FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

BlackRock’s Bitcoin ETFs Become the Top Income Driver, Overtaking S&P 500 Funds – Fintech Schweiz Digital Finance News

Breaking Fintech News: Stay updated with the latest in the financial technology world.

Table of Contents

Free newsletter

Get the hottest fintech news in your inbox every month

BlackRock’s Bitcoin Exchange Trade Fund (ETF) is becoming the primary revenue generator for asset managers.

according to For Bloomberg, the Ischels Bitcoin Trust ETF (IBIT) has an annual salary of approximately $75 billion, an estimated annual fee of $187.2 million, exceeding the company’s Core Ishares S&P 500 ETF (IVV). IBIT is now the third largest income ETF for BlackRock, which has nearly 1,200 funds. explain Eric Balchunas, senior ETF analyst at Bloomberg.

Blackrock is the world’s largest asset manager, with assets under management (AUM) of $11.5 trillion as of 2024. STIS’ long-established IVV fund was launched in 2000 and based on the S&P 500, it is one of its underlying assets and charges an ultra-low expenditure ratio of 0.03%.

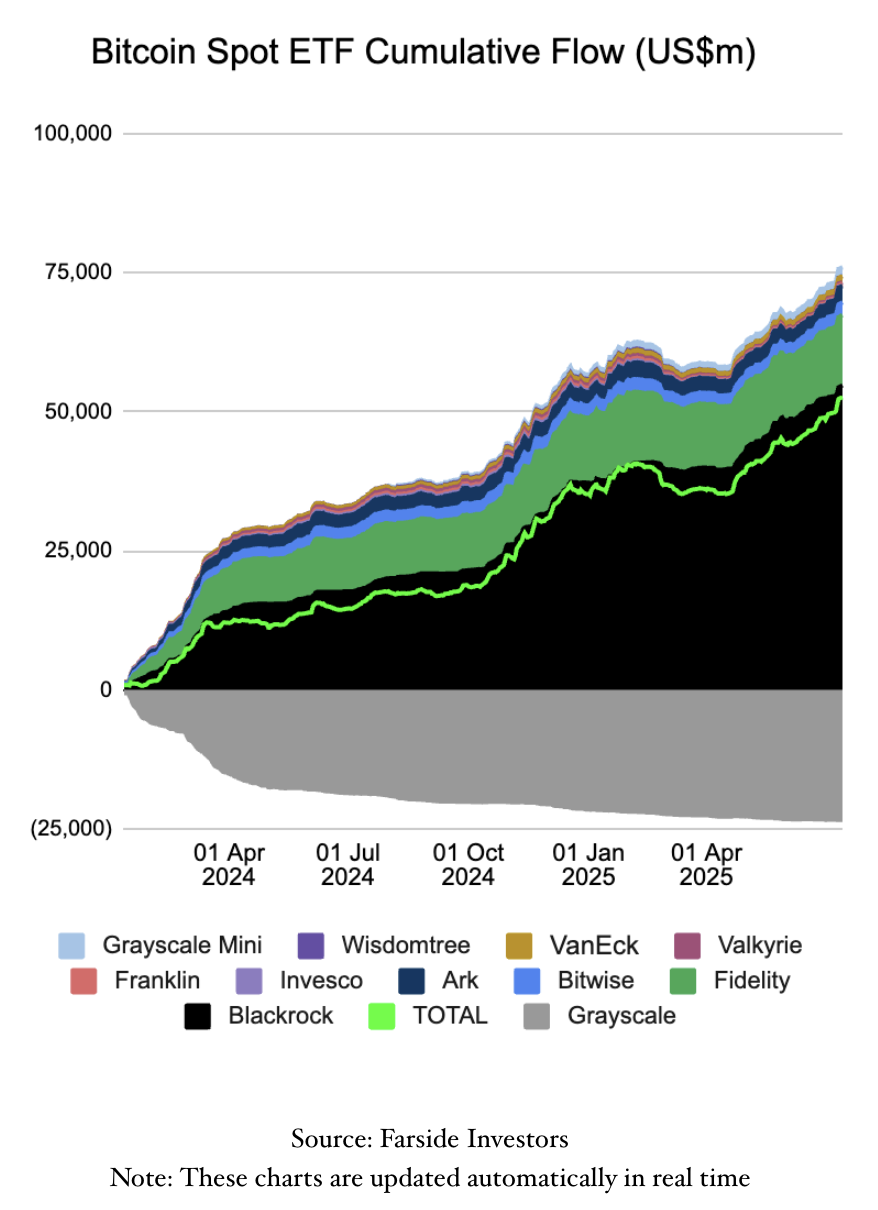

IBIT is BlackRock’s spot Bitcoin ETHF, which gives investors direct access to cryptocurrencies. The fund, launched in January 2024, attracted a large inflow from institutional and retail investors, with a large inflow of more than $50 billion, but all 18 months of net traffic were positive except for one month.

Today, IBIT is the largest Bitcoin attraction in the world Over 700,000 Bitcoins At AUM, according to To the Farside data, it now accounts for 3.52% of the total Bitcoin share.

“IBER’s IVV, which exceeds IVV’s annual fee income, reflects investors’ demand for Bitcoin and the substantial fee compression in core stock exposure,” said Nate Geraci, president of Novadius Wealth Management, who endured Bloomberg.

“While spot Bitcoin ETFs are very competitive, IBIT proves that investors are willing to pay the price for the real added effect of their portfolio.”

The fee of Ibit is consistent with other Bitcoin ETHFs, which is from 0.15% of Grayscale Small Bitcoin ETF (BTC) Up to 1.5% of flagships Bitcoin Trust ETF (GBTC).

Encrypted ETFs soar

As cryptocurrencies’ prices have skyrocketed, investors’ demand for crypto ETFs is what you’ve come this year. On July 10 and 11, 2025, Bitcoin ETFs exceeded $1 billion inflows for two consecutive days, and on Thursday alone, it was only $1.18 billion.

This happened simultaneously, with Bitcoin hitting an all-time high of $119,000 on July 14, 2025, up 57% in April, according to Used to share market cap data.

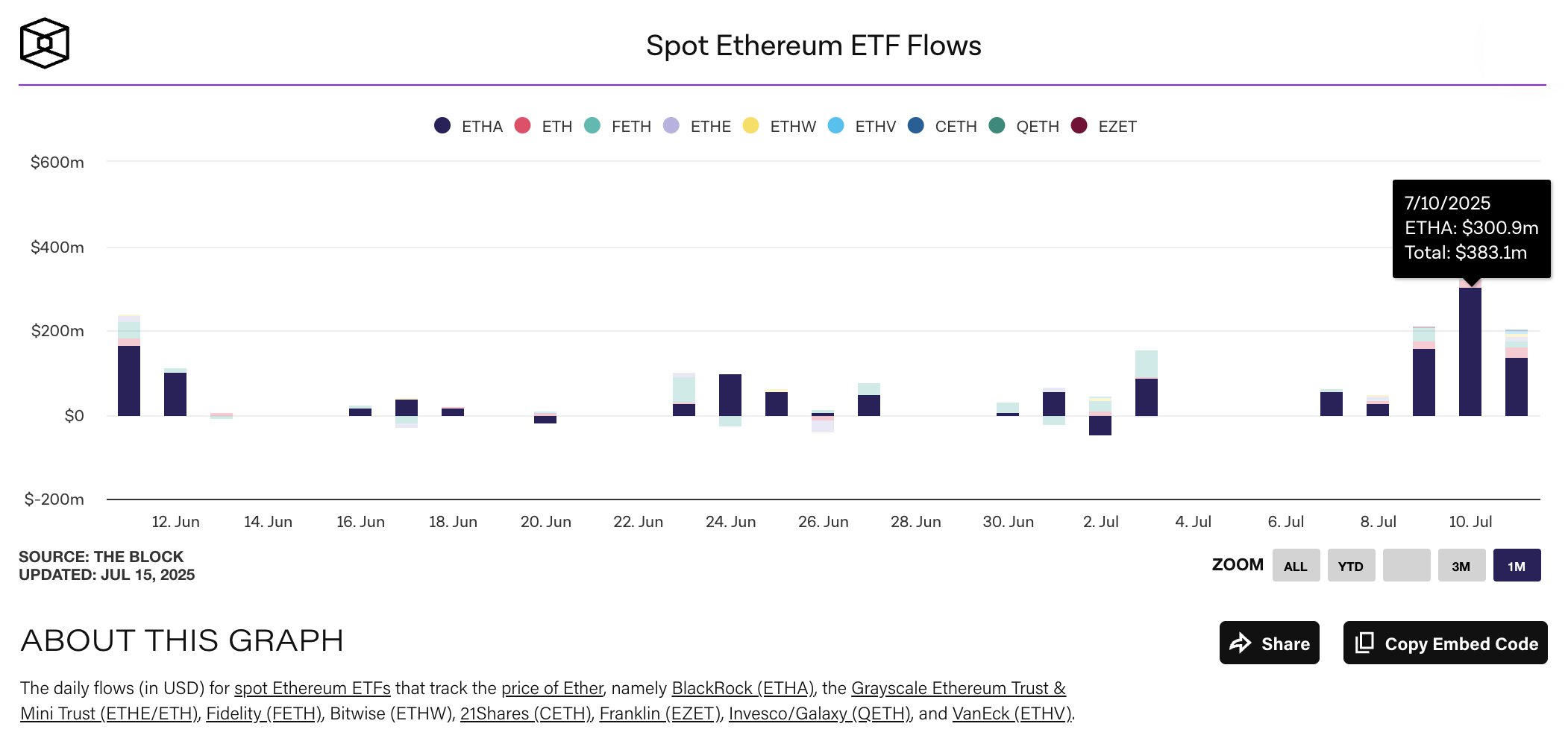

The Ether ETF also saw record inflows. On July 10, the U.S. spot Ether ETF attracted a total of $383.1 million in net inflows. Blackrock’s iShares Ethereum Trust (ETHA) leads with a net daily inflow rate of $300.9 million according to Data from blocks. Fidelity’s Feth, Grayscale’s Eth and Ethe, Bitwise’s EthW and Vaneck’s Ethv, respectively, were $37.3 million, $20.7 million, $189 million, $3.2 million and $2.1 million.

Your capital flood helped push Ether’s rebound to $3,000, the highest price in nearly five months.

Favorable regulatory development

Investors have been expecting cryptocurrencies to record fresh this year Passed new encryption legislation.

U.S. House of Representatives start This week was reviewed on a series of crypto bills known as “crypto week.” Potential laws aim to provide a Cleraer regulatory framework for the digital asset industry.

Meanwhile, the U.S. Securities and Exchange Commission (SEC) relay The guide states that issuers of crypto-asset exchange-traded products (ETPs) such as Bitcoin and Ether ETFs should comply with the U.S. federal securities disclosure laws.

Experts told Fortune that this clarity could lead to an impact on the application of Crypto ETFs, such as Solana and Ripple’s XRP.

“The gates are basically completely open to what can be introduced,” Andy Martinez, CEO of digital asset data provider Crypto Insights Group, Andy Martinez, who AWD media.

“This is eliminating the long process, and under such guidance, part of the plan is to reduce this time to launch a large scale (…) and we expect we will see a lot of capital entering cryptocurrency investment production.”

Crypto ETFs debuted in the U.S. in early 2024, with SEC approving 11 Bitcoin-based ETFs saw $4.7 billion in trading volume on the first day. The Ethereum ETF was subsequently followed in July 2024.

These products have gained attention by making it easier for investors to gain exposure to cryptocurrencies through traditional stock exchanges and home brokerage accounts. With crypto ETFs, investors no longer need to buy, store or manage cryptocurrencies directly, benefiting the trading process that Other Familia is familiar with.

As of July 7, 76 ETFs were listed in the United States that can track crying points and future prices. Fortune says Bitcoin and Ethereum products make up the vast majority of crypto ETFs.

Featured Images: Images edited by Fintech News Switzerland, based on the image’s Thanyakij-12 By FreeEpik

No Comments