FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

DEFTF Stock: Price, Forecast, Analysis & Investment Guide

DEFTF stock has recently started to appear on the radar of investors who are searching for growth opportunities in the natural resources sector. Unlike large-cap companies, smaller mining and exploration firms like Defiance Silver Corp often trade with less coverage, which makes them attractive for investors willing to research beyond the mainstream. The rising global demand for silver as both an industrial commodity and a precious metal has brought renewed focus to companies operating in this segment. With silver being a core material for renewable energy technologies, electric vehicles, and electronics, DEFTF has become an interesting stock to watch.

Table of Contents

- What This Guide Covers

- What is DEFTF Stock?

- Company Full Name and Symbol

- Industry and Sector Overview

- Stock Exchange Listing Details

- DEFTF Company Background

- Company History and Growth

- Products, Services, and Operations

- Market Reputation and Position

- DEFTF Stock Current Price and Market Performance

- Today’s Price and Volume

- 52-Week Highs and Lows

- Market Capitalization Snapshot

- Historical Performance of DEFTF Stock

- Price History Over the Years

- Key Milestones in Growth

- Trading Trends Over Time

- Technical Analysis of DEFTF Stock

- Moving Averages (50-Day & 200-Day)

- RSI, MACD, and Momentum Indicators

- Support and Resistance Levels

- Fundamental Analysis of DEFTF Stock

- Revenue and Earnings Growth

- Balance Sheet and Debt Ratios

- Dividend Policies and Payout History

- Factors Driving DEFTF Stock Price

- Industry Demand and Supply Impact

- Economic and Geopolitical Influences

- Market Sentiment and Media Coverage

- Analyst Ratings and DEFTF Stock Forecast

- Expert Recommendations (Buy, Hold, Sell)

- Short-Term Price Targets

- Long-Term Market Predictions

- Risks and Challenges with DEFTF Stock

- Stock Volatility Concerns

- Industry-Specific Risks

- Global Market Uncertainty

- DEFTF Stock vs Competitors

- Comparison with Peer Companies

- Strengths of DEFTF vs Rivals

- Market Share Differences

- Is DEFTF Stock a Good Investment?

- Advantages of Investing in DEFTF

- Risks of Holding DEFTF Stock

- Ideal Investors for DEFTF

- How to Buy DEFTF Stock

- Exchanges and Platforms Offering DEFTF

- Step-by-Step Buying Guide

- Minimum Investment and Fees

- DEFTF Stock News and Recent Updates

- Latest Corporate Announcements

- Mergers, Acquisitions, and Deals

- Market Events Impacting DEFTF

- Expert Opinions on DEFTF Stock

- Analyst Insights and Recommendations

- Institutional Investor Positions

- Growth Opportunities Ahead

- Future Outlook for DEFTF Stock

- Short-Term Forecast (Next 6–12 Months)

- Long-Term Forecast (3–5 Years)

- Market Trends to Watch

- Final Thoughts on DEFTF Stock

- Key Opportunities for Investors

- Main Risks to Keep in Mind

- Balanced Closing Note

- FAQs About DEFTF Stock

- What does DEFTF Stock represent?

- Where can I check the live price of DEFTF Stock?

- Is DEFTF Stock considered a safe investment?

- What affects the price of DEFTF Stock the most?

- How has DEFTF Stock performed historically?

- Can beginners invest in DEFTF Stock?

- How do analysts view DEFTF Stock?

- What are the main risks with DEFTF Stock?

- How can I buy DEFTF Stock online?

- Is DEFTF Stock good for short-term trading?

- Can DEFTF Stock provide long-term growth?

- How does DEFTF Stock compare to competitors?

- What recent news impacts DEFTF Stock?

- Who should consider investing in DEFTF Stock?

- What is the future outlook of DEFTF Stock?

What This Guide Covers

This guide provides a full breakdown of DEFTF stock, including background on the company, its market performance, technical and fundamental analysis, expert opinions, and risks that come with investing in a micro-cap stock. It also explores how DEFTF compares to its competitors, whether it is suitable for long-term investment, and what the future outlook may hold. The aim is to give investors a complete understanding before making any decision.

What is DEFTF Stock?

DEFTF Stock refers to the publicly traded shares of a company listed under the ticker symbol DEFTF. Investors track it to measure ownership in the firm and potential returns. The stock represents both growth opportunities and exposure to the company’s market performance. Many traders follow DEFTF for its position in its respective industry.

Company Full Name and Symbol

DEFTF is the ticker symbol for Defiance Silver Corp, a Canadian-based resource company focused on silver exploration and development. It trades on the OTCQB market in the United States, which allows U.S. investors to gain exposure to the silver sector without directly investing on foreign exchanges.

Industry and Sector Overview

Defiance Silver operates within the mining and natural resources sector, with a specific concentration on silver and precious metals. The silver industry plays a critical role in both traditional investment markets and industrial demand. While gold is commonly seen as a safe-haven asset, silver combines both monetary and industrial uses, which often leads to sharp movements in price. Companies like DEFTF can benefit from bullish silver markets but also face high pressure when global demand weakens.

Stock Exchange Listing Details

The stock is listed on the OTCQB exchange, a platform designed for smaller and growth-oriented companies. While this gives investors access to a wide range of opportunities, it also comes with higher volatility and lower liquidity compared to major stock exchanges like NYSE or NASDAQ.

DEFTF Company Background

The company behind DEFTF operates in a specialized sector, focusing on innovative projects and strategic developments. Its background includes years of building expertise and maintaining strong partnerships. Over time, the firm has gained recognition for adapting to global market changes. This foundation influences the long-term outlook of DEFTF stock.

Company History and Growth

Defiance Silver Corp was formed with the mission of exploring high-potential silver properties in Mexico, one of the world’s largest producers of silver. Over the years, the company has expanded its resource base and built a portfolio of projects located in Mexico’s most prolific mining regions. While it has not yet reached production stage, the company has made progress through exploration programs and strategic acquisitions.

Products, Services, and Operations

Unlike larger mining companies that generate revenue from active production, Defiance Silver is primarily focused on exploration. The company identifies and develops properties with significant silver reserves. Its strategy is to increase resource estimates through drilling and exploration results, which can enhance the value of its projects over time.

Market Reputation and Position

Although DEFTF does not have the global recognition of major mining corporations, it has earned a reputation within the junior mining sector for targeting resource-rich areas. Investors who follow small-cap and junior exploration firms often highlight DEFTF for its potential upside, provided exploration projects yield favorable outcomes.

DEFTF Stock Current Price and Market Performance

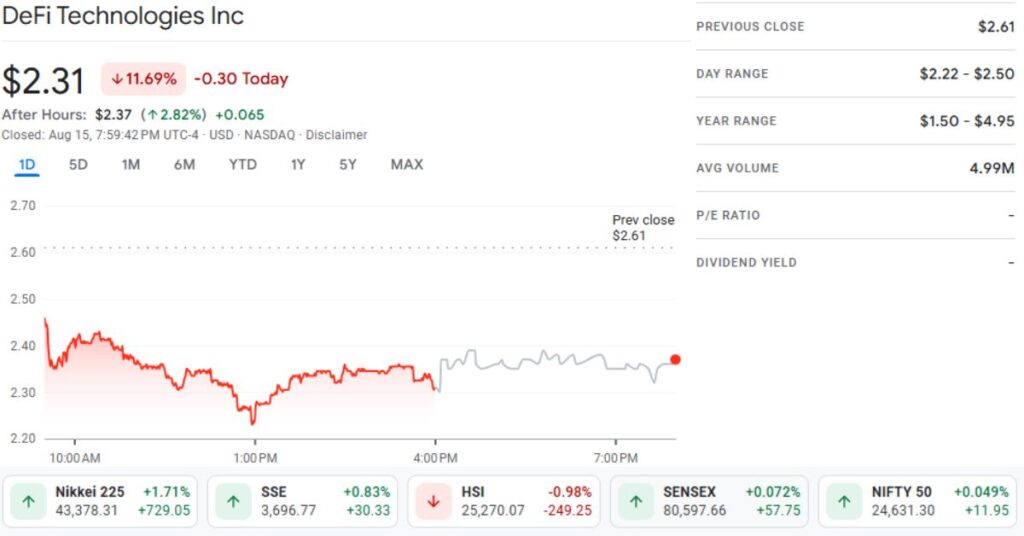

The current price of DEFTF stock reflects investor confidence and market activity. It often responds to news, earnings reports, and broader economic conditions. Daily performance is closely monitored by traders aiming for short-term gains. Over the past months, DEFTF has shown both volatility and opportunities.

Today’s Price and Volume

The stock trades at a relatively low price per share, making it accessible to retail investors with limited budgets. Daily trading volume remains modest, which means even small buying or selling activity can influence price movement. This level of thin liquidity is common among micro-cap exploration stocks.

52-Week Highs and Lows

In the last twelve months, DEFTF has shown wide price fluctuations. It has reached highs during periods of strong silver demand and dropped to lows when investor sentiment cooled. This volatility reflects its nature as a junior mining stock tied to the commodity cycle.

Market Capitalization Snapshot

With a market capitalization in the micro-cap range, DEFTF is considered a speculative investment. Smaller market caps often attract investors seeking high growth potential, though they also carry higher risks compared to established companies.

Historical Performance of DEFTF Stock

Looking at DEFTF’s history, the stock has gone through cycles of growth and correction. Past years highlight how market trends, industry developments, and global events shaped its trajectory. Long-term investors often analyze these records for patterns. This history helps in forecasting potential future movements.

Price History Over the Years

DEFTF’s price history aligns closely with movements in silver markets. During periods when silver demand increases, particularly during global uncertainty or rising industrial usage, the stock has experienced upward momentum. Conversely, during weaker commodity cycles, it has faced downward pressure.

Key Milestones in Growth

The company’s key milestones include property acquisitions in silver-rich regions of Mexico and exploration results that expanded its resource base. Each project update has historically influenced price action.

Trading Trends Over Time

Long-term investors observe that DEFTF tends to follow cycles of accumulation during exploration stages, followed by spikes when favorable drilling results are announced. Such cycles are typical for junior mining stocks.

Technical Analysis of DEFTF Stock

Technical analysis of DEFTF focuses on chart patterns, support and resistance levels, and momentum indicators. Traders examine moving averages and price trends to make entry or exit decisions. These tools provide insights into short-term price direction. For active traders, DEFTF’s technical signals play a key role.

Moving Averages (50-Day & 200-Day)

The 50-day moving average reflects short-term momentum, while the 200-day moving average highlights long-term sentiment. When the 50-day crosses above the 200-day, traders often view it as a bullish signal. For DEFTF, such movements tend to coincide with silver price rallies.

RSI, MACD, and Momentum Indicators

Technical indicators like RSI (Relative Strength Index) and MACD provide insight into momentum and trend direction. DEFTF often shows sharp swings on RSI due to its low liquidity, making it sensitive to even small changes in buying or selling pressure.

Support and Resistance Levels

Support levels typically form around historical lows where investors see value, while resistance levels occur at past highs where selling pressure increases. For DEFTF, these levels help traders identify potential entry and exit points.

Fundamental Analysis of DEFTF Stock

Fundamental analysis looks at the company’s financial health, revenue streams, and balance sheet strength. Investors evaluate earnings reports, debt levels, and cash flow. The goal is to understand whether DEFTF is undervalued or overvalued. A strong fundamental base supports long-term stock growth.

Revenue and Earnings Growth

Since Defiance Silver is in the exploration phase, revenue is not yet a significant factor. The company’s growth potential is tied to resource discovery and future development rather than current earnings.

Balance Sheet and Debt Ratios

The company usually funds its operations through equity financing rather than heavy debt. A relatively low debt structure helps it avoid financial strain but may lead to shareholder dilution when new shares are issued to raise capital.

Dividend Policies and Payout History

DEFTF does not pay dividends. Like many exploration-focused firms, all available funds are allocated to expanding its resource base and conducting exploration activities.

Factors Driving DEFTF Stock Price

Several factors affect DEFTF’s price, including global demand, industry innovation, and government policies. Market sentiment and investor speculation also play a role. External conditions such as interest rates or commodity prices may influence trends. Each driver impacts the stock differently in short and long terms.

Industry Demand and Supply Impact

Silver is essential in electronics, renewable energy, and industrial manufacturing. Demand growth in these industries supports long-term prospects for companies like DEFTF.

Economic and Geopolitical Influences

Macroeconomic factors such as inflation, interest rates, and global stability influence silver prices. Investors often turn to silver as a hedge during uncertain times, boosting related stocks.

Market Sentiment and Media Coverage

As a micro-cap stock, DEFTF is highly sensitive to news releases. Positive drilling updates or exploration results can spark rallies, while delays or disappointing outcomes may trigger declines.

Analyst Ratings and DEFTF Stock Forecast

Analysts regularly issue ratings for DEFTF, ranging from “buy” to “sell.” These forecasts are based on both technical and fundamental research. Price targets provide a view of expected movement in the coming months. Many investors follow these expert opinions as a guide for decisions.

Expert Recommendations (Buy, Hold, Sell)

Analyst coverage for DEFTF is limited, but resource-focused investors generally view it as a speculative buy, given its exploration potential.

Short-Term Price Targets

Short-term targets are influenced heavily by silver spot prices and upcoming project updates. Any strong drilling results could provide a short-term boost.

Long-Term Market Predictions

If the company advances its projects successfully, DEFTF could see significant long-term gains, especially during a strong silver cycle.

Risks and Challenges with DEFTF Stock

Like any investment, DEFTF carries risks such as market volatility and sector-specific challenges. Economic downturns or regulatory shifts can pressure the stock. Internal risks like weak earnings or debt can also affect performance. Awareness of these challenges is key for cautious investing.

Stock Volatility Concerns

Low liquidity in DEFTF stock often leads to sharp and unpredictable price changes, where even small trades can create big swings in value. Investors need to be mentally and financially prepared for sudden ups and downs. This volatility can create both opportunities and risks depending on market timing. For many, it is a reminder that DEFTF should be approached as a speculative investment.

Industry-Specific Risks

The mining and exploration sector carries inherent risks such as regulatory approvals, delays in project development, and the uncertainty of actual resource quantities underground. Even if initial drilling looks promising, results may not always translate into viable commercial production. Companies like Defiance Silver also rely heavily on financing, which can impact shareholder value if not managed well. These factors make it a challenging industry for risk-averse investors.

Global Market Uncertainty

Silver demand is tied not only to jewelry and investment but also to industries like renewable energy and electronics. Any slowdown in these sectors, global trade conflicts, or broader economic downturns can reduce demand, directly affecting DEFTF’s stock price. Geopolitical tensions and fluctuating commodity prices also play a big role in shaping investor sentiment. This makes DEFTF’s performance heavily dependent on external market conditions.

DEFTF Stock vs Competitors

Comparing DEFTF with its competitors highlights strengths and weaknesses. Some rivals may have larger market share or stronger revenue growth. Others might lack the innovation that DEFTF brings to the table. Such comparisons help investors judge DEFTF’s standing in the market.

Comparison with Peer Companies

When compared to other junior mining firms, DEFTF is relatively smaller in size but holds projects in Mexico’s promising silver-producing regions. While its peers may have more developed operations, they also tend to have less growth potential. For investors seeking early exposure, DEFTF represents a company with higher speculative upside. However, its lack of scale means the risks are equally higher than established mining firms.

Strengths of DEFTF vs Rivals

A key advantage of DEFTF is its concentrated focus on resource-rich areas of Mexico, which are historically known for high-quality silver deposits. This geographic positioning gives it access to proven silver belts, potentially increasing its chances of discovery success. Unlike more diversified rivals, Defiance Silver’s strategy centers on maximizing value from targeted exploration. This focus helps differentiate it in a crowded junior mining market.

Market Share Differences

Currently, DEFTF holds only a small share of the silver exploration market due to its size and early-stage projects. However, if exploration results continue to deliver positive updates, its market share could expand significantly. Many risk-tolerant investors are attracted to these opportunities where growth potential outweighs current size. Still, competition from larger and better-funded rivals remains a factor to consider.

Is DEFTF Stock a Good Investment?

Whether DEFTF is a good investment depends on risk tolerance and goals. Growth-focused investors may see potential in its innovative strategies. Conservative investors may weigh volatility and industry risks carefully. The answer often lies in balancing short-term fluctuations with long-term prospects.

Advantages of Investing in DEFTF

One of the key benefits of DEFTF is the chance to gain exposure to silver at an early stage of development. If Defiance Silver successfully moves closer to production, early investors could see substantial gains. The company’s projects in silver-rich regions also add credibility to its long-term growth story. For those who believe in the future of silver, DEFTF offers an entry point with higher reward potential.

Risks of Holding DEFTF Stock

Investing in DEFTF also comes with high levels of risk, including project uncertainty and a lack of steady revenue streams. The company is still dependent on external funding, which may result in shareholder dilution. Strong price volatility can also make it difficult for investors to hold through downturns. Those entering this stock should only allocate funds they are comfortable risking.

Ideal Investors for DEFTF

This stock is best suited for investors who are comfortable taking risks and have a strong interest in commodity-driven markets. It appeals to individuals who understand the cyclical nature of mining and are willing to wait for exploration results. Conservative investors looking for stable returns may find larger silver producers a safer choice. DEFTF fits better in a speculative or diversified portfolio.

How to Buy DEFTF Stock

Buying DEFTF stock requires an account with a licensed brokerage. Investors can search the ticker symbol, enter the number of shares, and execute the trade. Many platforms also allow limit orders and stop-loss settings. Beginners often start small before expanding their position.

Exchanges and Platforms Offering DEFTF

DEFTF is available for trading on the OTCQB exchange, which is accessible through most online brokerage platforms. Investors should confirm that their broker supports OTC markets before attempting a purchase. Since OTC stocks can have lower liquidity, it is wise to carefully select trade timing. This ensures that investors avoid paying higher spreads due to thin market activity.

Step-by-Step Buying Guide

To buy DEFTF, start by opening a brokerage account that allows OTC trading. Once the account is set up and funded, search for the ticker “DEFTF” on the platform. Next, choose an order type such as market or limit order depending on trading strategy. Finally, confirm and place the order, and track the investment through the broker’s dashboard.

Minimum Investment and Fees

There is no fixed minimum requirement for investing in DEFTF stock, making it accessible to both small and large investors. However, costs can vary depending on brokerage fees, commissions, and potential currency exchange charges. Investors should review their broker’s fee structure before trading. These expenses can impact overall returns, especially for smaller investment

DEFTF Stock News and Recent Updates

Recent updates on DEFTF often cover financial reports, new projects, or strategic partnerships. News surrounding its sector also affects investor sentiment. Market announcements can quickly influence daily price movements. Staying updated helps investors react to changes on time.

Latest Corporate Announcements

The company regularly shares updates regarding exploration programs, drilling results, and corporate strategies. Positive news often creates short-term spikes in stock performance as investors react to potential resource expansion. Staying updated with these announcements is crucial for those monitoring the stock closely. Project milestones are often the main drivers of DEFTF’s valuation.

Mergers, Acquisitions, and Deals

Defiance Silver may pursue partnerships or acquisitions within the silver mining space to strengthen its portfolio. Such moves can provide additional resources or funding to support exploration. Investors often view these announcements as signals of long-term commitment to growth. Any strategic deal has the potential to significantly impact the company’s outlook.

Market Events Impacting DEFTF

External events like silver spot price movements, global industrial demand, and geopolitical shifts have a direct impact on DEFTF’s trading activity. The stock is highly reactive to these external pressures due to its dependence on commodity cycles. Investors tracking DEFTF should always keep an eye on broader silver market conditions. These factors often dictate the short-term direction of the stock.

Expert Opinions on DEFTF Stock

Experts provide different views depending on market data and company updates. Some highlight growth opportunities, while others focus on risks. Opinions often reflect broader market trends and sector performance. Investors can use these insights alongside their own research.

Analyst Insights and Recommendations

Analysts who follow resource-focused companies often suggest keeping an eye on exploration data and project updates. Since DEFTF does not yet generate revenue, its valuation heavily depends on future potential. Positive exploration results can quickly shift sentiment in its favor. For now, most expert opinions categorize DEFTF as speculative with growth possibilities.

Institutional Investor Positions

Institutional investors typically avoid micro-cap stocks due to liquidity concerns. However, specialized resource funds occasionally take small positions in companies like DEFTF. Their involvement provides added credibility and sometimes signals industry confidence. Retail investors often monitor these positions as an indirect indicator of institutional interest.

Growth Opportunities Ahead

The global transition toward renewable energy and technology adoption continues to fuel silver demand. This trend creates long-term opportunities for companies like DEFTF that are exploring high-potential projects. If silver prices strengthen alongside industrial demand, DEFTF could benefit significantly. Growth prospects remain tied to both global silver trends and the company’s own exploration progress.

Future Outlook for DEFTF Stock

The outlook for DEFTF depends on industry expansion, global demand, and financial strength. Analysts project steady growth if the company maintains innovation. Economic stability and investor confidence will also play key roles. Long-term trends look promising for patient investors.

Short-Term Forecast (Next 6–12 Months)

Over the next year, DEFTF’s performance will likely depend on silver price movements and the pace of project development. Positive drilling results or progress announcements could provide short-term price boosts. At the same time, broader market volatility could lead to sudden drops. Investors should keep expectations balanced when trading this stock in the near term.

Long-Term Forecast (3–5 Years)

In the longer horizon, if Defiance Silver successfully proves and expands its resources, the stock could grow from being purely speculative to becoming a serious growth contender. This transformation depends on both exploration success and favorable silver prices. Long-term holders may benefit most if the company progresses toward production. However, patience and risk tolerance are key.

Market Trends to Watch

Silver’s increasing role in clean energy, electric vehicles, and electronics will remain an important trend shaping DEFTF’s outlook. As global demand continues to rise, companies positioned in strong silver regions may gain significant benefits. Investors following DEFTF should watch industry reports and silver price forecasts closely. These indicators often set the tone for the stock’s movement.

Final Thoughts on DEFTF Stock

DEFTF stock offers both opportunities and risks, like any equity investment. It attracts attention due to its sector position and growth potential. Careful research is necessary before committing capital. With balanced strategies, DEFTF can be part of a diverse portfolio.

Key Opportunities for Investors

DEFTF offers investors early exposure to promising silver projects in Mexico, with the possibility of significant upside if exploration proves successful. The company’s focus on silver-rich areas gives it a strategic advantage for future growth. Those who enter early may benefit from strong appreciation in favorable market conditions. The upside potential is what makes DEFTF attractive to high-risk investors.

Main Risks to Keep in Mind

The company still faces several risks, including uncertain exploration results, lack of consistent revenue, and the volatility of silver prices. These challenges can lead to unpredictable swings in stock value. Financing needs may also lead to shareholder dilution over time. For conservative investors, these risks may outweigh the benefits of owning the stock.

Balanced Closing Note

For investors who are willing to accept higher risk in exchange for potential high rewards, DEFTF remains an intriguing opportunity in the silver exploration sector. Its projects have potential, but success will depend on both company execution and global silver trends. Those seeking stability may find larger mining companies more suitable. DEFTF fits best as a speculative play within a diversified portfolio.

FAQs About DEFTF Stock

What does DEFTF Stock represent?

DEFTF Stock represents shares of a company traded in the over-the-counter (OTC) market. Investors buy it as a way to participate in the company’s growth and performance. Since it is not traded on a major exchange, liquidity and visibility may be lower. However, it still attracts attention from traders seeking unique opportunities. Many people analyze its background before investing.

Where can I check the live price of DEFTF Stock?

The live price of DEFTF Stock can be tracked on financial platforms such as Yahoo Finance, MarketWatch, or OTC Markets. Investors also use brokerage accounts for real-time updates. Monitoring live price helps in making entry and exit decisions. It also reflects daily trading activity and investor sentiment. Staying updated ensures more informed investment choices.

Is DEFTF Stock considered a safe investment?

DEFTF Stock carries risks like most equities, especially since it trades in OTC markets. Safety depends on company fundamentals, market demand, and external factors. While some investors find potential, others see higher volatility. Risk tolerance and research play an important role. Investors should always balance it with diversified holdings.

What affects the price of DEFTF Stock the most?

The price of DEFTF Stock is influenced by market demand, financial performance, and industry trends. News updates, analyst ratings, and competitor activity also impact price movements. Broader economic conditions may play a role. Even investor sentiment can drive fluctuations. Monitoring these factors helps predict future behavior.

How has DEFTF Stock performed historically?

DEFTF Stock has shown different performance phases depending on market conditions. Investors often look at charts to understand past trends. Historical growth or decline helps forecast future outcomes. While history doesn’t guarantee results, it guides investment strategies. Analysts rely on this data to evaluate opportunities.

Can beginners invest in DEFTF Stock?

Yes, beginners can invest in DEFTF Stock, but they should research carefully. OTC stocks are often less regulated compared to major exchange-listed ones. New investors should start with small amounts. Learning about market trends and risk management is essential. A guided approach helps avoid costly mistakes.

How do analysts view DEFTF Stock?

Analysts provide mixed opinions on DEFTF Stock, depending on their evaluation of company fundamentals. Some view it as a growth opportunity, while others highlight risks. Analyst forecasts often include target prices. Reports usually combine technical and fundamental analysis. Investors use these insights to refine strategies.

What are the main risks with DEFTF Stock?

Risks of DEFTF Stock include high volatility, limited market liquidity, and lack of major exchange oversight. OTC stocks may also face regulatory challenges. The company’s financial health strongly impacts risk level. Global economic conditions can add uncertainty. Investors must evaluate all factors before investing.

How can I buy DEFTF Stock online?

Investors can purchase DEFTF Stock through brokerage accounts that allow OTC trading. Popular platforms like E*TRADE, TD Ameritrade, and Interactive Brokers support these trades. Opening and funding an account is the first step. After that, the stock ticker can be searched and purchased. Always review fees before trading.

Is DEFTF Stock good for short-term trading?

Some traders use DEFTF Stock for short-term gains due to its volatility. Daily or weekly price swings can create quick opportunities. However, short-term trading requires strict risk management. Market news and technical analysis play a big role. Traders should be ready for sudden changes.

Can DEFTF Stock provide long-term growth?

DEFTF Stock may provide long-term growth if the company continues to improve performance. Investors holding for years usually focus on fundamentals. Growth also depends on industry demand and competition. Positive financial trends can strengthen long-term potential. Patience is required when investing for the future.

How does DEFTF Stock compare to competitors?

DEFTF Stock competes with other OTC and listed companies in the same sector. Analysts compare revenue, performance, and market share. Sometimes competitors may be more stable or better known. Investors review such comparisons before making decisions. Competition analysis helps clarify value.

What recent news impacts DEFTF Stock?

News updates about the company or industry often influence DEFTF Stock price. Earnings reports, product launches, or partnerships can increase interest. Negative events may create declines. Investors often monitor financial media for updates. Staying informed helps react quickly to market changes.

Who should consider investing in DEFTF Stock?

DEFTF Stock may attract investors willing to take on higher risk for potential returns. Active traders looking for short-term opportunities may also find it appealing. Long-term investors may buy if they believe in the company’s growth story. Conservative investors, however, might avoid OTC stocks. Suitability depends on individual goals.

What is the future outlook of DEFTF Stock?

The future outlook of DEFTF Stock depends on company strategy, financial performance, and market demand. Analysts study trends to estimate future potential. Positive industry developments may support growth. However, risks should always be acknowledged. Investors balance both outlook and risk before committing.

No Comments