FintechZoom.com | Your Gateway to Financial Insights

- Home

-

Stocks Updates

- News

-

Finance Tools

- Crypto Profit Calculator

- Savings Goal Calculator

- Compound Interest Calculator

- Currency Converter

- Tax Calculator

- Retirement Planner

- Net Worth Tracker

- Investment Portfolio Calculator

- Credit Card Payoff Calculator

- Monthly Budget Planner

- Mortgage Affordability Calculator

- Debt-to-Income (DTI) Ratio Calculator

- Fuel Cost Calculator

- Stock Return Calculator

- Loan EMI Calculator

- Latest Blogs

- Jobs Updates

Money FintechZoom in 2024: Empowering Personal Finance for a Smarter Digital Future

Table of Contents

Introduction

Money FintechZoom: Enter Money versa, the FintechZoom money app is changing how people approach personal finance by bringing cutting-edge financial technology to users globally. The platform looks to democratize the world of finance, providing tools and a slick interface that demystifies budgeting, expense tracking, and investing.

Table of Contents

- Table of Contents

- Introduction

- Key Points

- Main Content

- Understanding money FintechZoom

- Key Features of money FintechZoom

- Focus On AI In Personal Finance

- Security Features in money FintechZoom

- User Experience: A Case Study

- Fintech News: Top fifteen Best Investment Opportunities in 2021

- The Future of Fintech In Personal Finance

- Problems of Fintech platforms

- Customer Support Services

- Engagement with the Community and Resources

- Competitor Comparative Analysis

- Mobile App Experience

- Strategic Partnerships and Collaborations

- Regulation and Trustworthiness

- Community Education & Financial Literacy

- FAQs

- What is Money FintechZoom?

- Is My Data Safe on FintechZoom?

- Is Money FintechZoom a Good Investment?

- Conclusion

Through this article, we will walk you through its key aspects and how FintechZoom is transforming financial management into a more advanced digital finance solution that the future would look towards.

FintechZoom crm solutions for personal finance / WealthTech: The platform fills an important void in the world of financial technology where tools have lagged innovation.

It has characteristics that distinguish it from older forms of finance, helping to manage various financial tasks with the help of real time analytics and market insights.

Faster financial The Major Trend Followed by Digital Finance Solutions: Fintech on Top With the surge of e-commerce in the business space, although it has been a great ride for consumers — frequenting online portals boasting products and services is just another part of regular day-to-day life

Faster financial transactions have immensely paved:The post Growing trend Of digital finance solutions appeared first on Inland Empire News.

Key Points

Latest Technologies: The money FintechZoom has the latest technology packed with AI for a better financial management experience.

User-Friendly Interface: To accommodate users with all levels of financial literacy, FintechZoom simplifies complex financial tasks for the common man.

Future Trends: As fintech technology continues to develop, FintechZoom is well-placed to take advantage of new technologies and trends.

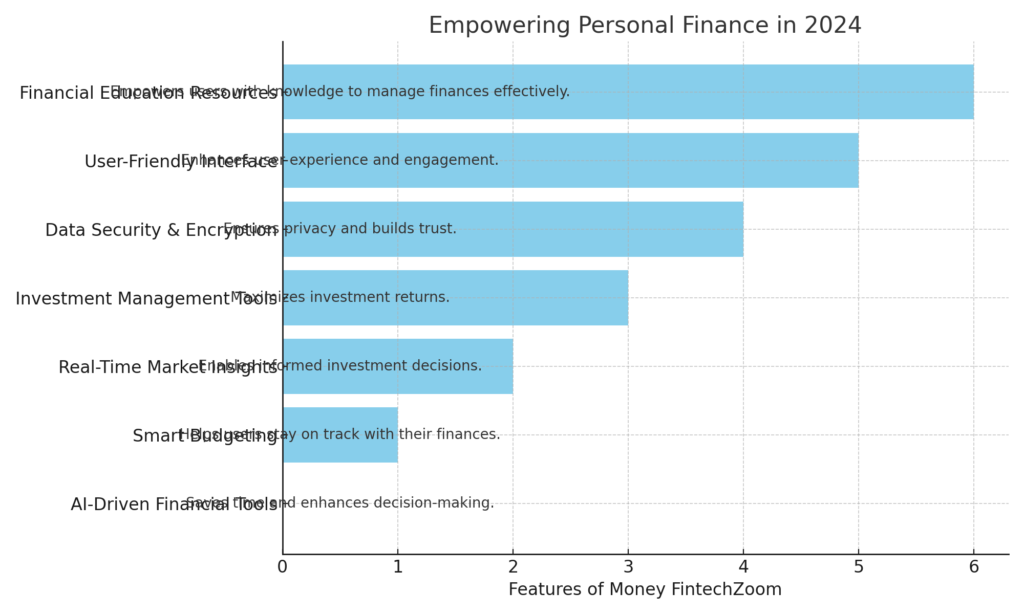

Here’s a horizontal bar chart illustrating the features of Money FintechZoom and their corresponding benefits for personal finance empowerment in 2024. You can download the chart using the link below:

Main Content

Understanding money FintechZoom

FintechZoom is a digital platform that makes managing your personal finances as easy and effortless! It combines the different financial services like budgeting tools, investment tracking and market analysis in a single interface.

Definition & Core Mission Our mission at FintechZoom is to become the world’s leading financial technology and wealth management platform. It wants to bridge the gap between traditional banking and modern digital finance.

Background: Rising up with the need of financial tools which can be easily used digitally in modern technology, money FintechZoom has been a cornerstone for moving from conventional methods to tech-driven platforms. This mirrors a wider trend around the world towards internet banking and more customer facing financial services.

Key Features of money FintechZoom

What distinguishes FintechZoom from other fintech platforms is its set of features that take personal finance to a new level.

UI Experience and Features: The interface is user-friendly that provides a very clean process to navigate for budgeting, monitoring your expenses or exploring opportunities in investing. It does this by using visual data visualization techniques to help present financial information in a concise, user-friendly manner.

Financial Accounting Tools and Services Integration — FintechZoom enables users to connect financial accounts in a way so that they may easily view their money. This consists of stock market instruments as well as cryptocurrency wallets and price provider for precious metals like gold, silver.

Real Time Markets Updates: This includes a collection of up-to-the-minute information on financial indicators such as Nasdaq trends, Dow Jones data, insights to cryptocurrency prices and movements in commodity prices that give traders the support they need when considering any trade.

Focus On AI In Personal Finance

Money FintechZoom greatly benefits from having AI integrated into its platform which helps in automating daily tasks and processes for users while providing data-driven insights to manage their finances better.

AI Powered Analytics for Recommended Personalization: AI scans through spend, investment and financial goals to provide customization suggestions. As an example, it can provide investment recommendations tailored to a user’s risk tolerance and market analysis.

Autonomous Budgeting and Expense Tracking: Just like you have virtual assistants that track your gesture, dashboard cam for records everything happens in the car so why not a personal financial assistant. This can even be used to generate an alert if the user overspends, or a transaction is made that appears unusual.

Security Features in money FintechZoom

FintechZoom has multiple levels of protection to secure user data and financial information, as it is indispensable in the process of creating confidence around digital finance.

Encryption technologies employed: It secures the data in transit and at rest using advanced encryption standards like AES-256 stand advised. This means that even unauthorized users are not able to read the data, and prevents sensitive information like bank details or personal records from being accessed with theft of keys.

Adhere to Financial Regulations: FintechZoom meet global financial regulations, such as GDPR and PCI DSS, with high standards on data security principles (such like user privacy).

User Experience: A Case Study

Learning about user feedback on the ground can help determine how FintechZoom fares in real-life use cases, and whether this is a beneficial product to invest in.

User Reviews: money FintechZoom has been a game-changer for users in terms of how they manage finance, be it planning long-term investments or budgeting. The real-time Nasdaq trends and cryptocurrency prices updates have also been praised by many of our users.

Other Fintech Platforms: Mint offers only some of the same features, and is rather targeted on personal finance management. Meanwhile Robinhood focuses almost entirely also exclusively at stock trading — with one notable exception among a cash admin product now intesting (Read Stock Trading PlatformRobinhood Offers Savings Account With 3% Interest).

Fintech News: Top fifteen Best Investment Opportunities in 2021

FintechZoom delivers well-researched information covering every angle that assists enterprises, corporations and individuals to make the right investment decisions in trade-related services across almost any industry such as stocks, mutual funds/ETFs etc; futures & options; banking/loans alternatives towels), cryptos.

Investment Offerings: From tech stocks to real estate investment trusts (REITS) and commodities such as gold & silver, you can diversify your portfolio with a variety of different asset classes. Users of the platform have access to trading opportunities from multiple markets due to its integration with a number of financial systems.

Advice to Help Investors Make Informed Financial Decisions: With the help of money FintechZoom, investors can better understand trends in the market and learn about what is causing pricing changes as well as economic health. Stock screeners, cryptocurrency trend analyzers are useful for finding investment opportunities.

The Future of Fintech In Personal Finance

The world of finance has changed considerably in recent years, and companies like FintechZoom are moving fast!

How the Blockchain, AI and Advanced Analytics are Going to Revolutionize Personal Finance: The continued growth of personal finance-based tools on both blockchain technology and platforms offers users a more integrated lifestyle with their banking solutions than ever before.

Emerging Technologies to Take Even Bigger Place: Innovations like DeFi (Decentralised Finance) and Predictive Analytics are expected to become a more routine affair for consumers looking on securing the level of control over their finances.

Problems of Fintech platforms

While these all have undeniable benefits, those same aspects could be setbacks in potentially growing and widespread adoption for FintechZoom etc.

Regulatory Challenges: Fintech is a highly regulated industry and it has to deal with the continuously changing laws which it can be challenging for companies in this sector. To operate globally, FintechZoom needs to be compliant with these regulations.

Competition from Banks and Other Fintechs: As banks integrate digital solutions, and various other fintech companies bring new products to market, continued innovation is necessary for money FintechZoom to stay ahead.

Customer Support Services

This is also a major part of the FintechZoom value proposition as it allows users to solve problems in customer service when necessary…

Customer Support Channels: FintechZoom offers various customer support channels, including live chat, email and phone. The multi-channel approach accommodates users who might prefer one medium of communication over another.

Service Times and User Satisfaction: The response times of money FintechZoom of support team are fast, with most issues reported resolved in low time intervals. The user satisfaction scores are high due to prompt throttling of requests.

Engagement with the Community and Resources

FintechZoom is incredibly engaged with its user community, and provides a plethora of resources to help people gain Financial Literacy.

User Forums or Discussion Boards: As a platform, there are community forums for users who can get together to talk about anything from market volatility and passive income strategies to economic trends.

Content on money FintechZoom The platform provides a variety of educational resources, including articles and video tutorials centered around lessons such as wealth management, cryptocurrency trading, real estate investment.

Competitor Comparative Analysis

Knowing how FintechZoom stacks up against other fintech services helps shed some light on where their strengths and weaknesses are.

Fintech Competitors: Mint, Acorns and SoFi; all provide similar services with some key differences in user experience & feature sets.

FintechZoom USP: FintechZoom offers a blend of personal finance management tools, situational market analysis and investment avenues all-in-one place which makes it an intuitive choice for users looking for an encompassing solution.

Mobile App Experience

The FintechZoom mobile app offers access to the same capabilities available via the platform and provides a unified experience across all devices.

MobileApp Features: features included in the mobile app are real-time notifications for stock market alerts, personalized alert triggers on budget thresholds and tools to scan Cryptocurrency prices.

Mobile Experience: User reviews and ratings indicate that the mobile app is successful due to its simple design and abundant features, all of which enable you to easily manage your personal finance on-the-go.

Strategic Partnerships and Collaborations

FintechZoom (📰 🕊️) also augment the FintechZoom solution with exhaustive set of strategic partnerships in a full range of financial services & tools.

Banks or Financial Institution Partnerships: These partnerships offer you access to these Banks, customers get exclusive investment products and banking services right on the platform.

Integrations impact on service delivery: FintechZoom serves as a singular comprehensive solution from end to end, improving quality of services while enhancing overall customer satisfaction.

Regulation and Trustworthiness

FintechZoom needs to obey the laws/regulations and win users trust is fundamental for his ICO as fintech company.

Compliant practices: Audited for compliance with worldwide financial standards and globals regulations.

User Trust Indicators: FintechZoom releases transparency reports, lists security certifications and launches educational materials in data privacy to advance trust among users of the service.

Community Education & Financial Literacy

FintechZoom is dedicated to promoting literacy among all users and, in particular the youth.

Workshops or Webinars: FintechZoom also offers workshop specific curriculum that teaches market analysis, investment strategies and how economic trends affect personal finance.

Self-Learning Resources: Hundreds of articles, e-books and interactive tools on financial topics suitable for both beginner.RequestParam() users.

ALSO READ THIS BLOG: SILVER PRICE FINTECHZOOM 2024 INSIGHTS FOR A DYNAMIC MARKET

FAQs

What is Money FintechZoom?

FintechZoom MONEY FINECARE GAINS OF Rs 2,861 CROREProceedPrivacy & Cookies PolicyIf you have any concerns or query regarding our Privacy and Cookies Polic…

Is My Data Safe on FintechZoom?

FintechZoom uses secure encryption and maximum standards of financial compliance in order to ensure the highest security for your user data.

Is Money FintechZoom a Good Investment?

FintechZoom, on the other hand has plenty of investment options: stocks, ETFs and even cryptocurrencies or commodities with some decision supporting tools as well.

Conclusion

Money FintechZoom is an advancement in how personal finance can be managed using technology combined with financial security and user friendly design.

Summary of Features on the Platform

Focus on an emerging need in digital finance solutions

Future of fintech developments

No Comments