater range and faster charging speeds.

Self-driving cars features: The incorporation of self-driving technologies has started to become a necessity. Consumers prefer cars with improved safety measures or levels of automation and this boosts the attractiveness of Lucid to the market.

Investor Sentiment and Market Predictions

Presently, the opinion of investors regarding Lucid stock is presented as one of optimism but with some elements of caution.

Market Reactions: They are extremely affected by any news regarding production, partnerships or simply the state of the market as a whole. They may bring about sharp increases in stock price or bring about drops in the prices.

Analyst Predictions: Estimates of Latinos motors usually concentrate on the topics of financial resources available, competition and tendencies in the current market. Expectations of growth in the future are more guarded than optimistic as focus is on the markets of luxurious electric vehicles.

Risks Associated with Investing in Lucid Stock

In understanding investing in FintechZoom Lucid stock , potential investors should appreciate that the company is associated with a number of risks.

Production Related Issues: Lucid has experienced production shortcomings and was not able to satisfy demand as a result. Such issues may foster negative sentiment amongst investors and affect stock performance .

Regulatory Hurdles: The uncertainty which comes due to the changes in the regulations or policies of the government. For instance, alteration of the EV incentives or emissions standards would undoubtedly influence the demand or the cost of production.

Future Outlook for Lucid Motors

FintechZoom Lucid stock looks to have bright prospects especially in the area of luxurious EVs.

Growth Opportunities: As the market for luxury electric vehicles grows, Lucid Motors stands to benefit significantly. The client base, which the company satisfies, consists of customers who expect high quality and performance from their vehicles.

Strategic Initiatives: Lucid Motors’s strategy for increasing its market share is premised on acquiring technology, partnerships, and advertising, among others, to drive consumer awareness. These efforts are intended to strengthen the brand image and increase the number of customers.

Using FintechZoom When Making an Investment Decision

The investors can use many features that FintechZoom Lucid stock has to offer in order to make smart investment decisions.

Tracking Performance: With such an option as picking stocks and investing in the online stock markets, this feature allows the users to control the financial situation in even real time. Timers for important price moves are also useful to other investors as they present opportunities to act.

Expert Analysis: They are helpful as the users obtain expert opinion and financial news for up to date and timely decision making. This information is very important for investors who intend to understand the risk and opportunities available in the market.

Live Update: Market Sentiment and Performance Metrics

In my opinion, investors still have to keep their thoughts & eyes towards the sentiment and the performance metrics regarding which would drive FintechZoom Lucid stock .

Key Performance Indicators: Evaluating measures like quarterly earnings and earnings per share, production growth, volumes of orders could assist in predicting the direction of the company. For instance, growth in the number of vehicle orders can mean that there is an increase in consumer appreciation for the products offered.

Market Sentiment Indicators: In addition to news headlines, social media theme and user comments in the primary investor forums may also have usefulness. A good answer to the question is ‘how do investors feel towards the prospects of Lucid’ and then track such platforms like FintechZoom.

LCID Live Stock Chart

Technical Analysis (LCID)

Stock/ETF Screener

LCID Mini Chart

ALSO READ THIS BLOG : FINTECHZOOM QQQ STOCK: A COMPREHENSIVE GUIDE FOR INVESTORS IN 2025

FAQs

What is Lucid Motors’ current stock status?

FintechZoom Lucid stock has been known to be a transformer of late as a result of it facing challenges in production assurance though still retains a good level of growth due to the opinion on luxury EVs expanding. Analysts express the need to keep track of updates on production on a regular basis.

In what ways does FintechZoom Lucid stock aid investors?

FintechZoom Lucid stock is an excellent informational tool which has covered in real-time stock prices, moves in the market, and analysis from professionals, making investing reasonable. Its interface is user friendly allowing valuable data to be sorted out with ease.

What are some of the biggest challenges faced by Lucid Motors?

Some of the challenges present for Lucid Motors include waste in the processes of production, penetration of the markets by new and old rivals, and the changing moods of the investors. All these tensions bring about investment paranoia for the unsuspecting investors.

Conclusion

FintechZoom have a comprehensive perspective over the dynamics of FintechZoom Lucid stock and its latest event to aid in making the correct investment decisions.

Recap of Key Insights: The presented analysis focuses on market positioning, financial analysis, and competition surrounding Lucid Motors.

Relevance of Tracking Developments in Technology: If batteries and autonomous driving continue to develop, breakthroughs in the future may be expected which would greatly improve the great potentials of the technology and the investment as a whole.

Conclusion Regarding Investment Risk versus Reward: Presence of wonderful returns is greatly impeded by production and market competitiveness attributes, but the rewards are strongly enticing.

In this ever-changing environment, FintechZoom Lucid stock and other sources should help the investors make decisions that are not only relevant to the market but are also in tandem with the expectations, preferences, and behavioral aspects of investors. There is a consistent understanding that timely decisions and drawn from contemporary facilitation of financial assessment will assist investors to thrive in the crowded dynamics of EV and luxury stocks.

No Comments