FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

3D Printing Stocks – Complete Guide for Investors

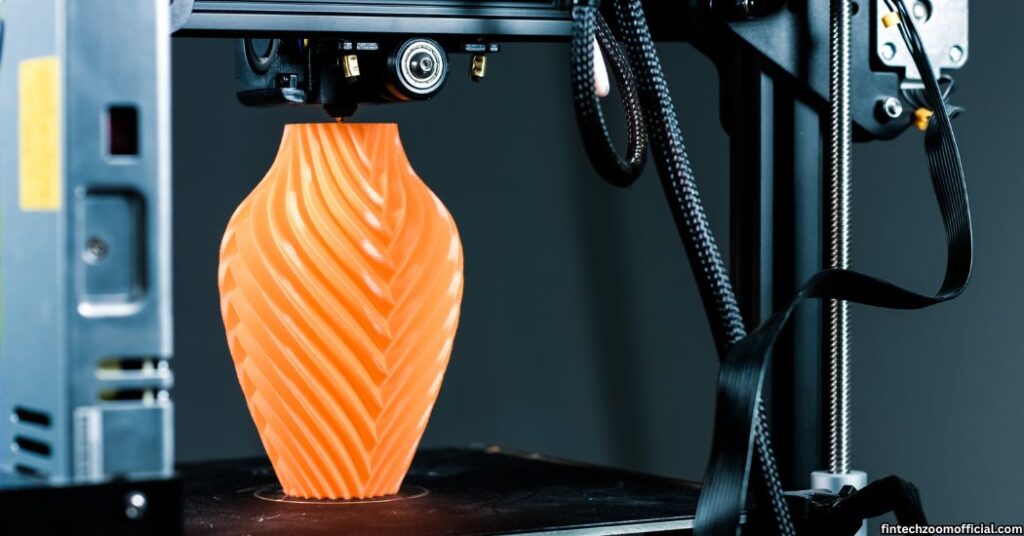

3D printing stocks represent companies involved in additive manufacturing, from producing industrial and consumer 3D printers to specialized materials, design software, and printing services. Once limited to prototyping, 3D printing is now used in aerospace, healthcare, automotive, and construction. The technology’s ability to drive innovation, efficiency, and customization has attracted both retail and institutional investors.

Table of Contents

- How 3D Printing Is Changing Industries

- Why Investors Are Paying Attention

- Market Overview of the 3D Printing Industry

- Global 3D Printing Market Size and Growth Forecast

- Key Sectors Driving 3D Printing Adoption

- Recent Technological Innovations

- List of Popular 3D Printing Stocks

- Emerging 3D Printing Startups to Watch

- ETFs Focused on 3D Printing

- How to Analyze 3D Printing Stocks

- Fundamental Analysis Tips for 3D Printing Companies

- Technical Analysis Tools for Price Trends

- Evaluating Revenue Streams and Business Models

- Risks and Challenges of Investing in 3D Printing Stocks

- Market Volatility

- Competition and Technological Shifts

- Regulatory and Supply Chain Issues

- Future Outlook for 3D Printing Stocks

- Growth Potential in Healthcare, Automotive, and Aerospace

- Role of AI and Automation in 3D Printing

- Expert Predictions for the Next 5–10 Years

- Tips for New Investors in 3D Printing Stocks

- Setting Realistic Investment Goals

- Diversifying Your Portfolio

- Staying Updated with Market News

- Conclusion

- Frequently Asked Questions About 3D Printing Stocks

- What are 3D Printing Stocks?

- How can someone invest in 3D Printing Stocks?

- Why are 3D Printing Stocks attracting attention?

- Which industries influence 3D Printing Stocks the most?

- Are 3D Printing Stocks considered risky investments?

- What factors affect the price of 3D Printing Stocks?

- Can beginners invest in 3D Printing Stocks?

- What are the benefits of investing in 3D Printing Stocks?

- How do global events impact 3D Printing Stocks?

- Do 3D Printing Stocks pay dividends?

- How can someone research 3D Printing Stocks effectively?

- Are ETFs a good option for 3D Printing Stocks?

- What is the future outlook for 3D Printing Stocks?

- How can investors manage risk with 3D Printing Stocks?

- Are 3D Printing Stocks suitable for long-term investing?

How 3D Printing Is Changing Industries

From aerospace components to dental implants, 3D printing has become a transformative manufacturing method. It allows faster prototyping, reduces material waste, and supports the production of highly customized products. Industries that once relied entirely on traditional manufacturing now integrate 3D printing to improve efficiency, reduce costs, and expand design possibilities.

Why Investors Are Paying Attention

Interest in 3D printing stocks has grown due to the technology’s expanding commercial applications. As production processes become more precise and material options increase, companies in this sector are gaining competitive ground across manufacturing, healthcare, automotive, and construction. For investors, this represents an opportunity to participate in a technology-driven market with long-term growth potential.

Market Overview of the 3D Printing Industry

The global 3D printing industry is projected to surpass $100 billion by 2030, fueled by new technologies, advanced materials, and wider adoption in manufacturing. Aerospace and automotive companies use it for lightweight, complex parts, while healthcare applies it for custom implants and prosthetics. Construction firms are experimenting with large-scale on-site printing, signaling ongoing growth across sectors.

Global 3D Printing Market Size and Growth Forecast

Industry analysts project the global 3D printing market to surpass $100 billion by 2030, with annual growth rates exceeding 20%. These figures are fueled by advances in printer speed, material science, and design software, along with rising adoption in multiple industries.

Key Sectors Driving 3D Printing Adoption

- Aerospace – Producing lightweight yet durable parts for aircraft and spacecraft.

- Automotive – Streamlining the design and testing of components, reducing production lead times.

- Healthcare – Developing patient-specific prosthetics, surgical tools, and bio-printed tissues.

- Construction – Printing building elements directly on-site, reducing labor costs and waste.

Recent Technological Innovations

New developments such as multi-material printing, bio-printing for human tissue, and AI-driven design optimization are expanding the technology’s capabilities. Faster printing speeds and advanced composite materials are making large-scale production more practical for manufacturers worldwide.

List of Popular 3D Printing Stocks

- Stratasys Ltd. (SSYS) – Known for high-quality industrial 3D printers, Stratasys serves aerospace, automotive, and healthcare sectors worldwide.

- 3D Systems Corporation (DDD) – Offers printers, materials, and printing services, with a strong presence in medical and industrial applications.

- HP Inc. (HPQ) – Brings large-scale additive manufacturing solutions to market, focusing on speed, precision, and cost efficiency.

- Desktop Metal, Inc. (DM) – Specializes in metal-based 3D printing systems aimed at mass production and manufacturing automation.

- Markforged Holding Corp. (MKFG) – Produces composite and metal printers, designed for durability and use in demanding industrial environments.

- Nano Dimension Ltd. (NNDM) – Focuses on 3D printed electronics, catering to defense, aerospace, and high-tech manufacturing industries.

- ARK 3D Printing ETF (PRNT) – An exchange-traded fund that provides exposure to a diverse portfolio of companies in the 3D printing ecosystem.

Emerging 3D Printing Startups to Watch

Small-cap innovators such as Markforged Holding Corporation and Nano Dimension Ltd. are gaining attention for their advanced materials and niche printing technologies. These companies carry higher investment risk but also potential for rapid expansion.

ETFs Focused on 3D Printing

For investors seeking broader exposure, the ARK 3D Printing ETF (PRNT) offers a portfolio of companies engaged in additive manufacturing, reducing dependence on the success of any single stock.

How to Analyze 3D Printing Stocks

Analyzing these stocks means reviewing financial performance, R&D spending, and innovation capacity. Revenue trends, debt levels, and cash flow reveal a company’s financial health. Market factors such as customer base, material partnerships, and geographic reach show growth potential, while technical chart patterns can guide entry and exit points.

Fundamental Analysis Tips for 3D Printing Companies

Review financial statements for revenue trends, profit margins, and debt levels. Consider a company’s research and development spending, as innovation is a primary driver of competitiveness in this sector.

Technical Analysis Tools for Price Trends

Indicators such as moving averages, Relative Strength Index (RSI), and MACD can help identify market trends and entry points. Tracking volume changes alongside price movements offers insights into investor sentiment.

Evaluating Revenue Streams and Business Models

Some companies focus on selling 3D printers, while others earn recurring revenue from materials, software, and maintenance contracts. Understanding this mix can provide a clearer view of long-term stability and growth potential.

Risks and Challenges of Investing in 3D Printing Stocks

This fast-moving industry faces volatility, with stock prices sensitive to earnings, launches, and competitor breakthroughs. High innovation costs can strain weaker companies, and supply chain issues may cause production delays. Patent disputes and industry regulations also add complexity, making careful risk management essential for investors.

Market Volatility

Like other technology-driven sectors, 3D printing stocks can experience sharp price fluctuations. Shifts in investor sentiment or unexpected earnings results often cause rapid market reactions.

Competition and Technological Shifts

The fast pace of innovation means companies must continually advance their technology to stay competitive. Falling behind in product development can lead to loss of market share.

Regulatory and Supply Chain Issues

Patents, material sourcing, and compliance with safety regulations can impact production timelines and costs. Global trade policies and logistical disruptions may also affect supply chains.

Future Outlook for 3D Printing Stocks

Over the next decade, 3D printing is expected to grow in healthcare, aerospace, and automotive. Advances like bio-printing could revolutionize medicine, while AI will help optimize designs and speed production. As adoption spreads and technology matures, the sector could deliver significant long-term opportunities for investors.

Growth Potential in Healthcare, Automotive, and Aerospace

Healthcare could see breakthroughs in organ bio-printing, while automotive and aerospace sectors benefit from lighter and more efficient components. These applications are expected to drive steady demand for advanced printing solutions.

Role of AI and Automation in 3D Printing

Artificial intelligence is enhancing design efficiency by predicting structural performance and minimizing waste. Automated production lines that integrate 3D printing are making large-scale manufacturing faster and more adaptable.

Expert Predictions for the Next 5–10 Years

Market analysts forecast consistent expansion as 3D printing costs fall and adoption widens. While challenges remain, industry experts expect the technology to become a standard manufacturing method across multiple sectors.

Tips for New Investors in 3D Printing Stocks

Begin with research on both established leaders and emerging innovators to balance safety and growth potential. Diversify to manage volatility, and stay updated on industry news and product developments. Define your investment goals—whether short-term gains or long-term growth—and tailor your strategy accordingly.

Setting Realistic Investment Goals

Decide whether your approach will be long-term growth or short-term trading. Align your strategy with your risk tolerance and market knowledge.

Diversifying Your Portfolio

Balancing 3D printing stocks with holdings from other industries can help reduce exposure to sector-specific risks.

Staying Updated with Market News

Industry conferences, quarterly earnings calls, and specialized publications provide valuable updates. Following these sources helps investors remain aware of technological and market changes.

Conclusion

3D printing stocks offer a chance to invest in a manufacturing method that is changing how products are designed and produced. While the industry faces competitive and economic challenges, its growth prospects remain strong. With careful research, a balanced portfolio, and consistent market monitoring, investors can position themselves to benefit from the advancements driving this sector forward.

Frequently Asked Questions About 3D Printing Stocks

What are 3D Printing Stocks?

3D Printing Stocks are shares of companies involved in the additive manufacturing industry. These businesses produce 3D printers, printing materials, and related services for sectors like healthcare, aerospace, and automotive. Investors buy these stocks to benefit from the growing demand for 3D printing technology. The performance of 3D Printing Stocks often reflects industry innovation and adoption rates. Understanding these stocks helps identify potential long-term growth opportunities.

How can someone invest in 3D Printing Stocks?

Investing in 3D Printing Stocks can be done through buying individual company shares or exchange-traded funds (ETFs) focused on additive manufacturing. Investors typically use brokerage accounts to purchase these securities. Some prefer ETFs for broader exposure to multiple companies in the 3D printing sector. Researching financial performance and market trends is key before investing. This approach helps reduce risk while tapping into industry growth.

Why are 3D Printing Stocks attracting attention?

3D Printing Stocks are gaining popularity due to the rapid adoption of 3D printing in various industries. Businesses use this technology for cost-effective production, customization, and faster prototyping. Investors see potential in its ability to disrupt traditional manufacturing methods. The growing range of applications makes these stocks appealing for both short and long-term gains. This attention is fueled by consistent innovation in the field.

Which industries influence 3D Printing Stocks the most?

Industries like aerospace, healthcare, automotive, and construction have a major impact on 3D Printing Stocks. These sectors use additive manufacturing to produce lightweight, customized, or complex components. Growth in these industries often drives demand for 3D printing solutions. Investors monitor developments in these markets for potential stock performance shifts. Industry adoption plays a direct role in the success of these stocks.

Are 3D Printing Stocks considered risky investments?

Like many technology-driven investments, 3D Printing Stocks carry a higher level of volatility. Rapid innovation means companies must consistently adapt to remain competitive. Stock prices can be influenced by product launches, earnings reports, and industry trends. While the sector offers strong growth potential, risks include market competition and supply chain issues. Investors should weigh these factors before making decisions.

What factors affect the price of 3D Printing Stocks?

The price of 3D Printing Stocks is influenced by company earnings, product innovations, and industry demand. Positive news such as new contracts or patents can push prices upward. Conversely, weak sales or technological setbacks may cause declines. Broader market conditions and investor sentiment also play a role. Monitoring these factors can help predict price movements.

Can beginners invest in 3D Printing Stocks?

Yes, beginners can invest in 3D Printing Stocks if they take time to research the market. Starting with ETFs can provide exposure without the need to choose individual companies. Beginners should learn about market trends, company performance, and industry growth areas. A clear investment goal is important for making smart choices. With patience, even new investors can benefit from this sector.

What are the benefits of investing in 3D Printing Stocks?

Investing in 3D Printing Stocks can offer exposure to a fast-growing, innovative industry. The technology is used in various fields, reducing reliance on traditional manufacturing. Many companies in this sector have strong potential for future expansion. Investors may benefit from both capital gains and diversification. These advantages make the sector appealing to growth-focused portfolios.

How do global events impact 3D Printing Stocks?

Global events like supply chain disruptions, trade policies, and economic shifts can influence 3D Printing Stocks. For example, shortages in raw materials may affect production timelines. On the positive side, increased demand for localized manufacturing can boost sales. Political stability and trade agreements also shape market performance. Investors track these events to anticipate potential changes in stock value.

Do 3D Printing Stocks pay dividends?

Some 3D Printing Stocks may offer dividends, but many companies in this sector reinvest earnings into growth. Dividend-paying stocks are often more mature businesses with stable cash flow. In the 3D printing industry, firms prioritize research and product development. Investors focused on income might combine these stocks with other dividend-paying investments. Checking each company’s payout policy is essential.

How can someone research 3D Printing Stocks effectively?

Effective research on 3D Printing Stocks involves studying company financial reports, product announcements, and industry forecasts. Tracking patent filings and partnerships can reveal future growth plans. Following news from trade shows and technology conferences is also helpful. Analysts’ reports provide additional insight into potential performance. Consistent research builds a stronger understanding of the sector.

Are ETFs a good option for 3D Printing Stocks?

ETFs that focus on 3D Printing Stocks provide diversified exposure to multiple companies in the sector. This reduces the risk of poor performance from any single stock. ETFs are especially useful for beginners or those wanting a hands-off approach. They can include both established leaders and emerging innovators. Many investors use ETFs to participate in industry growth without heavy research.

What is the future outlook for 3D Printing Stocks?

The future of 3D Printing Stocks looks promising as industries continue adopting additive manufacturing. Advances in materials, speed, and AI integration will expand its capabilities. Healthcare, aerospace, and construction are likely to see increased usage. As demand grows, companies may experience stronger revenues and market share. This creates long-term potential for investors who act early.

How can investors manage risk with 3D Printing Stocks?

Risk management for 3D Printing Stocks involves diversification, research, and disciplined investing. Combining them with other sectors can balance portfolio performance. Setting stop-loss orders can limit potential losses in volatile markets. Regularly reviewing market news and company updates helps maintain awareness. A strategic approach reduces exposure to sudden downturns.

Are 3D Printing Stocks suitable for long-term investing?

Yes, 3D Printing Stocks can be suitable for long-term portfolios if chosen carefully. The industry’s growth prospects suggest strong potential over the next decade. Long-term investors can benefit from compounding returns as companies expand. However, patience is key during periods of volatility. Focusing on financially strong and innovative firms improves the odds of success.

No Comments