FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

Deep diving: Kaifeng Paypal’s core product stack: Sam Boboev

Table of Contents

PayPal is one of the original giants of fintech –

PayPal is one of the original giants of fintech –

430 million Customer accounts across more than 200 markets – It powers approximately a quarter of global e-commerce transactions. However, even companies of this size must grow. In 2025, under new CEO Alex Chriss, Paypal is improving its core product stack to restart growth and lead the fast-growing competitors. This in-depth dive explores how PayPal modernizes every layer of its products, flowing from consumer wallets and checkouts to merchant tools and Venmo’s social payments while leveraging its massive two-sided network. Timing is crucial: After years of slow growth and growing competition from tech giants and fintech lists, PayPal’s new strategy aims to

Drive durable growth Through checkout, expand all channels of payment and use

AI-driven personalization Bring more value to consumers and businessmen. In the following sections, we will look at PayPal’s consumer strategy (covering brand checkout, omnichannel experience, rewards and peer-to-peer), the development of its checkout technology (including new ones) dome and guest Checkout Experience), Reinvention under its Small Business Platform

PayPal is open Initiative, Venmo’s monetization roadmap and future plans for B2B bill payments to Stablecoins and AI. Along the way, we will focus on key metrics and financial goals related to each plan. The result is a portrait of a fintech incumbent who actively changes its product stack (perhaps fate) in real time.

“Everywhere” consumer strategy

Paypal’s gaming program is inspiring its consumer ecosystem to promote engagement and

Paypal’s gaming program is inspiring its consumer ecosystem to promote engagement and

“Select” – The tendency to select users PayPal at checkout. Brand checkout has always been Paypal’s monetization engine, and now every part of the company is responsible for the task of driving more consumers to choose PayPal when paying. PayPal’s consumer team has zeroed in on target population

Young families and professionals Their 30 and 40s medium to high

incomethey demand convenience and want to make the most of their money. For these users, PayPal aspires to be “the easiest, safest, and most meaningful way to pay, send and save money” – in short

The smartest way to pay. To make this promise, PayPal’s consumer strategy is based on three pillars called by the Chris team

“Pay everywhere, pay, and get the most value.”

Pay everywhere Meaning that PayPal will be everywhere in every channel – online, in-store, peer-to-peer, and even cryptocurrencies. PayPal launched a year ago “Pay Pals everywhere” In the US, expand its wallet for offline use (such as paying with PayPal or Venmo debit cards) and see strong early results. For example, enabling in-store debit usage not only increases payment volume, but actually drives more online PayPal checkouts –

For every four debit card users, one becomes incremental PayPal checkout user. In fact, the total payment volume on PayPal’s branded debit cards has doubled year by year, indicating the “flywheel” effect of users who can pay with PayPal in more places. In 2025, PayPal expanded these omnichannel capabilities internationally, from launching

NFC Tap to Payment Wallet in Germany.

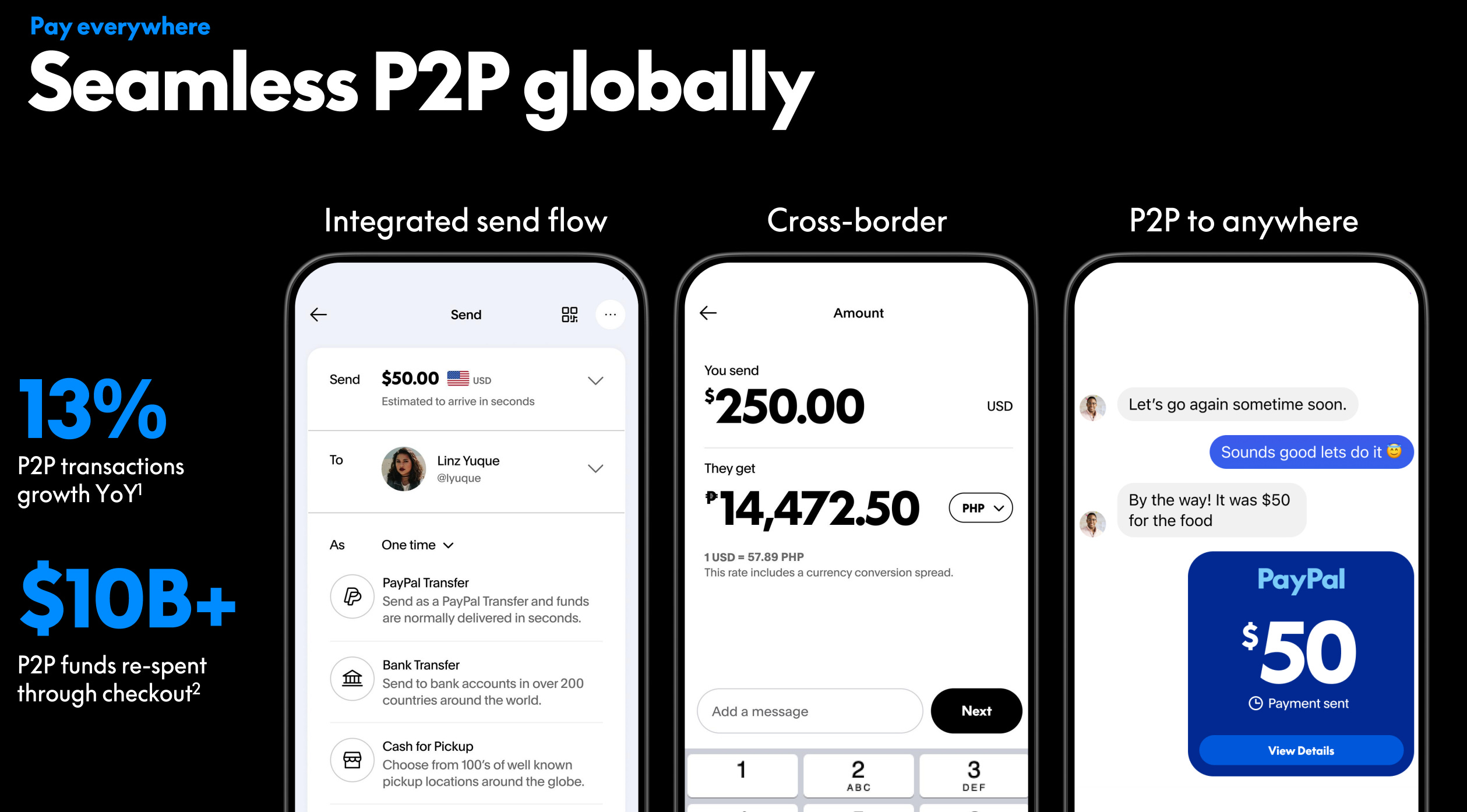

Peer-to-peer (P2P) payment

Still the cornerstone of PayPal’s consumer ecosystem – not only a service, but also as a

User acquisition channel. about 30% of PayPal’s new active users are transferred towhat is important is,

$10 billion The funds people receive through P2P are then spent among merchants through PayPal. In other words, P2P brings new users and involves them in the PayPal network, which can then flow into monetized checkout transactions. PayPal is continuing to innovate P2P features to maintain its lead. Soon, users will be able to

Send money directly to a bank account or mobile wallet or even a crypto walletgiven its global network, almost anywhere in the world – Paypal has the capability to “deliver only (IT)”. Perhaps more interesting is that PayPal plans to send payments to anyone only via phone number or chat processing:

“Even outside our network, anyone can get payment through text or messengers” By PayPal. This open-loop P2P can extend PayPal’s range far beyond its own user base. When it comes to the topic of scope: Paypal will also enter cryptocurrency as part of “paid ubiquitous”. PayPal introduces users’ ability to buy, hold and sell cryptocurrencies

“Explosive growth” Among consumers who use cryptocurrency for transfers and payments. PayPal users can even use cryptocurrency balances to view in the case of millions of merchants, PayPal handles instant conversions. By integrating cryptocurrencies into your wallet, PayPal wants to be a place for consumers “Don’t want to do crypto anywhere else”bridging traditional and on-chain payments under its trusted brand.

Pay IThe second pillar, focusing on flexibility and ease of use. PayPal knows that fast, frictionless checkout is crucial – “Checkout must be fast”as the team said – but they further drive the concept with innovative new experiences. A big plan is being introduced

“New vault checkout experience” This makes PayPal almost invisible during payment. Actually,”dome“meaning users can pre-authorize and save PayPal as the preferred payment method in a given situation (e.g., in a ride-sharing app or a food delivery app) so that future transactions can be made in a TAP without repeated logins. PayPal encourages developers to do it

Conservative Papa During the user’s entry And enable

Friction-free In-app payments, especially for high-frequency, low-value purchases. PayPal can be the default way to pay by signing services on site (and pre-selected)

Rides, meals, tickets and other daily purchases – A method that drives higher conversions and usage. PayPal still supports its classic “one-time” checkout integration for most e-commerce scenarios, but for some mobile-first use cases, the average fare is under $40, these Arched payment Recommended traffic makes PayPal as seamless as Apple Pay or saved cards. Additionally, Paypal is launching modern authentication

Passkeys (Biometric Login) In its consumer app, the password annoyance is eliminated and the login friction is cut to near zero. The new PayPal checkout process utilizes PassKeys so users can log in with their face or fingerprint and pay with a faucet – part of the overhaul “Reduce latency by up to 50%” And let the customer view

Twice faster Same as before. Speed is a feature that PayPal will eventually treat.

Get the most value is the third pillar that reflects the emphasis on rewards, offers and financial flexibility to keep customers back. This is Paypal’s acquisition (such as honey (coupons and cashback discoveries) and its internal acquisitions)

Buy now, pay later (BNPL) Functions come into play. PayPal has become the leading BNPL provider almost overnight – due to its size, it approved more than $20 billion in salary in the years since its launch. PayPal’s tone is

“Almost any of your Paypal you can pay later”highlight Availability of millions of businessmen As a competitive advantage over independent BNPL companies. PayPal’s goal is

“The best salary in the future, term” By offering maximum acceptance (through its vast network), flexible terms and no late fees, the purpose is to become

Most affordable and widely used BNPL options. In addition to paid time, PayPal is also

“The turbocharger and purchasing power have never been there.” This includes not only typical cashbacks on its PayPal credit and debit cards, but also new integrations of merchant-specific rewards and personalized offers. PayPal Wallet is getting “Smarter” About the application rewards and discounts – soon,

All quotations, rewards and loyalty programs for users will Automatic stacking and applied at checkout. For example, if the user has a store loyalty point and PayPal promotional offer, the app will layer by layer at the same time, ensuring that the customer maximizes savings. Users can even set preferences to automatically enable features such as BNPL for eligible purchases, offering

“Maximum flexibility” No extra effort. PayPal’s value drives expansion

back Checkout: The application is being introduced Smart receipt This makes it easy to track orders, process returns and even get tailored suggestions. These digital receipts will include

Personalized insights and product suggestions – For example, remember the user’s size or style preferences to suggest complementary items when visiting in the future. It’s all about putting more effort into the client

“Since PayPal unlocks how much value it has for them, please keep coming back.”

All these efforts on the consumer side have achieved a simple result:

More PayPal at checkout. Each new use case (whether it’s paying a friend, typing in a store or buying cryptocurrency) is designed to feed

Brand checkout flywheel. PayPal data shows that the more transactions a user makes in the PayPal ecosystem, the higher his lifespan value is –

“Every statistic we have shows that every consumer checks out,” As the team emphasized. The company’s Polaris is adding what they call

Selection Rate – The frequency frequency of this option when the user selects PayPal. By making PayPal almost everywhere (online/offline, any device, any payment type) and adding incentives and simplicity, they aim to be the highest atmosphere for payments. PayPal

The largest active user base in digital wallets (3× the size of the next competitor). With this foundation, the new consumer strategy is to deepen participation: turning occasional users into power users. Early signs are encouraging – Paypal in 2024

10%the number of unmoved users actually dropped by 4% as the re-engagement work began. More specifically, Paypal shares Venmo users (we will dig deeper into Venmo soon) to get someone to go beyond P2P to improve their range

ARPA (Average Income per Account) from $0 to $67. These figures illustrate the rewards of cross-selling multiple products. The final game: Consumers’ two-sided network Habit Use PayPal for all content and merchants will see PayPal’s usage translate into higher sales.

——————————————————————————————————————————–

source: PayPal Investors’ Day 2025 speech; PayPal News Room and Developer Blog; New Product Plan for Company Press Releases; Internal metrics and quotes from PayPal CEO and Product Owner. All facts and numbers come from these official PayPal sources.

Disclaimer:

Fintech summarizes public information that will be summarized for information purposes only. A portion of the content can be literalized from the original source and provides the full credit for the “Source: (name)” attribution. All copyrights and trademarks remain the property of their respective owners. Fintech summary cannot guarantee the accuracy, completeness or reliability of the summary content; these are the responsibility of the original source provider. Links to the original resource may not always be included.

(tagstotranslate) FineXtra(T) NewsT Online T Bank T Bank T Technology T Technology T Finance T Finance T Financial T Financial T FinT Tech T Tech T Tech T Tech T Tech T IT TI T IT Break T Latest T Latest T Retail T Retail T T Deprive T Trade Execution T Headline News Blockchain T t Digital t Investment T t Mobile t Business Challenger T Pay t Pay t Regtech T Regtech T Insurtech T Insurtech T Service

Source link

Comments are off for this post.