FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

CYBL Stock: Price Forecast, Market Analysis & Investment Guide 2025

CYBL stock represents Cyberlux Corporation, a penny stock that has captured investor interest due to its involvement in defense, energy, and technology-driven solutions. The company operates in specialized industries that rely heavily on innovation and government partnerships. As a low-priced security, CYBL offers both potential upside and high volatility. Investors are closely watching its progress in 2025, as market speculation and contract announcements continue to drive trading activity.

Table of Contents

- Company Background – Cyberlux Corporation (CYBL)

- History and Foundation of Cyberlux

- Core Business Model and Operations

- Major Projects and Innovations

- CYBL Stock Market Performance Overview

- Historical Price Movement & Charts

- Market Capitalization & Shareholder Structure

- Trading Volume & Liquidity Status

- CYBL Stock Financial Analysis

- Revenue Streams & Profitability

- Debt Levels & Cash Flow Position

- Balance Sheet & Growth Metrics

- CYBL Stock Price Prediction

- Short-Term Forecast (2025)

- Medium-Term Forecast (2026–2027)

- Long-Term Forecast (2028–2030)

- Analyst Ratings and Market Opinions

- Factors Driving CYBL Stock

- Technological Advancements & Products

- Partnerships, Contracts & Mergers

- Industry Demand & Market Trends

- Investor Sentiment on Penny Stocks

- Risks and Challenges for CYBL Stock

- Volatility of Penny Stocks

- OTC Market Limitations

- Regulatory & Legal Challenges

- Competition in the Tech Sector

- Expert Opinions on CYBL Stock

- Analyst Recommendations

- Investor Community Views (Reddit, StockTwits, Twitter)

- Press Releases & News Updates Impact

- CYBL Stock Compared to Other Penny Stocks

- CYBL vs ENZC Stock

- CYBL vs HCMC Stock

- Which Penny Stock Has More Growth Potential?

- How to Buy CYBL Stock?

- Where CYBL is Traded (OTC Markets)

- Step-by-Step Guide for Beginners

- Best Brokers and Trading Platforms

- Things to Check Before Investing

- CYBL Stock Investment Strategies

- Day Trading CYBL Stock

- Swing Trading Opportunities

- Long-Term Holding Strategy

- Diversification Tips

- CYBL Stock Dividend Information

- Latest News & Updates on CYBL Stock

- Recent Developments in Cyberlux Corporation

- Government Contracts & Partnerships

- Press Releases That Impacted Stock Price

- Future Outlook for CYBL Stock

- Growth Potential in Tech Industry

- Market Expansion Plans

- Long-Term Value for Investors

- Alternatives to CYBL Stock

- Conclusion

- FAQ About CYBL Stock

- Is CYBL Stock a good investment?

- Why is CYBL Stock popular among traders?

- What are the risks of buying CYBL Stock?

- How has CYBL Stock performed recently?

- Can beginners invest in CYBL Stock?

- What factors drive CYBL Stock price?

- Is CYBL Stock suitable for long-term holding?

- How do analysts view CYBL Stock?

- What makes CYBL Stock different from other penny stocks?

- Where can investors buy CYBL Stock?

- How volatile is CYBL Stock?

- What strategies work best for CYBL Stock?

- How do market trends affect CYBL Stock?

- What is the future outlook of CYBL Stock?

Company Background – Cyberlux Corporation (CYBL)

Cyberlux Corporation (CYBL) is a technology-driven company that focuses on advanced systems across defense, security, and renewable energy sectors. Over the years, the firm has built partnerships with government and private organizations to expand its product offerings. Its operations combine innovation with practical solutions, targeting both commercial and military applications. This diverse presence has given CYBL a base to grow within multiple industries.

History and Foundation of Cyberlux

Cyberlux Corporation was founded in 2000 with a focus on advanced lighting systems for commercial and government use. Over the years, the company shifted its strategy and expanded into defense technology, unmanned systems, and renewable energy solutions. Its ability to adapt to market demand has kept it relevant in industries that are highly competitive and fast-changing.

Core Business Model and Operations

The company operates by securing contracts that require specialized technology, often in sectors like defense and infrastructure. Its focus includes developing energy-efficient systems, UAV technology, and advanced security products. By working with government agencies and private sector partners, Cyberlux aims to establish a stable revenue base in industries that continue to evolve.

Major Projects and Innovations

Cyberlux has been linked to projects in clean energy, tactical lighting, and unmanned aerial systems. These ventures highlight its efforts to diversify its product portfolio while targeting industries with long-term growth potential. Many of its contracts are tied to defense-related needs, which gives the company an advantage in markets where reliability and innovation are valued.

CYBL Stock Market Performance Overview

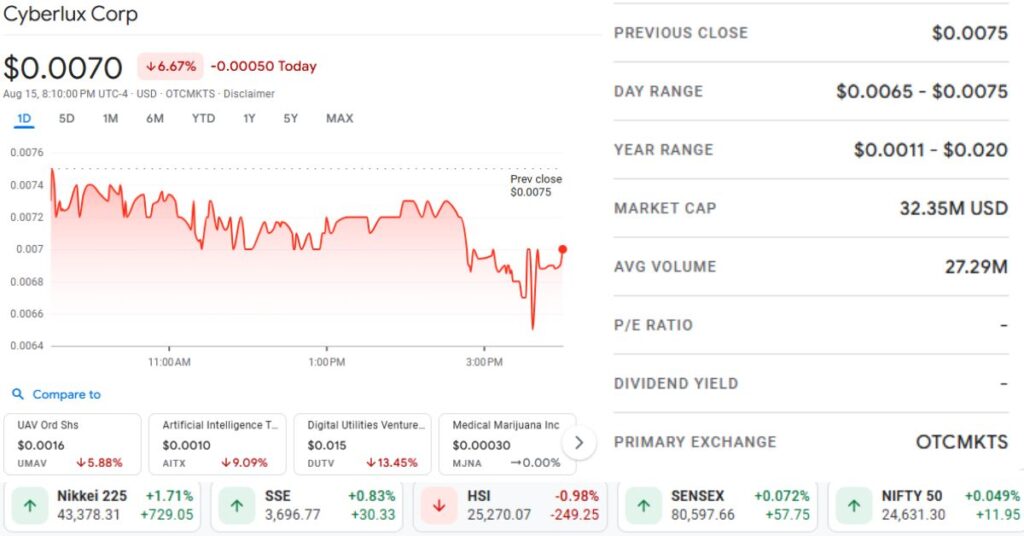

CYBL stock has shown varied movement in the over-the-counter market, attracting both retail and speculative investors. The price trend reflects market sentiment toward small-cap technology firms, often reacting quickly to news and corporate announcements. While the stock has periods of volatility, trading volume highlights active investor interest. Market performance also depends on broader economic cycles and investor appetite for high-risk growth opportunities.

Historical Price Movement & Charts

As a penny stock traded on OTC markets, CYBL has shown large swings in price over time. Sharp rallies often occur when the company releases new announcements or updates investors about contracts. At the same time, corrections are frequent, which reflects the uncertainty surrounding small-cap companies.

Market Capitalization & Shareholder Structure

CYBL has a relatively modest market capitalization compared to larger tech firms. A significant portion of trading activity is influenced by retail investors, which increases volatility. The shareholder base often includes traders looking for short-term gains, which can amplify both upward and downward moves.

Trading Volume & Liquidity Status

The stock’s trading volume tends to fluctuate depending on news and market sentiment. Liquidity can be limited, meaning larger transactions may quickly affect the price. For investors, this presents both opportunities for rapid gains and risks of sharp losses.

CYBL Stock Financial Analysis

The company’s financials highlight challenges common to microcap firms, including limited revenue streams and reliance on external funding. Debt and cash flow levels play a central role in shaping the investment outlook. Analysts often review quarterly filings to gauge progress in reducing expenses and improving balance sheet stability. The numbers reveal both growth potential and the risks of operating in capital-intensive sectors.

Revenue Streams & Profitability

Cyberlux generates most of its revenue through contracts in defense, renewable energy, and infrastructure support. However, profitability has been inconsistent, as the company often reinvests in new technologies. This makes CYBL more of a growth-oriented play rather than a stable income stock.

Debt Levels & Cash Flow Position

Like many small-cap companies, Cyberlux faces challenges related to debt and cash flow management. While it has secured government-related work, maintaining steady financial health remains a challenge. Investors should monitor quarterly filings for clarity on debt reduction and operating expenses.

Balance Sheet & Growth Metrics

The balance sheet reflects both opportunity and risk. On one hand, Cyberlux is involved in industries with strong demand. On the other, it must improve its financial strength to gain long-term investor confidence. Growth metrics are tied to contract wins, execution of projects, and technological advancements.

CYBL Stock Price Prediction

Forecasting CYBL stock price remains speculative, influenced by both company progress and investor psychology. Analysts consider past trading ranges, technical indicators, and industry developments to build short-term and long-term expectations. While some projections see room for growth, others highlight the uncertainty of penny stocks. Predictive models generally point to sharp movements rather than steady trends.

Short-Term Forecast (2025)

In the short term, CYBL is expected to remain volatile throughout 2025. Analysts suggest that price movement will largely depend on contract announcements and investor sentiment. Short bursts of growth may occur, but these gains are often followed by corrections.

Medium-Term Forecast (2026–2027)

Looking at 2026 and 2027, the company’s stock performance will depend on its ability to scale operations. If Cyberlux secures long-term projects and delivers consistent revenue, the stock may trade at higher ranges. Without steady growth, it could remain a speculative penny stock.

Long-Term Forecast (2028–2030)

Long-term projections are more optimistic, especially if Cyberlux successfully expands into renewable energy and unmanned technologies. By 2030, CYBL may grow beyond its penny stock status if it demonstrates sustainable earnings. However, risks remain high due to market competition and financial hurdles.

Analyst Ratings and Market Opinions

CYBL stock is rarely covered by major institutions, but independent analysts and investor communities often debate its future. Some see it as an undervalued growth play, while others view it as a high-risk speculative bet.

Factors Driving CYBL Stock

Investor attention toward CYBL is shaped by defense contracts, renewable energy projects, and technology innovation. Announcements of new deals or collaborations often act as price catalysts. The company’s ability to adapt to shifting market demands also affects investor sentiment. Broader themes such as clean energy adoption and national security spending add external drivers to the stock’s movement.

Technological Advancements & Products

The company’s ability to innovate is a primary driver of its stock price. Advancements in unmanned systems and renewable energy solutions create new opportunities for growth. Investors often respond positively when Cyberlux introduces new technology.

Partnerships, Contracts & Mergers

New government contracts and partnerships with larger companies can lead to stock price surges. Such deals not only provide immediate revenue but also build long-term credibility for the firm.

Industry Demand & Market Trends

Global interest in defense technology, clean energy, and infrastructure projects supports the industries where Cyberlux operates. Demand in these sectors often drives investor optimism for the company’s stock.

Investor Sentiment on Penny Stocks

Penny stock investors are often driven by speculation. CYBL’s low price makes it attractive to traders seeking quick gains, but this also adds risk as price swings can be unpredictable.

Risks and Challenges for CYBL Stock

CYBL stock carries risks tied to its penny stock status, including liquidity concerns and sharp price swings. The company faces hurdles in sustaining consistent revenue and competing against larger, established firms. Regulatory scrutiny in defense and technology sectors may also slow down progress. These challenges make CYBL a high-risk, high-reward investment case.

Volatility of Penny Stocks

CYBL experiences frequent price swings because of its penny stock status. Small changes in trading activity or news releases can trigger sharp upward or downward movements. This volatility makes it difficult for investors to predict stable growth and requires careful timing. While some traders benefit from quick moves, long-term investors may find the unpredictability challenging.

OTC Market Limitations

Since CYBL trades on the OTC market, it does not have the same regulatory oversight or transparency as larger exchanges like NASDAQ or NYSE. This often makes it harder for investors to analyze the company’s financials with full confidence. OTC-listed companies also face liquidity challenges, making large trades risky. Limited reporting standards further add to investor uncertainty.

Regulatory & Legal Challenges

Cyberlux Corporation’s reliance on government-related work exposes it to strict regulations and compliance requirements. Any disruption in approvals or policy changes can directly affect its revenue streams. Legal delays in contracts or disputes with agencies may also slow down project execution. This dependency increases risk for investors who expect steady results.

Competition in the Tech Sector

CYBL operates in highly competitive sectors, including defense technology and renewable energy, where larger, well-funded companies dominate. Without strong financial backing and steady innovation, maintaining its position is difficult. Competitors with more resources often win contracts that smaller firms cannot match. Cyberlux must consistently improve its offerings to survive in such a competitive landscape.

Expert Opinions on CYBL Stock

Market experts remain divided on CYBL, with some highlighting its disruptive potential and others pointing to financial instability. Supporters see opportunity in the company’s alignment with long-term growth industries. Critics, however, emphasize the volatility and speculative nature of investing in microcap stocks. Investor forums and independent analysts provide mixed reviews, shaping a cautious approach.

Analyst Recommendations

Independent market analysts often describe CYBL as a speculative investment with potential, provided the company delivers on its project pipeline. They typically advise cautious investing, recommending it only as part of a diversified portfolio. While optimism exists for its defense and energy projects, analysts highlight risks tied to financial instability. Investors are encouraged to track performance closely.

Investor Community Views (Reddit, StockTwits, Twitter)

The online investor community remains divided when it comes to CYBL stock. Many traders on forums such as Reddit and StockTwits are bullish, citing its focus on defense technology and energy markets. Others remain skeptical, pointing to inconsistent financials and cash flow issues. The contrasting opinions reflect both the opportunities and uncertainties surrounding this penny stock.

Press Releases & News Updates Impact

Press releases and corporate updates have historically had a strong influence on CYBL’s price movements. Announcements about contracts, mergers, or financial results often lead to sudden trading spikes. Positive updates generate investor excitement, while delays or missed targets cause sharp corrections. For active traders, monitoring news releases is critical to anticipating market reactions.

CYBL Stock Compared to Other Penny Stocks

When placed alongside other penny stocks, CYBL often attracts attention due to its activity across multiple sectors such as renewable energy, defense technology, and infrastructure solutions. Many penny stocks struggle to show clear direction, but CYBL differentiates itself by pursuing contracts and partnerships that hint at long-term potential. While it carries the same risks of volatility and liquidity challenges as its peers, its diversification provides an added layer of interest for investors. This contrast makes CYBL a stock that stands out in the crowded penny stock market.

CYBL vs ENZC Stock

While CYBL operates in defense and energy sectors, ENZC focuses on biotech and medical research. Both attract speculative investors but appeal to different market interests. CYBL may gain stronger long-term traction due to its government-related contracts. ENZC, on the other hand, relies heavily on breakthroughs in biotechnology, which carry different risks and timelines.

CYBL vs HCMC Stock

Compared to HCMC, which is linked to consumer health and wellness, CYBL has closer ties to government-backed projects. This gives it a potential advantage in building long-term stability if contracts expand. HCMC relies on retail-driven trends, which are often more unpredictable. CYBL’s link to defense and energy makes it an appealing choice for some risk-tolerant investors.

Which Penny Stock Has More Growth Potential?

Among penny stocks, CYBL shows promise because of its presence in high-demand sectors like defense and clean energy. However, growth is not guaranteed and depends heavily on consistent execution and financial improvement. If Cyberlux delivers on its projects, it could outpace peers. Still, investors should balance optimism with the risks inherent in penny stock investing.

How to Buy CYBL Stock?

CYBL trades on the OTC markets, meaning it can be purchased through brokerage accounts that support penny stock trading. Investors typically need to search for the ticker symbol “CYBL” and place buy orders through platforms offering access to over-the-counter securities. Transaction fees and liquidity conditions may vary depending on the broker. New investors often start with smaller amounts due to the stock’s speculative nature.

Where CYBL is Traded (OTC Markets)

CYBL stock is traded on the OTC markets under the ticker symbol “CYBL.” Investors cannot access it directly through every broker, as some platforms limit OTC stock trading. Those interested must select brokers that provide access to this exchange. OTC trading generally carries higher risk but remains popular for penny stock investors.

Step-by-Step Guide for Beginners

To purchase CYBL stock, open a brokerage account that supports OTC trading and deposit funds. Search for the ticker symbol “CYBL” on your platform and place a buy order for your desired number of shares. Monitor the performance after purchase, as penny stocks are highly volatile. Beginners should start with smaller positions until they gain experience.

Best Brokers and Trading Platforms

Several brokers such as E-Trade, TD Ameritrade, and Interactive Brokers allow access to OTC stocks like CYBL. Each platform has its own fee structure, order types, and execution speeds. Choosing the right broker depends on your trading style, whether short-term or long-term. Investors should compare costs and reliability before selecting a platform.

Things to Check Before Investing

Before investing in CYBL, review the company’s financial statements, press releases, and recent contract updates. Trading volume and liquidity should also be analyzed to avoid difficulties in entering or exiting positions. Understanding the risks of penny stocks is necessary to avoid overexposure. Careful research helps investors make informed decisions rather than trading on hype.

CYBL Stock Investment Strategies

Investment strategies around CYBL often depend on risk appetite and time horizon. Some investors focus on short-term trading, taking advantage of price volatility. Others consider long-term holding, betting on the company’s growth potential in defense and renewable sectors. Diversification is commonly suggested to reduce exposure, since penny stocks carry higher levels of unpredictability.

Day Trading CYBL Stock

Day traders often look at CYBL for its sharp intraday movements, aiming to profit from quick price swings. This approach requires constant monitoring of market news and technical patterns. While gains can be fast, the risk of losses is equally high. Only traders with experience and discipline should consider this short-term strategy.

Swing Trading Opportunities

Swing trading involves holding CYBL stock for days or weeks to capitalize on short-term trends. News updates and contract announcements often fuel these momentum-driven moves. Investors can benefit from waiting for dips before entering positions. This strategy works well for traders who cannot monitor markets constantly but still want to capture opportunities.

Long-Term Holding Strategy

Some investors choose to hold CYBL stock long-term, anticipating that its defense and energy projects will deliver growth in future years. This approach requires patience and a strong tolerance for volatility. Long-term gains are possible if the company executes successfully. However, holding penny stocks over time carries significant uncertainty compared to established firms.

Diversification Tips

Investors should avoid placing too much of their portfolio in CYBL or any single penny stock. Diversifying across different sectors and asset classes helps manage risk. Including a mix of growth, dividend-paying, and stable blue-chip stocks balances volatility. CYBL may serve as a speculative addition rather than a core investment.

CYBL Stock Dividend Information

CYBL currently does not distribute dividends to its shareholders. Instead, the company reinvests earnings into new projects, research, and business expansion. For investors seeking steady income, dividend-paying stocks in more established industries may be a better choice. CYBL appeals more to those looking for growth potential rather than consistent payouts.

Latest News & Updates on CYBL Stock

Recent updates around CYBL often include new contracts, quarterly filings, and corporate announcements. Investors closely follow press releases, as these can impact price movement immediately. Industry-related news, such as defense spending policies or renewable energy initiatives, also plays a role in shaping market reaction. Staying updated with official reports helps investors track the company’s actual progress.

Recent Developments in Cyberlux Corporation

Cyberlux has been exploring opportunities in both defense technology and renewable energy. Its focus on innovation keeps it relevant in industries experiencing long-term demand. Investors often react strongly to updates about product advancements or new markets. These developments continue to influence the stock’s short-term trading patterns.

Government Contracts & Partnerships

A large portion of Cyberlux’s growth potential is tied to securing new government contracts. Such agreements provide revenue stability and boost credibility in competitive markets. Positive contract announcements usually drive significant interest from investors. Partnerships with established organizations further strengthen its position.

Press Releases That Impacted Stock Price

Past press releases from Cyberlux have caused noticeable changes in CYBL’s stock price. Announcements about mergers, financial updates, or major projects tend to influence investor sentiment quickly. Traders who follow company news closely often benefit from early reactions. Staying updated on press releases is key to anticipating movements.

Future Outlook for CYBL Stock

The future of CYBL stock depends on its ability to strengthen financials and secure larger contracts. If the company successfully expands its presence in defense and renewable sectors, investor confidence could grow. At the same time, its microcap status means uncertainty will remain a major factor. The long-term outlook blends potential opportunity with the caution of speculative investing.

Growth Potential in Tech Industry

Cyberlux is positioned in industries like defense and renewable energy, which are expected to expand over the coming years. Continued innovation in these areas could provide a long-term boost to its stock. Success in scaling new technologies may create stronger market relevance. However, the company must compete aggressively against larger players.

Market Expansion Plans

The company aims to expand into unmanned systems and renewable energy markets. Both sectors have global demand and provide opportunities for growth. Successful execution of these plans could help CYBL diversify its revenue sources. Expansion into new industries also improves its resilience against market fluctuations.

Long-Term Value for Investors

For long-term investors, CYBL presents both opportunity and risk. Its growth depends heavily on financial discipline, contract execution, and industry positioning. If Cyberlux achieves stability, it could deliver meaningful returns over the next decade. However, given its penny stock nature, caution and diversification remain necessary for those considering it.

Alternatives to CYBL Stock

Investors seeking alternatives often look at other penny stocks like ENZC, HCMC, and SIRC. Some prefer shifting toward small-cap growth companies with stronger financial performance and less volatility.

Conclusion

CYBL stock offers investors exposure to industries with long-term demand, including defense and renewable energy. Its penny stock status makes it highly volatile, but contract wins and new projects can lead to rapid growth phases. While the potential is real, the risks are equally high, which means CYBL is best approached as part of a diversified investment strategy. Careful research and risk management are essential for anyone interested in this stock.

FAQ About CYBL Stock

Is CYBL Stock a good investment?

Whether CYBL Stock is a good investment depends on risk tolerance and financial goals. As a penny stock, CYBL Stock can deliver large gains but also heavy losses. Long-term investors may be cautious, while short-term traders seek price momentum. Evaluating company fundamentals is key before deciding. Always compare CYBL Stock with other alternatives before investing.

Why is CYBL Stock popular among traders?

CYBL Stock attracts traders due to its low entry price and potential for fast growth. Many investors look at penny stocks like CYBL Stock to find hidden opportunities. Market hype and online discussions also drive attention to CYBL Stock. The stock often reacts quickly to company news and investor sentiment. Its affordability makes it appealing to small-scale investors.

What are the risks of buying CYBL Stock?

CYBL Stock carries risks such as price volatility, lack of liquidity, and limited financial data. Investors often face sudden price swings in CYBL Stock. The stock may also struggle with regulatory or operational challenges. Being a penny stock, CYBL Stock can lose value rapidly. It is best suited for investors who can handle high uncertainty.

How has CYBL Stock performed recently?

Recent performance of CYBL Stock shows mixed results, with periods of growth and sudden declines. Short-term rallies often bring new attention to CYBL Stock. However, long-term growth remains uncertain. Investors monitor financial reports to evaluate stability. CYBL Stock continues to move in response to company news and market sentiment.

Can beginners invest in CYBL Stock?

Yes, beginners can invest in CYBL Stock, but they must understand the risks. CYBL Stock is considered speculative, so careful planning is required. New investors should start small and avoid overexposure. Learning about penny stock behavior can help reduce mistakes. Beginners are advised to research CYBL Stock before buying.

What factors drive CYBL Stock price?

CYBL Stock price is influenced by company performance, market sentiment, and industry trends. News updates often create strong reactions in CYBL Stock. Broader economic conditions also play a role. Investor demand for penny stocks can increase volatility. Each of these factors can shift CYBL Stock price quickly.

Is CYBL Stock suitable for long-term holding?

CYBL Stock may not suit all long-term investors due to its speculative nature. Some traders prefer holding CYBL Stock for quick profits. However, patient investors may hold in hopes of future growth. The uncertainty around penny stocks makes long-term holding risky. CYBL Stock requires constant monitoring if held for years.

How do analysts view CYBL Stock?

Analyst opinions on CYBL Stock are often divided. Some highlight growth potential while others focus on risks. Because CYBL Stock is a penny stock, it receives limited coverage from large firms. Independent analysts provide most reviews of CYBL Stock. Their insights often shape trader expectations in the market.

What makes CYBL Stock different from other penny stocks?

CYBL Stock stands out due to its projects and vision in technology-driven markets. Many penny stocks lack clear strategies, but CYBL Stock focuses on innovation. Investors often compare CYBL Stock with similar companies. Some traders see stronger potential in CYBL Stock compared to others. Still, the risks remain comparable to typical penny stocks.

Where can investors buy CYBL Stock?

Investors can buy CYBL Stock through brokerage platforms that support OTC markets. CYBL Stock is not traded on major exchanges. Buyers should confirm if their broker allows penny stock purchases. Transaction fees may apply depending on the platform. Always review the risks before purchasing CYBL Stock.

How volatile is CYBL Stock?

CYBL Stock is highly volatile, with frequent price swings in short periods. Traders often experience sudden gains or losses when holding CYBL Stock. News events can trigger strong reactions in its price. Many investors consider CYBL Stock a high-risk, high-reward choice. Volatility makes it attractive for day traders but risky for others.

What strategies work best for CYBL Stock?

Short-term trading strategies are often applied to CYBL Stock. Swing trading can help capture price momentum. Some investors diversify when including CYBL Stock in their portfolio. Others use stop-loss orders to manage risk. Choosing the right strategy depends on how CYBL Stock fits into overall goals.

How do market trends affect CYBL Stock?

Market trends in penny stocks often influence CYBL Stock. Positive industry news can boost interest quickly. A bearish market may cause CYBL Stock to drop sharply. Investor sentiment online also drives its movement. Tracking overall trends helps in predicting CYBL Stock performance.

What is the future outlook of CYBL Stock?

The future outlook of CYBL Stock depends on company execution and market growth. Supporters expect CYBL Stock to gain value if projects succeed. Critics highlight ongoing risks tied to penny stocks. Its path will likely include both ups and downs. CYBL Stock remains speculative but worth watching closely.

No Comments